Real Estate Group JSC (HOSE: DXG) has just released a report on its share issuance to increase charter capital from equity sources (bonus shares).

As of June 5, the company distributed 148.03 million bonus shares to 44,003 shareholders. The remaining 9,849 fractional shares will be canceled. The entitlement ratio is 100:17, meaning that for every 100 shares owned, shareholders will receive 17 new shares.

The newly issued shares are not restricted from transfer, except for existing shareholders holding ESOP 2023 (bonus type) shares during the restricted transfer period who will still receive the new shares, but these shares will be subject to the same transfer restrictions as the initial ESOP shares.

The issuance capital amounts to VND 1,480.4 billion, comprising VND 1,200 billion from undistributed post-tax profits according to the audited 2024 consolidated financial statements, and over VND 280.4 billion from share premium based on the company’s audited 2024 separate financial statements.

Following this issuance, the company’s charter capital increased from nearly VND 8,726 billion to VND 10,206.3 billion.

This capital increase plan was approved by the company’s shareholders during the 2025 Annual General Meeting of Shareholders (AGM) held on May 9, 2025.

Subsequent to this issuance, the company will proceed with another capital increase plan approved at the 2024 AGM, involving a private placement of 93.5 million shares to no more than 20 strategic investors. The minimum expected offering price is VND 18,600 per share, and the proceeds will be used to contribute additional capital and increase ownership in the company’s subsidiaries.

The AGM also approved the company’s 2025 targets, including consolidated net revenue of VND 7,000 billion and net profit of VND 368 billion, representing increases of 46% and 44%, respectively, compared to the previous year.

In the first quarter of 2025, DXG recorded consolidated net revenue of approximately VND 925 billion, a 13% decrease from the same period last year. This decline was mainly due to a nearly 19% decrease in core revenue from real estate transfers, amounting to over VND 666 billion. However, thanks to a 30% reduction in cost of goods sold, gross profit increased by 8% to over VND 510 billion.

After deducting taxes and expenses, the company reported a net profit of over VND 78 billion, a 1% increase compared to the previous year.

DXG Issues Over 148 Million Bonus Shares, Increasing Charter Capital to Over VND 10,206 Billion

Are there any other adjustments or refinements you would like to make?

“Issuing a source capital of over VND 1,480 billion, with VND 1,200 billion derived from undistributed post-tax profits on the 2024 audited financial statements, and over VND 280 billion sourced from share capital surplus on the separate 2024 audited financial statements, we aim to make a powerful impact.”

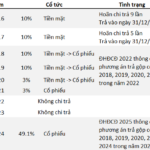

“SJ Group Issues Shares to Pay 5-Year Cumulative Dividends and Increase Charter Capital”

SJ Group plans to issue over 182.6 million shares to pay dividends for the years 2018, 2019, 2020, 2021, and 2024, as well as to increase its charter capital.

A Real Estate Firm Compounds Dividends with a 5-Year Stock Payout Strategy

The Ho Chi Minh City Stock Exchange-listed SJ Group Joint Stock Company (HOSE: SJS) has unveiled a plan to issue bonus shares and pay dividends in shares with a payout ratio of 159%. The issuance ratio relative to the number of shares currently in circulation stands at 160.33%, with the company holding nearly 1 million treasury shares.