On June 12, the National Assembly voted to pass a resolution on merging provinces and cities, resulting in a reduction to 34 provinces and cities. This includes the merger of Quang Nam Province and Da Nang City into a new city that will retain the name Da Nang City.

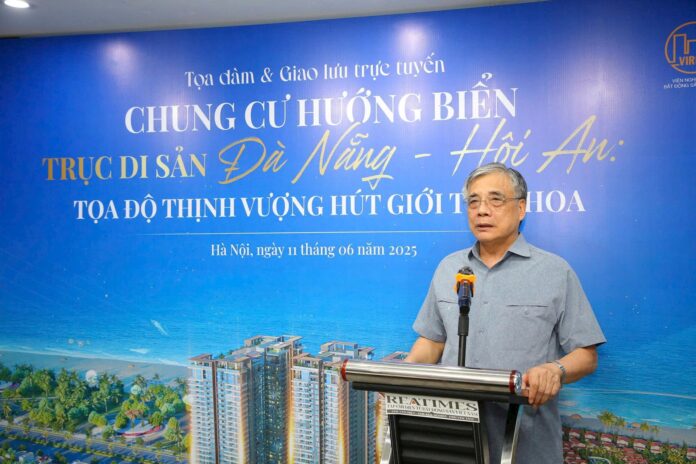

Recently, the Vietnam Real Estate Research Institute organized a seminar and online exchange with the theme “Seaside Apartments on the Da Nang – Hoi An Heritage Axis: The Coordinates of Prosperity Attracting the Elite.”

During the seminar, experts asserted that the coastal area of Da Nang – Hoi An is becoming the new focal point for investors and high-end residents due to a series of infrastructure developments, policies, and urban development visions.

According to a report by the Vietnam Real Estate Research Institute, there is a growing wave of international experts, entrepreneurs, and investors moving to Da Nang. This group of elite residents demands high standards of living environments, amenities, culture, and infrastructure, creating both challenges and opportunities for the region’s real estate market.

Notably, Da Nang is currently expanding its urban space, investing heavily in financial and free trade zones, transportation infrastructure, and particularly, the plan to merge with Quang Nam. With an area of nearly 12,000 km2 and two international airports, the new urban space will become the largest city among the centrally governed cities, boasting 200km of coastline – a highly valued potential for development by professionals.

The merger of Da Nang and Quang Nam brings about strategic changes to the southeast region of Da Nang, especially in Ngu Hanh Son District.

Experts agree that the southeast coastal corridor of Da Nang, stretching from Son Tra, My Khe, and Ngu Hanh Son to the ancient town of Hoi An and the Chu Lai open economic zone, converges three layers of value: nature, culture, and comprehensive connectivity. This will become a strategic belt and a “future convergence point” attracting domestic and foreign investment.

Assoc. Prof. Dr. Tran Dinh Thien, a member of the Prime Minister’s Policy Advisory Council, emphasized that the expansion of the geographical scope provides a “institutional springboard” for Da Nang, allowing for more flexibility in management and investment. This will create a modern chain of urban, port, industrial, and tourism areas capable of competing with leading centers in Asia.

Assoc. Prof. Dr. Tran Dinh Thien

From a planning perspective, Architect Tran Ngoc Chinh, President of the Vietnam Urban Planning and Development Association, asserted that future Da Nang must pivot towards the sea, aligning with the country’s sea-oriented development strategy. This is not only an urban conundrum but also an economic and social imperative in the long term.

However, alongside these advantages, the report also pointed out a concerning reality along the Truong Sa Street real estate axis, where most of the condotels, beach villas, and high-end resorts are concentrated. The majority of projects are granted only a 50-year land use right, face legal limitations, experience delays or are left abandoned, resulting in resource waste and an eyesore for the city.

In this context, the Vietnam Real Estate Research Institute suggested that the southeast coastal corridor, especially the Truong Sa Street area, needs to be restructured towards more sustainable and comprehensive development. Removing legal barriers for condotels and developing seaside urban areas with clear legal frameworks that cater to both vacation and long-term residential needs are key to reviving the market and creating sustainable appeal for the region.

A Maritime Company Goes Big: Investing Nearly $2 Billion in Two Ships Built in China

If the deal goes through, Vosco will have achieved half of its planned goal of purchasing four MR tankers. With this acquisition, their fleet of oil tankers will increase to seven, bringing their total fleet size to an impressive eighteen vessels.

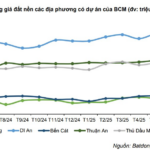

The Birth of a Mega-Metropolis: How the Merger of Ho Chi Minh City, Binh Duong, and Ba Ria-Vung Tau Creates a Powerhouse Benefitting the Industrial Park Baron of Binh Duong

“The proposed merger of Binh Duong, Ba Ria-Vung Tau, and Ho Chi Minh City is expected to provide a significant boost to the recovery of the Binh Duong real estate market, according to VCBS. This strategic move is anticipated to create a ripple effect, revitalizing the region’s property sector and presenting lucrative opportunities for investors and developers alike.”

DXG Issues Over 148 Million Bonus Shares, Increasing Charter Capital to Over VND 10,206 Billion

Are there any other adjustments or refinements you would like to make?

“Issuing a source capital of over VND 1,480 billion, with VND 1,200 billion derived from undistributed post-tax profits on the 2024 audited financial statements, and over VND 280 billion sourced from share capital surplus on the separate 2024 audited financial statements, we aim to make a powerful impact.”

Swan Lake Shophouses: Unlocking the Cash Flow Property Potential at Hoang Huy New City

In a market that is restructuring towards substance and practicality, investors are now prioritizing assets that offer immediate functionality, clear cash flow, and solid potential for capital appreciation. The shophouses at Swan Lake, part of the Hoang Huy New City development, stand out as one of the few assets that tick all these boxes.