The market witnessed another session of declining liquidity, indicating strong differentiation. The leading index retested the resistance level of 1,325 points, facing subsequent corrective pressure and strong fluctuations. At the close, the VN-Index dipped by 1.03 points (-0.08%) to settle at 1,315.2 points.

Against this backdrop, foreign investors’ net selling of nearly VND 236 billion in today’s session was a downside factor.

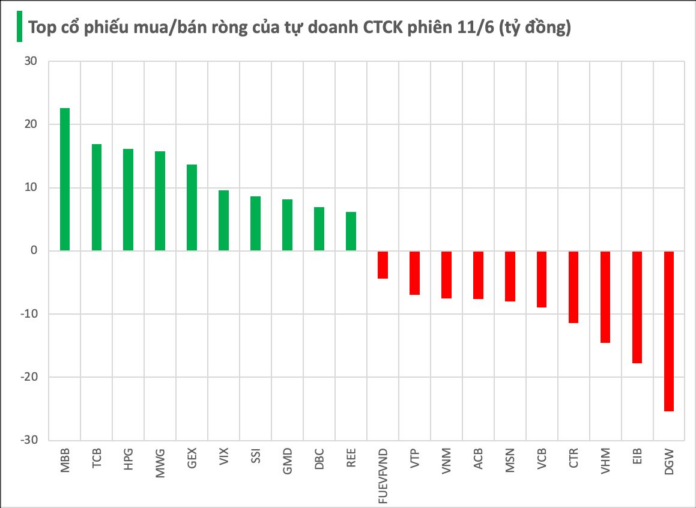

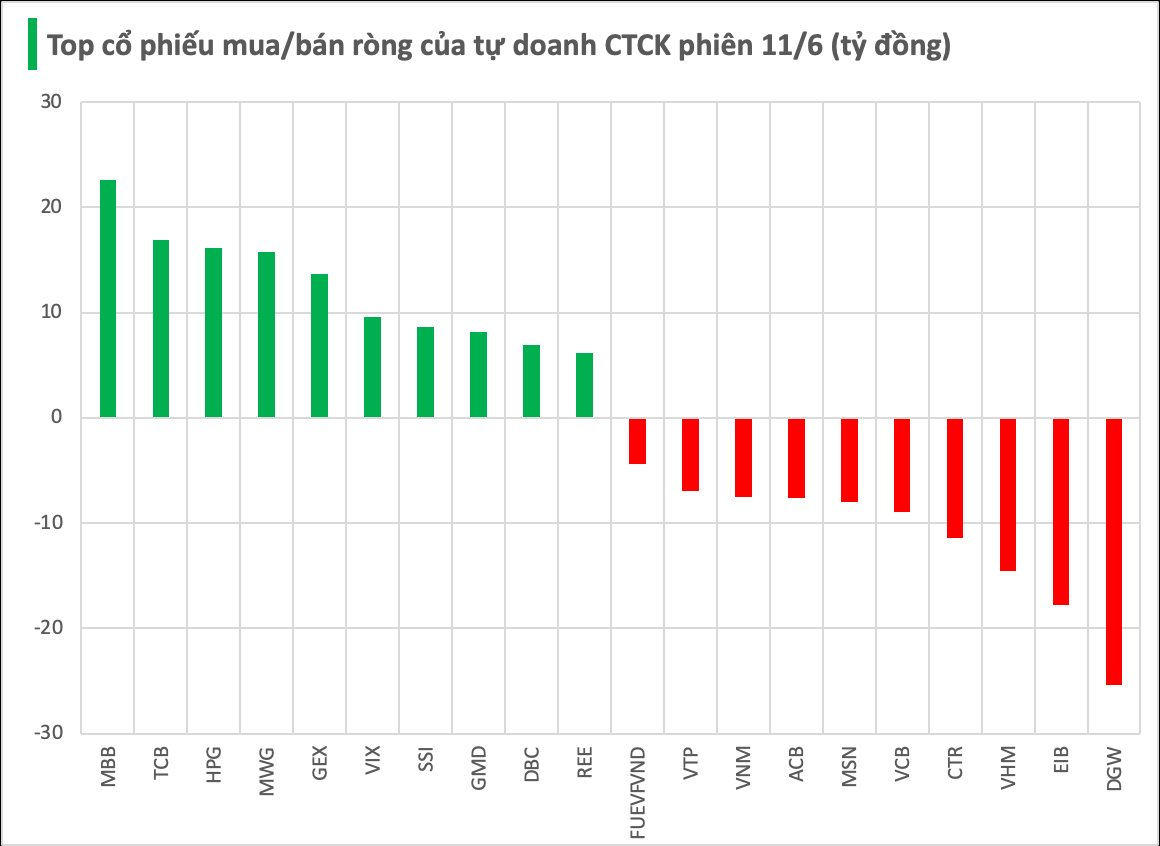

Securities companies’ proprietary trading recorded a net buy of VND 27 billion on the HoSE.

Specifically, securities companies offloaded DGW the most, with a net sell value of VND 25 billion. This was followed by EIB and VHM, which were net sold for VND 18 billion and VND 15 billion, respectively. Other stocks that faced net selling pressure today included CTR, VCB, MSN, ACB, VNM, VTP, and FUEVFVND…

On the buying side, MBB witnessed the strongest net buying, with a value of VND 23 billion. TCB, HPG, and MWG were also among the top net bought stocks, with respective values of VND 17 billion, VND 16 billion, and VND 16 billion. GEX, VIX, SSI, GMD, DBC, and REE were among the stocks that benefited from net buying by securities companies’ proprietary trading.

Market Pulse June 12: Choppy Trading with Narrowing Ranges After Initial Spike

The market maintained its positive momentum from the opening bell, with the VN-Index climbing 7.54 points to 1,322.74, the HNX-Index gaining 1.46 points to 227.69, and the UPCoM-Index rising 0.28 points to 98.32. Green dominated the market across the board.

A Brokerage Firm Launches Margin Loan Package with 6.6% Interest, Up to VND 3 Billion Credit Limit

In the midst of a robust stock market recovery, VPBank Securities slashes margin interest rates to an all-time low of just 6.6%/year. This unprecedented offer is accompanied by a host of other benefits, including lifetime waiver of trading fees, loyalty points redeemable for gifts upon account opening, and exciting gaming rewards.