The Vietnamese automotive market is witnessing an enticing price war, especially in the SUV segment. In June, two Chinese models, the Omoda C5 and Jaecoo J7, grabbed attention with significant dealer discounts of up to over VND 100 million, aiming to boost consumption and enhance competitiveness.

This aggressive pricing strategy for the Omoda C5 and Jaecoo J7 comes amidst a weak buying market, intensifying competition from established brands, and a certain wariness among Vietnamese consumers towards Chinese automobiles.

Deep discounts are seen as a strategic move to attract customers and gain a pricing advantage over rivals in the same segment.

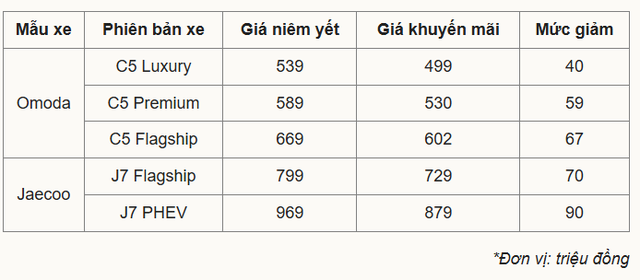

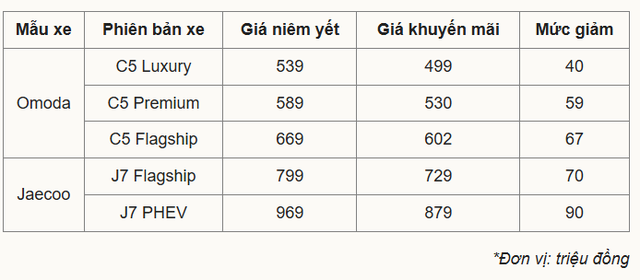

In June, Omoda & Jaecoo Vietnam continued to offer price cuts on their B- and C-sized SUVs. The Jaecoo J7 Flagship model witnessed a VND 70 million reduction, now priced at VND 729 million, while the plug-in hybrid (PHEV) version saw a VND 90 million drop to VND 879 million.

Similarly, the B-SUV Omoda C5 is also on discount during this month. The Luxury trim is reduced by VND 40 million, Premium by VND 59 million, and Flagship by VND 67 million. Additionally, customers are offered a 100% registration fee waiver, one-year physical insurance, a two-year or 20,000 km maintenance package, and car accessories. As a result, the C5’s selling price starts from just VND 499-602 million.

Moreover, for vehicles with the 2024 VIN, some Omoda & Jaecoo dealers provide an additional 100% registration fee waiver worth VND 59-67 million, but these offers are limited in quantity and color options. Buyers accepting older models can benefit from a double discount totaling over VND 130 million.

Omoda C5

Omoda launched in Vietnam in late November 2024 with its inaugural model, the Omoda C5. At that time, this urban SUV was distributed as a fully imported vehicle from its Indonesian factory, offering Premium and Flagship versions. Initial prices ranged from VND 589 to 669 million. In late March 2025, the Chinese automaker introduced the more affordable Luxury trim, priced at VND 539 million.

With these promotions, the C5 and J7 now offer some of the lowest prices in their segments. Rivals of the C5 include the MG ZS (VND 518-588 million), Geely Coolray (VND 538-628 million), Mazda CX-3 (VND 522-641 million), and Hyundai Creta (VND 599-699 million).

The C5, introduced to the Vietnamese market in late 2024 and imported from Indonesia, boasts the most extended warranty policy in the current Vietnamese automotive market. It covers the powertrain for seven years or 1,000,000 km and the engine for ten years or 1,000,000 km, whichever comes first.

Under the hood, the C5 features a 1.5-liter turbocharged engine producing 154 horsepower and 230 Nm of peak torque, paired with a CVT transmission. In March, Omoda unveiled the more affordable C5 Luxury, retaining the same engine but with altered specifications.

Jaecoo J7

The Chinese automobile, Jaecoo J7, debuted in Vietnam in early 2025 with two variants: the Flagship and PHEV Flagship. Initially, the J7 was priced at VND 799 million and VND 999 million, respectively. However, after nearly half a year on the market, this Chinese model has failed to convince the majority of buyers.

To boost sales, Omoda & Jaecoo Vietnam has recently joined the promotion race, slashing the selling price of the PHEV Flagship to just VND 879 million, undercutting its direct competitor in the gas-electric hybrid segment, the BYD Sealion 6.

Meanwhile, the J7’s rivals include the Mazda CX-5 (VND 749-979 million), Ford Territory (VND 759-889 million), Honda CR-V (VND 1,029-1,259 billion), Hyundai Tucson (VND 769-989 million), and Kia Sportage (VND 779-999 million).

The J7 PHEV is the first plug-in hybrid in its segment, featuring a 1.5-liter TDGI gasoline engine that generates 141 horsepower and 215 Nm of torque, coupled with a 201-horsepower electric motor delivering 310 Nm of torque. In contrast, the pure gasoline-powered J7 employs a 1.6-liter turbocharged engine producing 183 horsepower and 275 Nm of torque, mated to a seven-speed automatic transmission.

The persistent price cuts by Chinese automakers in Vietnam, including Omoda and Jaecoo, are unsurprising to automotive industry experts. Aside from the market’s general challenges, such as weak demand and intensifying competition, this group of vehicles also faces unique barriers in the Vietnamese market. Chief among these is consumers’ wariness, which remains the most significant obstacle.

A First Look at the Mitsubishi DST Concept: Spacious Third Row, ADAS Equipped, and a Resemblance to the Popular Xforce

Some sales consultants have revealed that the commercial version of the Mitsubishi DST Concept will be introduced in Vietnam as soon as 2025. This highly anticipated release marks a significant step for the automotive industry in the country, offering a glimpse into the future of mobility and innovative design. With Mitsubishi’s renowned engineering and cutting-edge technology, the DST Concept is expected to set a new standard in the market, captivating consumers and elevating their driving experience to new heights.

“The Bespoke Tailor: Elevating His Fleet with VinFast VF 7 and VF 3, with Aspirations for the VF 9 to Complete the Practical yet Stylish Collection”

Beyond his renown in the world of bespoke Sartorial fashion, Le Thanh Hung is also a discerning automotive enthusiast with a taste for vehicles that strike a perfect balance between aesthetics, character, and everyday functionality.

The Great Fried Chicken War: KFC, Jollibee, Lotteria, and McDonald’s Battle for Customers

The fast-food industry, particularly the fried chicken market, is witnessing an intense battle for customers, with brands employing a plethora of promotions and discounts.