Central exchange rate reverses and increases

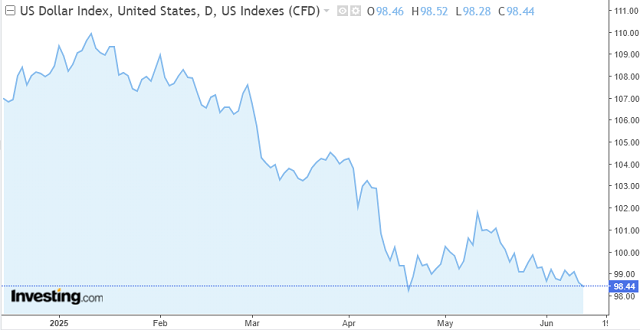

On the morning of June 12th, the USD-Index (DXY) decreased to 88.44 points, a decline of over 9% since the beginning of the year. This weakness stems primarily from concerns about economic growth and trade policies in the US.

|

USD-Index since the beginning of the year

Source: Investing.com

|

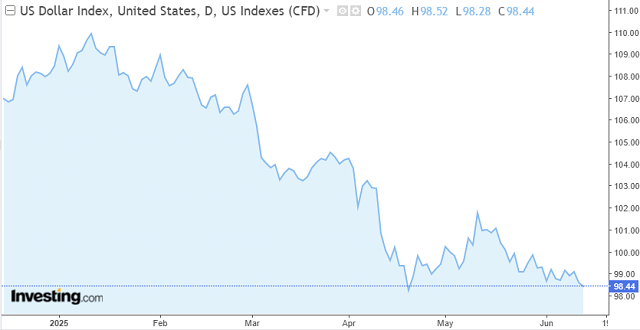

Domestically, after numerous reductions, the central exchange rate set by the State Bank of Vietnam (SBV) on June 12th reversed and increased to 24,990 VND/USD.

|

Central exchange rate since the beginning of June

Source: VietstockFinance

|

With a 5% margin, the USD exchange rate that commercial banks are allowed to trade is within the range of 23,740-26,240 VND/USD.

The reference exchange rate is also set by SBV at 23,791-26,189 VND/USD for buying and selling, respectively.

Vietcombank lists the selling price of USD at 26,200 VND/USD, while the buying price is at 25,810-24,840 VND/USD.

Source: SBV

|

Short-term pressure on the exchange rate remains

Prof. Nguyen Huu Huan – Senior Lecturer, University of Economics Ho Chi Minh City stated that the decrease in the USD-Index has alleviated pressure on the exchange rate. However, the fact that the rate remains high indicates that this pressure is still present. Additionally, exchange rates tend to be seasonal, and while the rate may decrease in the current period, it is expected to start increasing again around August.

Furthermore, it is crucial to monitor the outcome of tariff negotiations between the US and Vietnam. At present, the US is imposing stringent conditions on Vietnam, such as tightening raw material sources and preventing the country from becoming a transit station for goods. Thus, the negotiation results will play a significant role in impacting the exchange rate.

Sharing the same view, Mr. Nguyen Quang Huy – CEO of Finance and Banking, Nguyen Trai University believes that the slight reduction in the central exchange rate, despite the small fluctuation, is sufficient to signal flexible management and guide the market towards a state of stability, especially given the unpredictable international context.

The VND/USD exchange rate is influenced by both external and internal factors. The USD is witnessing a short-term recovery due to better-than-expected economic growth in the US, while the Federal Reserve has not provided a clear signal about the interest rate reduction cycle. Simultaneously, the currencies of many Asian countries, such as CNY, JPY, and KRW, are depreciating, creating competitive pressure on Vietnam’s exchange rate.

Additionally, there is an increased demand for foreign currency due to the import payment cycle, while the defensive mindset of a portion of businesses and financial institutions has led to a slight increase in USD retention.

According to Mr. Huy, there are three global trends reshaping the monetary environment: heightened concerns about public debt and global budget deficits, the potential formation of exchange rate intervention agreements linked to trade negotiations between major economies, and the growing trend among central banks to diversify foreign exchange reserves and reduce dependence on the USD.

These trends indicate a gradual weakening of the US dollar in the medium and long term, providing favorable conditions for the SBV to maintain a stable VND in a sustainable manner.

In reality, the VND has maintained significant stability in the past month, contrary to the depreciation trend of many Asian currencies. If trade, geopolitical, and monetary negotiations progress positively, exchange rate pressure will ease, providing room for the SBV to stabilize the rate around the 24,900-25,100 VND/USD level, which is both policy-wise and flexible in management.

In a recently published report on June 9th, UOB stated that, since the beginning of the quarter, the VND has depreciated by 1.8%, reaching a new all-time low of around 26,000 VND/USD. This weakness is mainly due to the less favorable economic outlook and the risk of the US reimposing a 46% tax if there is no significant progress in the US-Vietnam trade negotiations. These factors are expected to continue putting pressure on the VND in the short term.

UOB believes that the VND will continue to fluctuate in a weak price range against the USD until the end of the third quarter of 2025. However, from the fourth quarter of 2025 onwards, the VND may start to recover, joining the general improvement trend of Asian currencies as trade uncertainties subside.

– 12:00 12/06/2025

The Ultimate Guide to Mastering the Art of Currency Trading: Fiin Ratings’ Fresh Forecast on USD/VND Exchange Rates Unveiled

According to Fiin Ratings, the weakening of the US dollar is predicted to ease exchange rate pressure in the coming months.

The Art of the Deal: How US-Japan Trade Talks Could Spur a Yen Rally

“Japan’s leading investment bank is now recommending a short position on the US dollar, encouraging investors to buy the yen instead. This strategic move is based on a careful analysis of the current market trends and the potential for a shift in global currency dynamics.”

This revised version maintains the core message while adding a touch of sophistication and a subtle emphasis on the bank’s strategic insight.

The Ultimate Guide to Investing: Navigating the Financial Markets with Confidence

The Vietnamese Dong (VND) continues its decline against the US Dollar (USD), with a 2.7% loss despite the greenback hitting a three-year low against other major currencies. The DXY index, which tracks the USD’s performance, has fallen by 9% since the start of 2025, yet the VND struggles to gain traction.