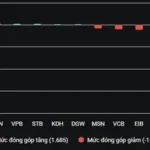

The Vietnamese stock market is on a strong recovery path after the slump caused by tariff policies earlier in April. From its low of 1,094 points on April 9, the VN-Index has surged over 23%, closing at 1,347 points on June 3 and hitting a three-year high. The overall picture looks brighter as foreign investors return to net buying, and the number of new stock accounts surges, indicating a restoration of individual investor confidence.

RECORD-LOW MARGIN INTEREST RATES

However, this recovery is not evenly distributed across the market. The clear differentiation between stock groups demands more selective and strategic investing than ever. In this context, leveraging tools like margin lending is becoming pivotal for optimizing investment returns.

VPBank Securities (VPBankS) stands by its clients during this recovery wave, offering an upgraded margin policy through a combo of interest rate discounts, lifetime transaction fee waivers, and Loyalty points. This program, running from June 9 to the end of 2025, targets new and returning clients. The margin package is designed with two distinct interest rates for different debt scales, peaking at VND 3 billion, catering to diverse investor needs and preferences.

Notably, for debts below VND 500 million, the margin interest is as low as 6.6%/year – the lowest ever offered by VPBankS. Unlike some market packages, the 6.6%/year rate is not limited to a few “national” stocks but extends to the entire basic margin portfolio of 261 stocks, with 169 of them eligible for a 50% loan ratio.

Additionally, VPBank offers transaction fee waivers for regular and margin sub-accounts and rewards of up to VND 200,000 when opening an account and fulfilling the conditions of the Loyalty policy.

After three years as the sole securities company under the VPBank ecosystem, VPBankS boasts a solid financial foundation with a chartered capital of VND 15,000 billion, ranking among the industry leaders. This abundant capital enables VPBankS to introduce various promotions, especially in margin lending, with competitive interest rates and large limits.

A RANGE OF INVESTMENT OPTIONS

VPBankS also offers promotions for other margin lending products like eMargin T+, VIP Margin, etc. eMargin T+5, T+10, and T+15 are tailored for “surfing” needs, with interest rates starting at 0% for 5, 10, or 15 days. VPBankS helps investors expand their trading scale, optimize costs, and seize opportunities in short-term waves by increasing the limit from VND 3 billion to VND 15 billion.

The VIP Margin policy caters to professional investors, provided by only a few securities companies and typically requiring case-by-case approval. With a debt limit of up to VND 50 billion per account and an interest rate of 8%/year, VPBankS’s VIP Margin is one of the few policies in the market that balances substantial capital needs with swift approval processes, forgoing complex exception procedures.

Simultaneously, VPBankS continuously enhances its product range to cater to all customer segments, including stocks, bonds, derivatives, and fund certificates. Recently, the company launched two new ePortfolio investment portfolios focusing on banking and securities stocks, with expected profits of 18-20%/year.

Currently, VPBankS offers ten ePortfolio portfolios spanning various fields and themes like “Market Upgrade,” “Competitive Advantage,” and “Stable Dividends,” catering to diverse risk appetites. These ePortfolio portfolios are built on real market data, analyzed by VPBankS experts, and regularly updated.

For details on the 6.6%/year margin policy, please visit: https://www.vpbanks.com.vn/post/margin-66-dau-tu-thanh-thoi-loc-kep-sieu-hoi

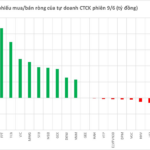

The Cautious Cash Flow: Paused Revival

The afternoon session witnessed a slight uptick in liquidity; however, it failed to make up for the lackluster morning performance. For the first time in six weeks, the HoSE floor’s matching value fell below 13 trillion dong, with the combined value of the two floors dipping below 15 trillion dong. Investors seem to be adopting a wait-and-see approach.

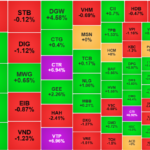

The Stock Market Plunge: A Sea of Red

Today’s trading session (June 9th) witnessed a broad-based decline among large-cap stocks. Sectors such as banking, securities, construction, materials, and chemicals were awash with red, indicating a day of losses and adjustments.