Illustrative Image

According to preliminary statistics from the General Department of Vietnam Customs, the export turnover of phones and components in May reached $4.6 billion, a significant increase of 22.6% compared to the previous month. In the first five months of the year, this sector brought in $22.4 billion, equivalent to the same period last year.

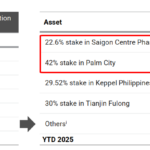

Looking at the market, the three tech powerhouses of China, the US, and South Korea are Vietnam’s leading export destinations for these products.

Specifically, China remains the largest importer, with a turnover of over $4.44 billion, a slight decrease of 5% compared to the same period last year. Closely following in second place is the US, with a turnover of over $4.4 billion, also a slight decrease of 4% compared to the same period in 2024.

South Korea is the third-largest export market for phones and components, with a turnover of over $1.38 billion, a 3% decrease compared to 2024.

Regarding the US market, the Trump administration decided on April 12 to waive retaliatory tariffs on smartphones, computers, and other electronic imports. This decision was made to reduce the negative impact of tariff measures on the US tech industry, especially companies that rely on global supply chains such as Apple and Nvidia, as well as electronic equipment manufacturers.

Vietnam is currently the second-largest exporter of mobile phones, fifth-largest exporter of components, sixth-largest exporter of computer equipment, seventh-largest software outsourcing destination, and eighth-largest exporter of electronic components in the world. According to the B&Company Vietnam business database, the Vietnamese electronics industry comprised approximately 2,800 companies in 2023, generating a net revenue of $134 billion.

The Vietnamese mobile phone market has become a bright spot, with rapid development and enormous potential. Apple has achieved remarkable success, and its three major partners in Vietnam, Foxconn, Luxshare, and GoerTek, are continuously expanding their investments in electronic production. FDI inflows into this sector continue, evident in the ongoing and upcoming projects in the country.

The electronics industry is well-positioned for growth, given Vietnam’s geographical location within a dynamic and rapidly developing industrial region. Additionally, the domestic market of over 100 million people and direct access to the 600 million consumer base of the ASEAN region are advantageous. The industry also benefits from extensive international export markets due to Vietnam’s participation in multiple free trade agreements (FTAs).

If the growth trajectory of 2024 is maintained, electronic exports in 2025 could reach a milestone of $140-145 billion. However, a significant challenge lies in potential trade policy changes in the US, which could lead to increased trade defense measures targeting exports to the US, including electronics.

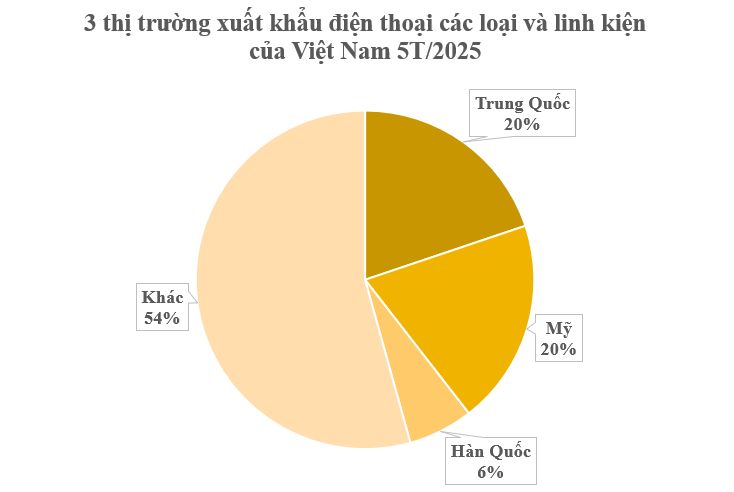

“Keppel Realizes Over $140 Million from Sale of Equity in Prime HCMC Project”

Keppel reaps windfall from divesting its stakes in property projects in China and Vietnam, notably the Saigon Centre Phase 3 project, which had been stagnant for over three decades.

Market Pulse June 12: Afternoon Jitters Shake Markets, Late Rally Boosts VN-Index by Almost 8 Points

The market opened the afternoon session with a strong rally, surging towards the 1,326-point mark, but this momentum was short-lived as it quickly faced resistance and entered a corrective phase, dipping to 1,317 points. It was only in the final hour of trading that the market staged a recovery, returning to the morning’s price levels.