Oil prices surge more than 4% to a two-month high amid escalating Middle East tensions.

Oil prices surge over 4% to a two-month high as Middle East tensions escalate

Oil prices soared more than 4%, reaching their highest level since early April, after the US prepared to evacuate its embassy in Iraq due to heightened security concerns. Specifically, Brent crude oil prices settled 4.34% higher at $69.77 per barrel, while WTI oil prices rose 4.88% to $68.15 per barrel.

The main driver of the market’s strong reaction was the unexpected geopolitical risk stemming from Iran’s threat to attack US bases if nuclear negotiations fail. The escalating tensions raised concerns about potential disruptions to oil supplies from the Middle East, particularly from Iran and Iraq.

Meanwhile, OPEC+ is expected to increase production by 411,000 barrels per day from July, but strong internal demand, especially in Saudi Arabia, could mitigate the negative impact of rising supplies on oil prices.

The market also found support in expectations of economic growth as the US and China reached a trade agreement, along with US crude oil inventory data showing a significant drawdown of 3.6 million barrels, much higher than the forecasted 2 million barrels. A sharp increase in domestic gasoline demand to 9.17 million barrels per day indicated a rebound in consumption.

Additionally, with US inflation for May rising only slightly, expectations grew that the Federal Reserve (Fed) would begin cutting interest rates as early as September, supporting the outlook for economic growth and energy demand.

Gold prices maintain upward momentum amid lower-than-expected US inflation and expectations of a Fed rate cut

Gold prices edged higher as data revealed that the US CPI for May increased by just 0.1%, lower than the expected 0.2%, reinforcing expectations of a Fed rate cut in September. Spot gold rose 0.1% to $3,324.72 per ounce, while gold futures remained almost unchanged at $3,343.70.

The market currently prices in a 68% probability of a Fed rate cut in September. Meanwhile, Trump confirmed a trade agreement with China, including Beijing’s provision of rare earths and the US allowing Chinese students to enter the country for study.

Platinum climbed 2.9% to $1,256.70, its highest level since 2021, but Goldman Sachs warned that the rally could be curbed by sensitive Chinese demand and rising supplies. Silver fell 1.2% to $36.11, while palladium gained 1.3% to $1,074.25.

Copper prices decline amid concerns over Chinese demand and prolonged trade tensions

Copper prices on the LME fell 1.1% to $9,655 per ton as prospects for weak demand from China and unresolved trade tensions with the US persisted.

China imported 427,000 tons of copper in May, a 2.5% decrease compared to April.

Despite LME copper inventories halving over the past three months to 119,450 tons, and 70,700 tons scheduled for delivery, prices remained under pressure as the US considered imposing import taxes on copper after raising tariffs on aluminum to 50% the previous week.

Morgan Stanley warned that if the US imposed tariffs on copper, demand from the country could falter, while signals from China indicated slowing demand growth and rising exports.

Other base metals saw modest movements: aluminum rose 0.8% to $2,513 per ton, zinc was unchanged at $2,656, nickel fell 0.9% to $15,180, lead inched up 0.3% to $1,988, and tin held steady at $32,711.

Iron ore prices rebound amid progress in US-China trade negotiations

Iron ore prices rebounded after the US and China reached a trade agreement framework in London, boosting market sentiment despite weak steel demand.

The September 2025 iron ore contract on the Dalian Commodity Exchange rose 1% to 707 yuan per ton ($98.39), while the July contract on the Singapore Exchange climbed 0.87% to $95.20 per ton.

Coking coal and coke prices also increased by 1.1% and 1.31%, respectively. On the Shanghai Futures Exchange, construction steel prices rose 0.67%, hot-rolled coil climbed 0.78%, wire rod gained 0.43%, and stainless steel edged up 0.48%.

However, steel demand is currently weak as the industry enters the off-season, and the China Iron and Steel Association has called for preventing “cut-throat competition” among businesses amid volatile market conditions.

Soybean and corn prices decline as US-China trade optimism fades and favorable weather supports crops

Soybean and corn prices on the Chicago Board of Trade fell as initial optimism over US-China trade negotiations faded, and favorable weather conditions in the Midwest were forecast.

July 2025 soybean futures dropped 7.25 cents to $10.50 per bushel, July corn fell 1.75 cents to $4.37 per bushel, and wheat was almost unchanged at $5.34 per bushel.

Initially, news of a trade agreement framework between the US and China in London supported prices, but the lack of details on agricultural goods disappointed the market. China is the world’s largest importer of soybeans, while the US is the second-largest exporter.

Additionally, mild weather in the Midwest favored crop development, raising expectations for high yields. The US has nearly completed soybean planting and is close to finishing corn planting.

The market awaits the June supply-demand report from the USDA on Thursday, which is expected to show a reduction in corn inventories due to strong exports, along with updates on wheat production.

In the Black Sea region, investors continued to monitor escalating tensions between Russia and Ukraine, two major wheat exporters, with Russia being the world’s top exporter and Ukraine ranking sixth.

Japanese rubber futures rise for a second session amid a weaker yen

Japanese rubber futures rose for the second consecutive session, reaching their highest level in nearly two weeks, as the yen weakened following news of the Japanese government’s plan to buy back super-long-term, low-interest-rate bonds.

On the Osaka Exchange (OSE), the November 2025 contract climbed 2.2 yen (+0.74%) to 299 yen per kg. On the Shanghai Futures Exchange (SHFE), the September 2025 contract advanced 115 yuan (+0.83%) to 13,890 yuan per ton, while July 2025 butadiene rubber fell slightly by 0.36% to 11,225 yuan per ton.

Export prices of Thai standard rubber grades (RSS3 and STR20) also increased by 1.56% and 2.49% to 77.05 and 62.19 baht per kg, respectively.

The July 2025 rubber contract on the SICOM Exchange in Singapore edged up 0.1% to 163.5 US cents per kg.

Raw sugar dips to near four-year low, coffee and cocoa prices decline

Raw sugar prices on ICE edged lower but remained above their four-year low, supported by rising energy prices, while coffee prices continued to fall.

Raw sugar for October delivery fell 0.06 cents (-0.4%) to 16.42 cents per lb, after touching an intraday low of 16.34 cents, just above the four-year low of 16.32 cents.

Market sentiment remained bearish due to the early arrival of monsoon rains in Asia, boosting production prospects in India, Thailand, and China.

The market awaited data on sugar and cane production in central-southern Brazil for the second half of May, with estimates from S&P Global indicating a 4.7% increase to 2.84 million tons. White sugar for October delivery rose 1.1% to $472.80 per ton.

Coffee

Arabica coffee for September delivery fell 1.3% to $3,486 per lb as harvesting in Brazil, the top producer, progressed well under favorable weather conditions.

Brazil’s exports of green coffee beans in May declined by nearly 36% compared to the previous year, totaling 2.6 million 60-kg bags.

According to Hedgepoint, ICE-certified arabica stocks declined, and forecasts for colder weather in Brazil could provide short-term support, but the long-term outlook remained bearish due to ample supplies of robusta beans from Brazil and Indonesia. Robusta coffee for September delivery fell 0.6% to $4,291 per ton.

Cocoa

London cocoa for September delivery fell 0.9% to £6,349 per ton as the outlook for the 2025/26 crop in West Africa improved with favorable rainfall. New York cocoa for September delivery gained 0.4% to $9,069 per ton.

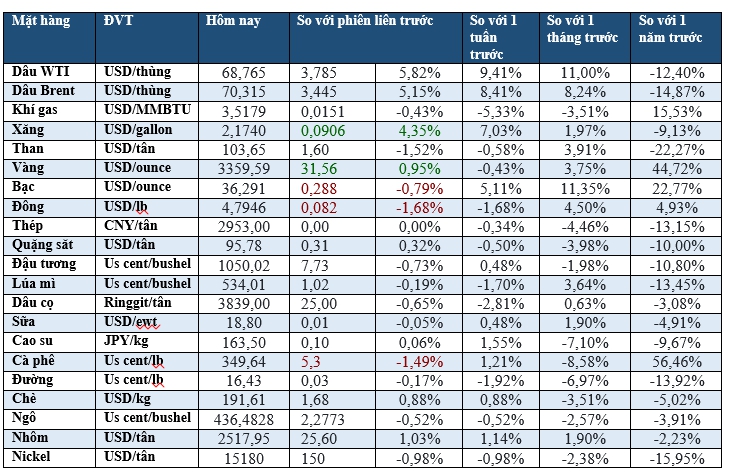

Prices of key commodities in the morning session today

The Energy Market on June 7: Oil Prices Continue to Surge, Gold Plunges Over 1%

The energy complex continued its upward trajectory on June 6th, with oil prices extending gains. Silver shone brightly, surging to a 13-year high, while platinum reached a 3-year peak. However, gold suffered a sharp decline, dropping over 1%. Raw sugar prices remained subdued, languishing at a 4-year low.

The Rising Tide of Fuel Prices: A Global Concern

On June 5th, a price hike was observed across the board for petroleum products. Specifically, E5RON92 gasoline increased by VND 67 per liter, while RON95-III gasoline witnessed a surge of VND 133 per liter. Similarly, various types of oil experienced increments ranging from VND 176 to VND 284 per liter, except for mazut 180CST 3.5S, which saw a decrease of VND 86 per kilogram compared to the current base price.

Gold to Maintain its Bullish Streak in 2025, Defying Global Commodity Turbulence

2024 is set to be a challenging year for key global commodities, particularly Brent crude oil and copper. However, in a contrasting development, gold is forecasted to continue its upward trajectory, remaining resilient amidst economic and geopolitical uncertainties, and is expected to soar in price over the coming year.

The Curious Case of Gold’s Global Price Movement

The gold price hovers tentatively, awaiting a new catalyst to spark action. Investors are cautious ahead of impending U.S. economic data and the Federal Reserve’s interest rate trajectory. With markets holding their breath, all eyes are on the Fed’s next move, as they delicately balance inflation concerns with economic growth. This delicate dance has investors poised, ready to pounce or retreat, depending on the Fed’s forthcoming steps.

The Market Dip: Exploring Stocks with Potential for Profitable Gains

The banking sector stocks form a significant part of the portfolio, thanks to their ability to generate stable profits. Alongside this, the real estate, transportation, and retail sectors present potential for mid- to long-term growth.