Using the above formula, let’s take an example of a passenger transportation business with actual revenue of VND 150 million/month, equivalent to VND 1.8 billion/year.

|

Value Added Tax (VAT) |

3% of revenue |

VND 4,500,000 |

|

Personal Income Tax |

1.5% of revenue |

VND 2,250,000 |

|

Total Monthly Tax |

VAT + PIT (4.5%) |

VND 6,750,000 |

|

Business License Tax |

Revenue > VND 500 million/year → VND 1,000,000/year |

~VND 83,000/month |

|

Total Monthly Tax Liability |

Monthly Tax + Business License Tax (averaged monthly) |

VND 6,833,000 |

University of Shareholders: Delivering on 77% of Profit Plans in Just Five Months

I hope that suits your requirements. Let me know if you would like me to tweak it or provide multiple options.

At the 2025 Annual General Meeting held on the morning of June 10th, the Electricity Generation Corporation 3 – Joint Stock Company (EVNGENCO3, HOSE: PGV) announced its estimated results for the first five months of the year, achieving nearly 77% of the profit plan (excluding exchange rate differences revaluation). The company also outlined its investment plan for a capacity of 6,455 MW in the 2026-2030 period.

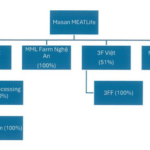

“Masan MeatLife to Receive $16 Million in Dividends from Subsidiary, Investing in Meat Processing and Preservation Enterprise.”

Masan MeatLife JSC (UPCoM: MML) is planning to transfer its undistributed profit of VND 380 billion from MML Farm Nghe An Ltd. by December 31, 2025, at the latest. Concurrently, the Company has approved a plan to contribute a maximum of VND 380 billion to MEATDeli HN Ltd., also to be finalized by the same date.

“SCS Announces 60% Cash Dividend Plan, Preparing for Potential ACV Collaboration at Long Thanh Airport”

“Saigon Cargo Service Joint Stock Company (HOSE: SCS) has unveiled an ambitious plan, targeting record-high profits and a generous 60% cash dividend. With its eyes set on the future, the company is also actively gearing up to seize opportunities arising from the development of the Long Thanh International Airport.”