On June 9th, Vietnam Opportunity Fund (VOF) – a VinaCapital-affiliated fund listed in London – announced its full exit from Tam Tri Medical Group (TTMC), a leading private healthcare network in Vietnam.

Tam Tri Medical is one of the foremost private healthcare providers in Vietnam and has been backed by a dedicated healthcare fund in South and Southeast Asia. Currently, TTMC owns and operates seven hospitals in the southern and central regions of the country.

Financial details of the transaction have not been disclosed.

Mr. Khanh Vu, Investment Director at VOF, commented: “VOF has sold its stake at a premium to one of the region’s leading healthcare investors, who understands the market and recognizes the immense potential of Vietnam’s healthcare sector.

Mr. Khanh Vu, Investment Director of VOF.

This successful exit comes despite challenges posed by the global macroeconomic context and the private equity M&A market.

Mr. Vu added that the realization of this significant investment allows the fund to recycle capital and reinvest in other attractive opportunities, especially as the government prioritizes the development of the private sector.

VOF initially invested in Tam Tri Medical in 2018 through a private equity investment when the group operated four hospitals with approximately 400 beds across its network.

Over the course of seven years, VinaCapital’s investment team supported the company in acquiring three new hospitals and initiating the construction of another.

This expansion has tripled the number of operational beds and staff across the group. Today, TTMC serves over one million outpatient visits and performs 20,000 surgeries annually.

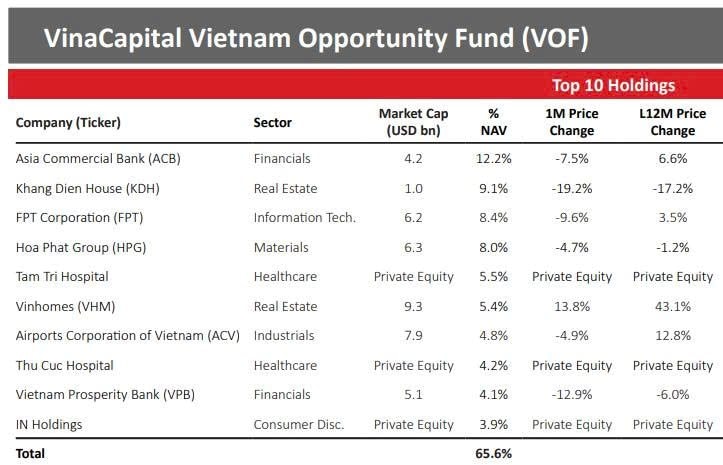

Prior to the exit, VOF held a 37.8% stake in Tam Tri. As of April 2025, this investment accounted for 5.5% of the fund’s net asset value, equivalent to $51 million.

This was VOF’s fifth-largest investment, following public market investments in ACB, Khang Dien, FPT, and Hoa Phat.

VinaCapital was among the first investors in Vietnam’s private healthcare sector through its investment in Hoan My Hospital in 2009.

Following exits from Hoan My and Tam Tri, VOF maintains one significant investment in the healthcare sector – Thu Cuc International Hospital, accounting for 4.2% of the fund’s net asset value. The investment in Thu Cuc was made in 2020, and the fund currently holds a 24.39% stake in the hospital.

The New Danang: A Real Estate Market Boom Awaits

“The merger of Da Nang and Quang Nam provinces is expected to unlock vast potential for real estate projects, particularly along the southern coastline. This is according to PGS. TS. Tran Dinh Thien, who highlights the potential for a significant boost to the region’s property market. The merger is anticipated to create a plethora of opportunities for developers, investors, and homebuyers alike, with the coastal areas expected to be a key focus.”

The High-Speed Rail Venture: Addressing Suspicions with a $100 Billion Vision

Mr. Vo Xuan Truong, Chairman of the Mekolor Investment Alliance and Great USD, has revealed ambitious plans for a high-speed rail project connecting the North and South of the country. With a staggering $100 billion in investment funds, Mr. Truong is determined to revolutionize interstate travel, promising a future of rapid, efficient, and comfortable transportation for all.

“Stock Recommendations for June: Tapping into Potential with a 33-35% Upside”

The sectors recommended in the May strategic report, including Real Estate, Exports, Oil & Gas, and Retail, are maintaining their positive momentum in the recovery process. Investors are advised to continue holding these stocks and to seize opportunities to increase their holdings when adjustments and positive signals arise.

‘Unbelievable’ Enterprise Proposes $100 Billion High-Speed Rail

The headquarters of Mekolor Joint Stock Company is nestled in a humble abode, tucked away in a quaint alley in Can Tho. With a modest registered capital of 1 billion VND, the company specializes in trade promotion and introduction. Established in 2016, Mekolor has since changed its address only once, a testament to its steady growth and presence in the dynamic world of commerce.

The Billion-Dollar Bauxite Mining Project: Unveiling the Low-Key Investor Behind the 16x Capital Increase

The recent survey revealed a total geological reserve of 497.7 million tons of raw ore, equivalent to over 200.5 million tons of refined ore.