|

Mr. Nguyen Thanh Trung, Chairman of Ton Dong A, shared at the 2025 Annual General Meeting of Shareholders

|

Speaking at the 2025 Annual General Meeting of Shareholders held on the morning of June 12, Mr. Nguyen Thanh Trung, Chairman of the Board of Directors, said that the trade flow in the steel industry has undergone many changes and disruptions due to political instability. Many countries have implemented trade barriers and protectionist measures, including the steel industry, in regions such as the US, Europe, and Southeast Asian countries.

On the contrary, in the domestic market, Vietnam is in the process of reorganizing and streamlining its administrative apparatus, boosting investment in key infrastructure projects, and witnessing a recovery in the real estate market. As a result, Ton Dong A has decided to increase its focus on the domestic market, targeting over 75% of its business (compared to 41.16% in 2024), focusing on the high-quality segment, and exploring new domestic market segments that the company previously overlooked,” said Chairman Trung.

He expects that by the end of 2025-2026, when global relations stabilize and trade flows normalize, the company will develop a more suitable sales plan and structure.

In terms of financial targets, for 2025, Ton Dong A sets a business plan with a total output of 780,000 tons, a total revenue of VND 18,000 billion, an expected profit after tax of VND 300 billion, and a maximum dividend of 20%.

Construction of Factory No. 4 to commence in Q4 2025

Mr. Pham Quoc Thang, Member of the Board of Directors, shared more about the investment plan. In addition to the current capacity of 800,000 tons/year, Ton Dong A is planning to invest in a galvanized steel factory (Factory No. 4) to increase the capacity of galvanized steel by 1.2 million tons/year; a pipe and tube factory (Factory No. 5) to increase the capacity of pipe and tube products by 150,000 tons/year; and an expansion of Factory No. 3 to increase the capacity of steel pipes by 50,000 tons/year. The company also has plans for overseas and new business investments.

“Regarding Factory No. 4, the company is completing the legal procedures and paperwork, and we expect to finalize the procedures and officially start construction in the fourth quarter of 2025,” said Mr. Thang about the timeline for the new project with a capacity of 1.2 million tons/year.

Regarding the reason for investing in a new factory, Chairman Nguyen Thanh Trung emphasized: “The new project is expected to commence in the fourth quarter of 2025, after completing the legal procedures. From construction to market launch, we estimate it will take about 1.5-2 years. We have a rather long-term investment plan, expected to span 5-8 years, so by the time we start bringing products to market, the economy may be entering a new expansion cycle, ensuring absorption for our products. Moreover, the new factory’s products will cater to various industries, including construction, household appliances, automotive, and critical components for the North-South railway project. We have divided the investment into several phases, implementing a staggered schedule to ensure the company’s safety and align with market demand.”

Estimated profit of VND 120 billion in the first half of 2025

Regarding financial performance, Chairman Nguyen Thanh Trung shared that in the first half of 2025, the company expects a profit of VND 120 billion.

Mr. Trung stated that Ton Dong A will accelerate its efforts in the last two quarters to achieve its target profit of VND 300 billion in 2025 by expanding into new domestic market segments and focusing on exporting to previously less targeted markets.

In addition to approving new investment plans, at this year’s General Meeting, Ton Dong A’s shareholders also approved the 2024 dividend plan with a maximum rate of 40% (10% in cash and 30% in stocks). The stock dividend is expected to issue a total of 34.41 million shares and will be implemented in the third quarter of 2025.

Regarding capital mobilization plans, shareholders also approved the plan to offer shares at a ratio of 3:1, with the expected timeline for implementation in 2025-2026. The proceeds from the offering will be used to supplement working capital and serve production and business activities.

Expected to be listed on the Ho Chi Minh Stock Exchange (HOSE) in 2025-2026

At the meeting, shareholders also approved the plan to list the company’s shares on the Ho Chi Minh City Stock Exchange (HOSE).

“We plan to make the transition to the HOSE in 2025-2026. Despite the financial market’s challenges, the economy is not facing significant difficulties. Therefore, we are seeking shareholders’ approval to have a legal basis and choose an appropriate timing strategy that aligns with the company’s development. We aim to maximize benefits for our shareholders,” emphasized Chairman Trung.

|

Additionally, Ton Dong A announced the appointment of new leadership positions for the 2025-2029 term: Mr. Ho Song Ngoc as Vice Chairman of the Board of Directors; Mr. Pham Quoc Thang as General Director of Dong A – Phu My One Member Limited Liability Company; Mr. Doan Vinh Phuoc as General Director; Mr. Nguyen Van Dai as Deputy General Director of Domestic Business; Mr. Nguyen Thanh Vinh Nhat as Deputy General Director of Planning and Supply; Mr. Lam Vinh Hao as Deputy General Director of Production; Mr. Do Huu Van as Deputy General Director of Internal and External Affairs, and several other key leadership positions. |

– 14:52 12/06/2025

Net-Zero Cement and Steel: Pipe Dream or Possibility?

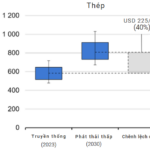

In the global economy’s journey towards carbon neutrality, the cement and steel industries present notable challenges.

A Surge in Tourism: Hue’s Unexpected Boon in May

The imperial city of Hue is witnessing a remarkable transformation in its economic and social landscape, particularly within the tourism industry. The city has experienced a significant surge in tourist arrivals, boasting an impressive increase of 85.5% compared to the same period last year. This is coupled with an exceptional growth in exports, which have risen by 29.8% over the past five months, showcasing the city’s thriving economic prospects.

“Vietnamese Billionaire’s Food Empire Aims for Sky-High Revenue Ahead of HOSE Listing”

In 2025, Masan Consumer aims to achieve an ambitious revenue growth target of between 8% and 15%. With a sharp focus on innovation and a deep understanding of the modern Vietnamese consumer, the company is poised to drive significant growth and solidify its position as a leading consumer goods company in Vietnam.