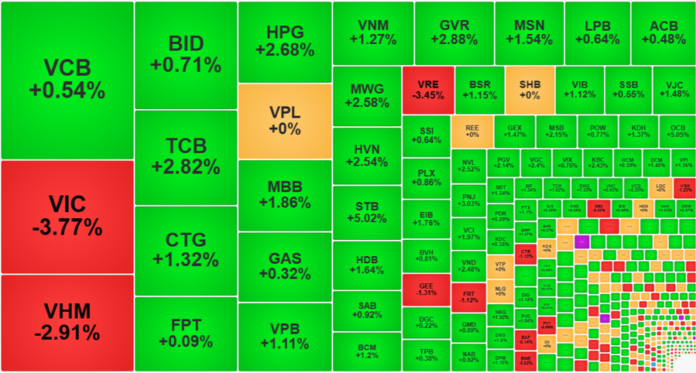

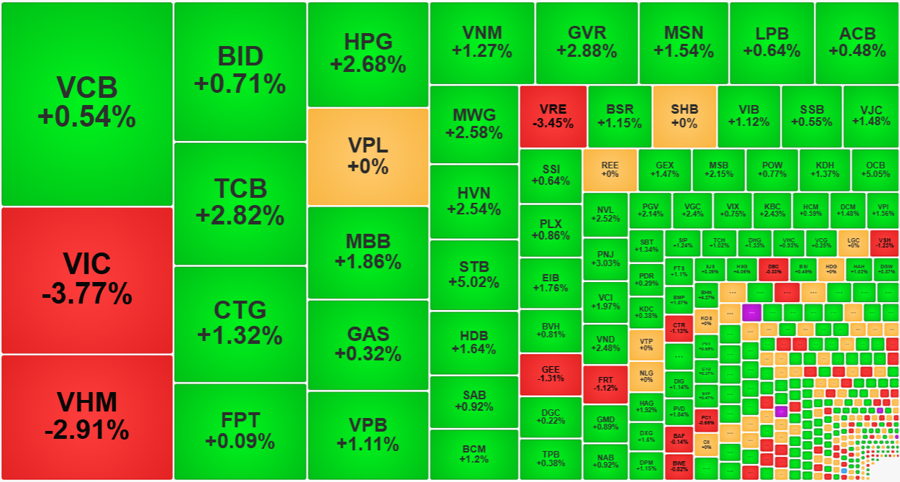

Buying power remained stable at high levels during the afternoon session, supporting stock prices despite deep declines in VIC and VHM. The impact of these two stocks was largely mitigated, pushing the VN-Index above the 1320-point mark towards the end.

In fact, there was a downward push mid-afternoon, with the VN-Index rising just 1.6 points at its lowest. This was mainly due to some large-cap stocks: VIC fell by up to 6.1%, and VHM decreased by 4.85%. These two stocks later recovered slightly, reducing the pressure on the remaining blue chips.

This pressure on the pillars did not cause too much market volatility, except for the index’s capitalization factor. The breadth at the index bottom was 173 gainers/115 losers. By the end of the session, it returned to a positive state with 206 gainers/85 losers. Many other pillars also wobbled at this time, but the decline was not significant.

The ability to maintain pillar rotation is a very positive factor. In previous sessions, VIC and VHM were a nightmare because when these two very large stocks fluctuated, the VN-Index was also seriously affected. Today, the index lost more than 5 points due to VIC and VHM, but the gain was still nearly 7.8 points. TCB rose 2.82%, HPG 2.68%, STB 5.02%, and GVR 2.88%, all of which were excellent compensating stocks. VN30-Index rose only 0.5% at the end of the day, but 14 stocks in the basket rose more than 1%, and the breadth was excellent at 26 gainers/3 losers. In addition to VIC, VHM, and VRE fell 3.45%.

It can be said that almost the entire market today went against the Vin group and rose very positively. Of the 85 codes still in the red on the VN-Index, only 8 codes had transactions of over VND 10 billion, meaning that the pressure was only concentrated in a few stocks. In addition to the 3 codes mentioned above, GEE also decreased by 1.31% with VND 94.5 billion; VSC decreased by 2.99% with VND 69.2 billion; FRT decreased by 1.12% with VND 61.7 billion; CTR decreased by 1.13% with VND 49 billion, and ELC decreased by 1.09% with VND 11.6 billion.

On the upside, 104 codes rose by more than 1%. Blue-chips included STB, GVR, TCB, HPG, and MWG, which rose by more than 2%. Mid-cap stocks also included VND, up 2.48%, DGW up 3.87%, HSG up 4.06%, NVL up 2.52%, MSB up 2.15%, OCB up 5.05%, YEG up 6.67%, NKG up 3.1%, HVN up 2.54%, KHG up 3.14%, and KBC up 2.43%. All of these stocks had liquidity of over VND 100 billion per share.

This is the clearest signal of the strength of buyers when money pushes prices and keeps them high until the end of the day. Although the healthiest group had only 104 codes, they accounted for 60% of the total trading volume on the HoSE floor.

Liquidity today is also a positive highlight. The value of matched orders in the afternoon session on the two exchanges increased by about 4% compared to the morning, bringing the total trading value of the day to VND 20,052 billion, up 42.2% from the previous day. Thus, after three weak sessions at the beginning of the week, liquidity has returned to above VND 20,000 billion, excluding agreements. About 54.2% of this was concentrated in the blue-chip basket, confirming that large investors have “reactivated” at a high intensity. Of the 16 stocks with the largest transactions of VND 300 billion or more, 13 are in the VN30 basket.

Foreign investors were also unexpectedly excited, and this afternoon contributed a net buy value of VND 229.6 billion. This block maintained a good buying intensity with VND 1,212 billion of new capital inflows, equivalent to the morning session. Meanwhile, the selling scale decreased by about 6% compared to the morning session, to VND 982.4 billion.

Foreign investors bought more significantly in HPG this afternoon, bringing the net value of the whole session to VND 222 billion. In addition, DGW +97.3 billion, MWG +90.3 billion, VCI +73.1 billion, NVL +71.9 billion, MSN +55.7 billion, STB +53.6 billion, and VIX +52.3 billion are all stocks that performed well. On the net selling side, there were SHB -104.2 billion, CTG -58.7 billion, VCB -49.8 billion, GEX -49.7 billion, HAH -46.3 billion, DBC -44.3 billion, VHM -41.1 billion, and VRE -40 billion.

Two Bank Stocks Were Actively Net Purchased by Proprietary Securities Companies in the June 11th Session

The proprietary trading arms of securities companies recorded a net buy value of VND 27 billion on the Ho Chi Minh Stock Exchange (HoSE).

Market Pulse June 12: Choppy Trading with Narrowing Ranges After Initial Spike

The market maintained its positive momentum from the opening bell, with the VN-Index climbing 7.54 points to 1,322.74, the HNX-Index gaining 1.46 points to 227.69, and the UPCoM-Index rising 0.28 points to 98.32. Green dominated the market across the board.