Vietnam-based real estate developer, Dat Xanh Group Joint Stock Company (coded DXG on the Ho Chi Minh City Stock Exchange), has released a report on its share issuance to increase capital from retained earnings.

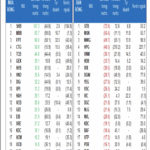

Specifically, as of June 5th, DXG issued a bonus issue of 148.03 million shares to 44,003 shareholders. The remaining 9,849 fractional shares will be canceled, with a ratio of 100:17 (for every 100 shares held, investors will receive 17 new shares).

The newly issued shares are not restricted from transfer, except for existing shareholders holding ESOP 2023 (bonus type) shares who are still within the restricted transfer period. These shareholders will receive the new shares but they will be subject to the same transfer restrictions as the original ESOP shares.

The issuance capital amounts to over VND 1,480 billion, with VND 1,200 billion sourced from undistributed post-tax profits on the 2024 audited financial statements, and over VND 280 billion from share capital surplus on the separate 2024 audited financial statements.

Following this issuance, Dat Xanh Group’s charter capital increased from nearly VND 8,726 billion to VND 10,206.3 billion.

In the first quarter of 2025, DXG recorded consolidated net revenue of approximately VND 925 billion, a 13% decrease compared to the same period last year. This decrease was mainly due to a 19% drop in core revenue from real estate transfers, amounting to over VND 666 billion. However, thanks to a 30% reduction in cost of goods sold, gross profit increased by 8% to over VND 510 billion. After deducting taxes and expenses, Dat Xanh reported a net profit of over VND 78 billion, a 1% increase compared to the previous year.

Recently, VCSC maintained a “Positive” recommendation for DXG and adjusted its target price by 24% to VND 18,600 per share. This adjustment was mainly due to: the revised timeline for the launch of the The Privé project, now expected to be completed in 2025-2028 instead of the previous estimate of 2025-2029; higher valuation for the brokerage segment; and an updated valuation model to mid-2026.

Additionally, VCSC adjusted its forecast for post-tax profit after minority interests in 2025 upwards by 3%, reflecting higher contributions from DXG’s self-developed projects. However, the forecast for 2026 and 2027 was reduced by 1% and 2%, respectively, mainly due to estimated higher net interest expenses.

VCSC expects the company’s post-tax profit after minority interests to reach VND 274 billion in 2025 (+7% YoY) and VND 433 billion in 2026 (+58% YoY). These forecasts are primarily based on anticipated higher sales and deliveries at Gem Sky World (GSW) and the continued recovery of the real estate brokerage segment.

Notably, VCSC’s valuation model does not yet include the private placement plan approved at the April 2025 General Meeting of Shareholders (93.5 million shares, equivalent to 9.2% of outstanding shares), which aims to increase charter capital and DXG’s ownership in its subsidiaries.

VCSC also noted potential risks for DXG, including slower-than-expected progress in new launches and dilution risks associated with capital mobilization plans.

Swan Lake Shophouses: Unlocking the Cash Flow Property Potential at Hoang Huy New City

In a market that is restructuring towards substance and practicality, investors are now prioritizing assets that offer immediate functionality, clear cash flow, and solid potential for capital appreciation. The shophouses at Swan Lake, part of the Hoang Huy New City development, stand out as one of the few assets that tick all these boxes.

“What’s in Store for Ho Chi Minh City’s Western District Real Estate Market in the Next Six Months Amid a String of Infrastructure Good News?”

The emergence of a series of expressway projects and large-scale road networks has significantly boosted the real estate market in Long An province during this period. This region is expected to remain a standout in terms of both supply and demand from now until the end of the year.