The market is buoyed by the easing of trade tensions and the potential for an extended tariff reprieve for negotiating partners. This has resulted in a surge of cash inflow, with a 58% increase in liquidity compared to yesterday’s morning session, reaching the highest level since the beginning of the week.

While still bearing the burden of the Vin group’s stocks, other large blue-chips were able to push the VN-Index up by 7.54 points (0.57%), surpassing 1322.74 points by the morning session’s close. Notably, the market breadth was positive with 205 gainers and 85 losers, indicating a widespread positive sentiment despite the influence of a few large-cap stocks.

VIC plunged by 1.77%, VHM decreased by 0.83%, and VRE fell by 2.3%, causing a loss of approximately 2.3 points for the VN-Index. On the other hand, TCB rose by 2.16%, HPG climbed by 2.68%, and STB gained 3.27%, making up for 2.7 points. The rest of the index’s gain was attributed to the dominant upward trend.

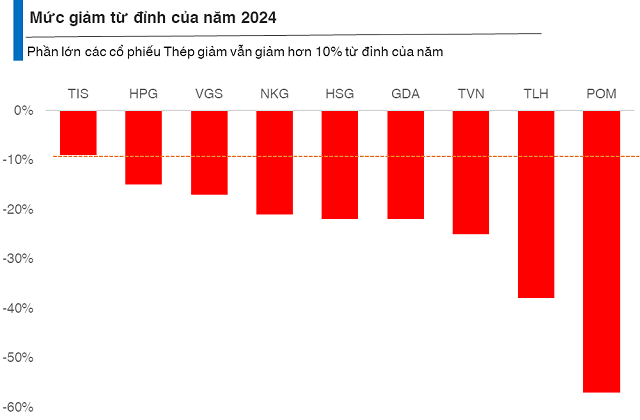

The VN30-Index also closed the morning session with a 0.63% increase, featuring 24 gainers and 6 losers. This basket of blue-chips demonstrated strength with 13 stocks rising by more than 2%. Notably, STB, HPG, GVR, and TCB surged by over 2%. Furthermore, there was a noticeable shift of cash flow back into the VN30 group, as liquidity rose by nearly 73% compared to the previous morning’s session. HPG’s robust trading was a significant factor, as its liquidity accounted for 43% of the basket’s total increased liquidity. HPG also led the market with a volume of nearly VND 1,005 billion, five times higher than the previous morning’s session. STB’s liquidity increased by 3.2 times with a price rise of 3.27%, MWG’s by 2.4 times with a price increase of 1.94%, TCB’s by 4.1 times with a price gain of 2.16%, and MSN’s by 3.2 times with a price appreciation of 1.39%…

The return of cash flow to the blue-chip basket is a positive sign, indicating that large investors are becoming more active. The VN30 group’s liquidity accounted for 48.7% of the total matched orders on the HoSE, the highest market share in three weeks.

The rest of the market also witnessed a positive sentiment, with the breadth indicating a strong upward momentum. Out of the 205 gainers, 105 stocks rose by more than 1%. While the blue-chips are undoubtedly attracting the most cash flow, there were also 10 midcap stocks that traded over VND 100 billion with significant price increases, notably VND rising by 3.11% with VND 231.4 billion, HSG climbing by 5.31% with VND 222.6 billion, NVL increasing by 3.24% with VND 178.3 billion, DIG gaining 2.56% with VND 133.9 billion, and YEG surging by 6.67% with VND 117.8 billion…

The smaller liquidity group also performed well, with over 30 stocks rising by more than 2%, such as DXS, DC4, VPG, NKG, CTI, and SMC, each trading in the tens of billions of VND. While the blue-chips dominated the main increase in liquidity on the HoSE, accounting for 56.1% of the value, the remaining VND 1,500 billion increase belonged to the mid- and small-cap groups. In summary, the best-performing group of the VN-Index currently accounts for 65% of the total matched volume on the HoSE.

On the downside, trading was sparse for a few stocks facing considerable pressure, such as GEX falling by 1.03% with a match of VND 125.6 billion, VIC decreasing by 1.77% with VND 124.8 billion, GEE dropping by 2.11% with VND 78 billion, VRE declining by 2.3% with VND 43.5 billion, VSC falling by 2.39% with VND 27 billion, and FRT slipping by 1.01% with VND 26.9 billion. Overall, the number of declining stocks was small, and their liquidity was modest. This suggests that the declining stocks are outliers and are out of sync with the overall positive sentiment of the market today.

Foreign investors also had a strong buying session, with a net buy value of nearly VND 1,265 billion on the HoSE, the highest in the last seven morning sessions. The net buy value stood at VND 223 billion, also the highest in seven sessions. HPG was heavily bought by this group, with a net buy value of VND 173.8 billion, despite the total buy volume accounting for only 24% of the stock’s liquidity. The rest of the trading was primarily driven by domestic investors. NVL (+VND 58.3 billion), MSN (+VND 46.9 billion), YEG (+VND 39.9 billion), VCI (+VND 36.1 billion), HSG (+VND 35.6 billion), and VIX (+VND 34.3 billion) were among the notable stocks that were bought, and their prices showed robust increases. On the selling side, CTG (-VND 48.9 billion), FPT (-VND 39.1 billion), VCB (-VND 32.4 billion), GEX (-VND 32.1 billion), and DBC (-VND 25.6 billion) were among the top sold stocks.

The market’s enthusiasm and the VN-Index’s rise above the 1320-point level signal a positive response to favorable information. A key strength is the return of cash flow after several declining sessions. Money only moves significantly when it perceives greater opportunities than risks.

A Brokerage Firm Launches Margin Loan Package with 6.6% Interest, Up to VND 3 Billion Credit Limit

In the midst of a robust stock market recovery, VPBank Securities slashes margin interest rates to an all-time low of just 6.6%/year. This unprecedented offer is accompanied by a host of other benefits, including lifetime waiver of trading fees, loyalty points redeemable for gifts upon account opening, and exciting gaming rewards.

Has the Stock Market Passed the Tariff Test?

If tariffs are considered a stern test of the stock market’s health, then the VN-Index’s journey from 1,300 points, falling below 1,100, and then rebounding to 1,335 can be interpreted in two ways: either as a reflection of the robust fundamentals of listed companies or as a manifestation of investors’ unwavering optimism.

“Stock Recommendations for June: Tapping into Potential with a 33-35% Upside”

The sectors recommended in the May strategic report, including Real Estate, Exports, Oil & Gas, and Retail, are maintaining their positive momentum in the recovery process. Investors are advised to continue holding these stocks and to seize opportunities to increase their holdings when adjustments and positive signals arise.

The Stock Market’s Hidden Gems: Unveiling June’s Top Growth Stocks

The An Binh Securities (ABS) team believes that the market is currently presented with a medium-term growth opportunity, attributed to positive developments in trade negotiations and the government’s proactive efforts.