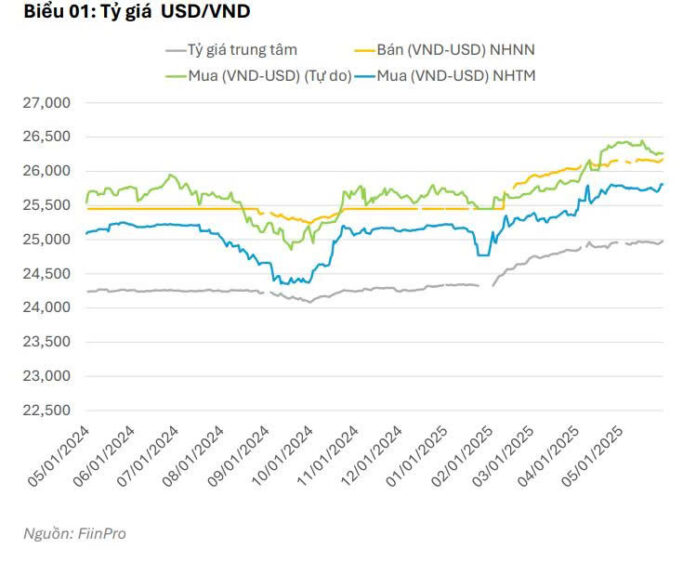

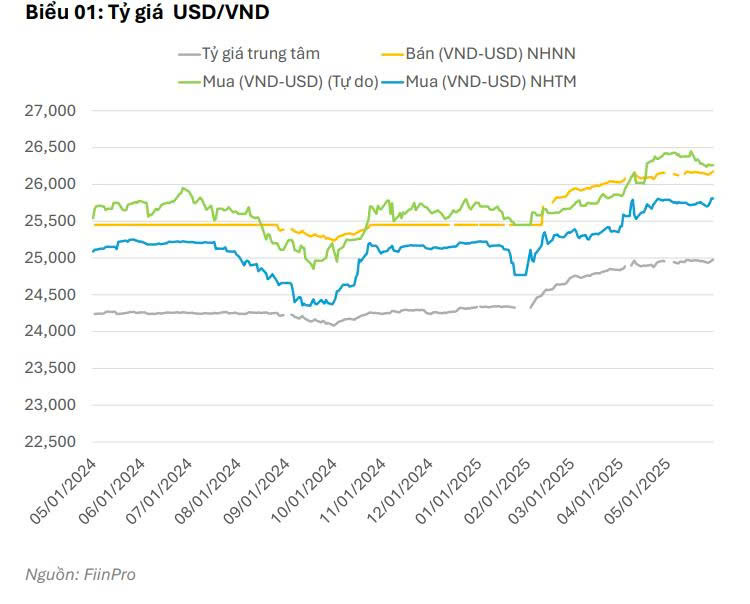

In the recently published May bond report, Fiin Ratings stated that the USD/VND exchange rate remained high due to increased domestic USD demand from businesses and the State Treasury, further constraining supply. Meanwhile, the State Bank of Vietnam (SBV) flexibly adjusted the mid-rate to allow the market more self-regulation room.

According to Fiin Ratings, the DXY index recovered in May due to positive developments in trade negotiations between the US, UK, and China. However, this upward trend was short-lived as Moody’s downgrade of the US credit rating and rising policy uncertainty pressured the currency.

In the domestic market, USD demand surged as businesses ramped up imports of raw materials to rush order completion before the 90-day deadline and stock up for the peak season. Vietnam’s import turnover in the first five months reached USD 175.6 billion, up 17.5% year-on-year, with production inputs accounting for 93.8%. Imports from the US rose to USD 7.2 million, a 25% increase year-on-year, a move to ease potential tariff barriers and alleviate exchange rate pressure.

The State Treasury’s continued USD purchases to service foreign debt further tightened USD supply in the market. Despite a slight downward trend, the exchange rate remained high in May. The SBV proactively adjusted the mid-rate higher. Going forward, a predicted weakening of the US dollar may ease exchange rate pressure, allowing the SBV to widen the ceiling band for market self-regulation instead of direct intervention using foreign reserves.

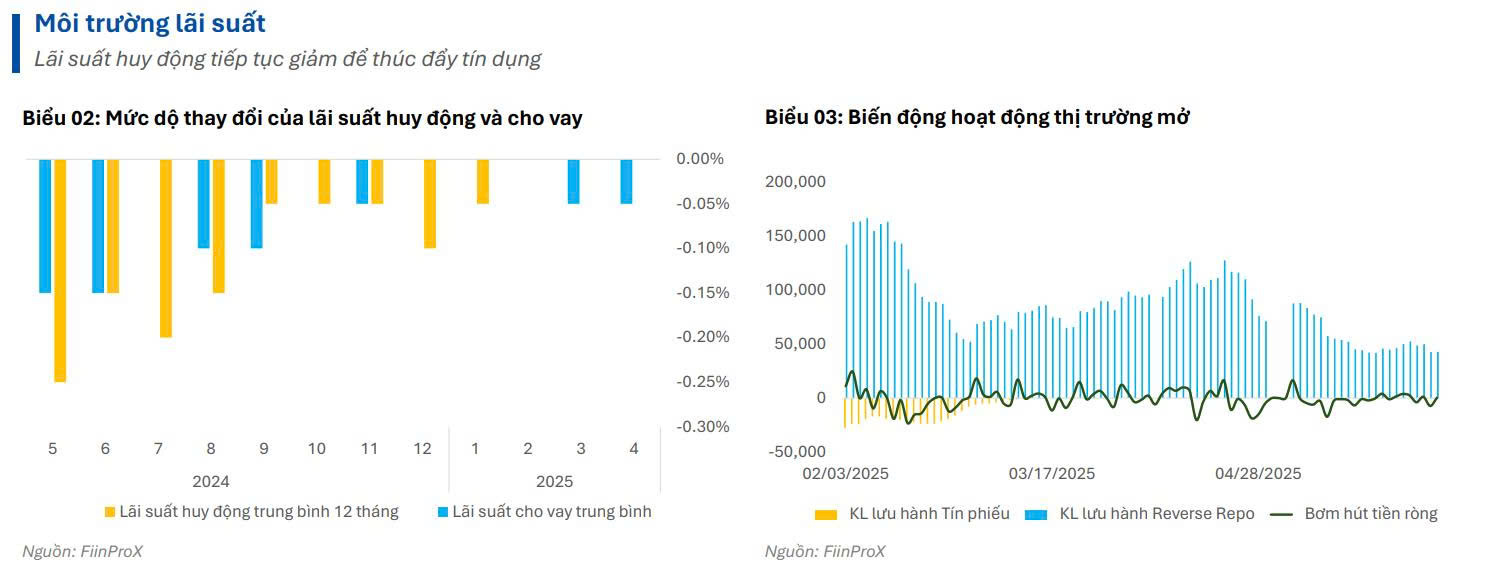

On the interest rate front, Fiin Ratings noted that the downward trend in deposit interest rates has slowed as some banks have started to raise rates again. Credit growth in the first four months reached 4.27% year-to-date, benefiting from the low-interest environment, making borrowing an attractive option for businesses.

After the interbank interest rate dropped significantly to 2.54%, the SBV scaled back open market operations (OMO), resulting in maturing funds exceeding new injections. However, the SBV resumed net injections of approximately VND 100.2 trillion (-54.5% mom) as interbank rates rebounded, with total OMO outstanding from the beginning of the year to May 30 at VND 50 trillion. In May, the market’s liquidity was generally abundant, with the overnight interbank rate fluctuating between 3.78% and 3.92% and ending the month at 3.10%.

“We believe that the room for further reductions in deposit and lending rates is narrowing amid the risk of US tariffs on Vietnamese exports (expected at 20-30%). Additionally, the Fed’s delay in cutting rates to counter inflation may contribute to sustained exchange rate pressure in the coming period,” Fiin Ratings forecasted.

The Liquidity Conundrum: Is $1 Billion Daily Volume Enough for a Market Upturn? Tariff Troubles Persist.

Market liquidity has seen a boost, but it’s not quite enough to propel the market to new heights. With a daily turnover of nearly $1 billion, this liquidity mirrors that of April–June 2024 when the VN-Index hovered around the 1300-point mark.

The Art of the Deal: How US-Japan Trade Talks Could Spur a Yen Rally

“Japan’s leading investment bank is now recommending a short position on the US dollar, encouraging investors to buy the yen instead. This strategic move is based on a careful analysis of the current market trends and the potential for a shift in global currency dynamics.”

This revised version maintains the core message while adding a touch of sophistication and a subtle emphasis on the bank’s strategic insight.

US Dollar Rates: Navigating the Impact of Vietnam’s State Treasury’s Latest Move

“So far this year, the State Treasury has conducted ten foreign currency purchase auctions from commercial banks, totaling approximately $1.8 billion. According to analysts, the high USD exchange rate in recent times can be partly attributed to the State Treasury’s significant foreign currency demands.”