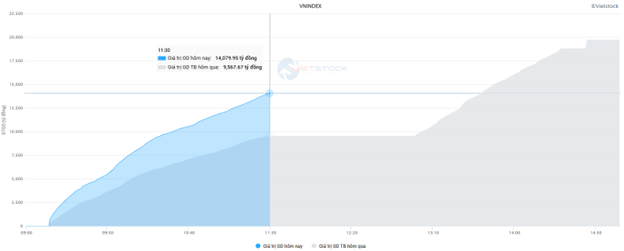

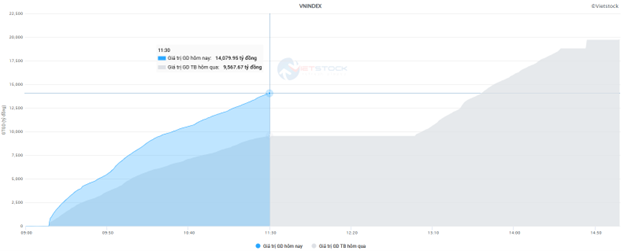

Market liquidity increased but in a negative context. The morning session recorded a trading value of more than 14 trillion VND on the HOSE floor, up nearly 50% over the same period in the previous session. Meanwhile, the HNX floor recorded a doubling of value, reaching nearly 1.5 trillion VND.

Source: VietstockFinance

|

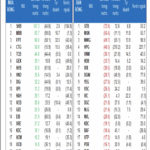

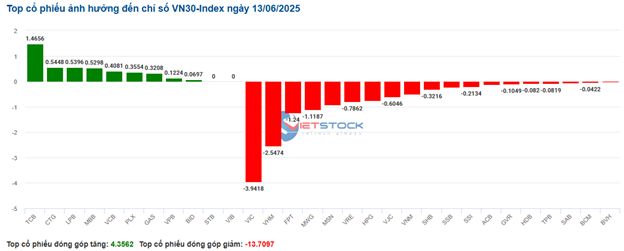

In the top 10 stocks influencing the VN-Index, CTG was the brightest spot, contributing more than 2 points. In addition, GAS, VCB, and BID also added nearly 2.5 points to the overall index. On the other hand, the main resistance came from the duo VIC and VHM, which took away 2.9 points and 2.4 points from the market, respectively.

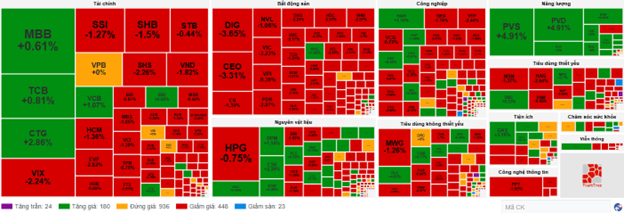

Considering sector performance, the real estate group is currently at the bottom of the market with selling pressure not only focused on the three Vingroup stocks as in the previous session but also on most stocks in the industry: VIC (-3.8%), VHM (-3.86%), VRE (-3.97%), BCM (-1.35%), NVL (-2.11%), KBC (-2.57%), PDR (-4.02%), NLG (-3.68%), etc. Following suit were the telecommunications and information technology sectors, also down more than 1%, as red dominated large-cap stocks such as VGI (-2.26%), FOX (-1.54%), CTR (-2.08%), SGT (-2.78%); FPT (-1.2%), CMG (-1.13%), and ITD (-4.93%).

On the opposite end, the energy sector index rose impressively by 4.61%, thanks mainly to PVS (+5.21%), PVD (+4.65%), PVC (+8%), POS (+3.89%), and PVB (+3.51%).

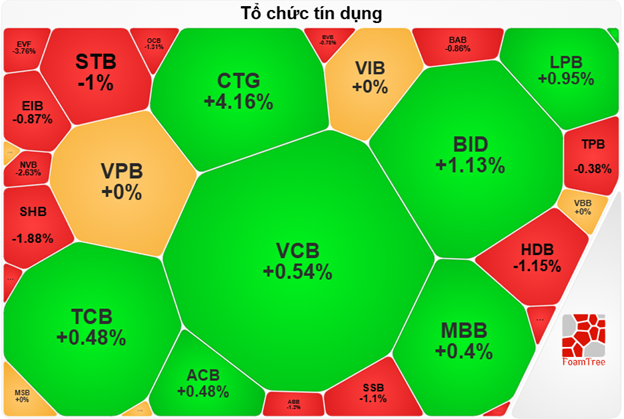

Additionally, the banking group is striving to hold the index up with a 0.48% gain, thanks to the industry’s “big brothers” such as VCB (+0.54%), BID (+1.13%), CTG (+4.16%), MBB (+0.4%), TCB (+0.48%), and ACB (+0.48%). However, many codes in this sector are still under strong selling pressure, including STB (-1%), HDB (-1.15%), SHB (-1.88%), and SSB (-1.1%), among others.

Source: VietstockFinance

|

Foreign investors continued the net selling trend, putting more pressure on the market. The total net selling value on the three exchanges in the morning session exceeded 237 billion VND, with the strongest selling pressure concentrated in FPT (71.81 billion VND) and VIX (61.38 billion VND). On the buying side, CTG stood out with a net purchase value of nearly 115 billion VND.

10:40 a.m.: Fierce tug-of-war, real estate and securities struggle

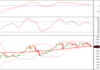

The morning trading session reflected a clear differentiation in the market. The red temporarily dominated the main indices, indicating a continuing adjustment phase. As of this writing, the VN-Index stood at 1,316 points, down 0.45%. Similarly, the HNX-Index also adjusted, losing 1.09% to 225 points.

The selling pressure was somewhat concentrated in large-cap stocks, as evidenced by the VN30 index falling 0.93% and the HNX30 index falling 0.73%, deeper declines than the overall indices of their respective exchanges. This indicates a certain caution among investors regarding short-term market leaders. The UPCoM index was almost unchanged, edging up 0.04%.

The VN30 basket showed a clear differentiation, with 10 codes increasing, 1 code referenced, and 19 codes decreasing. The positive momentum from large-cap stocks was somewhat weaker than the selling pressure. On the upside, the most significant contributors were TCB with 1.47 points, CTG with 0.54 points, LPB with 0.54 points, and MBB with 0.42 points. Conversely, the biggest drags on the index were VIC, which took away 3.94 points, VHM with 2.55 points, MWG with 1.28 points, and FPT with 1.24 points.

Source: VietstockFinance

|

Analyzing by industry, the picture becomes even clearer with strong differentiation. The most notable on the upside was the energy sector, which rose an impressive 4.72%. Notable codes in this industry include PVS, up 5.21%; PVC, up 9.68%; and PVD, up 1.48%.

The utilities sector also performed positively, rising 0.98%, thanks to contributions from POW, up 2%; GAS, up 1.48%; and PGV, up 2.67%.

Despite facing general pressure, the financial organization group remained in the green, up 0.81%, with notable codes such as TCB, up 1.62%; MBB, up 1.01%; BID, up 0.56%; and CTG, up 0.26%.

In contrast, the real estate sector fell 1.97%, with many important codes in the industry recording significant declines, such as DIG, down 3.80%; DXG, down 3.36%; KBC, down 3.20%; PDR, down 2.68%; and NVL, down 2.06%, while VIC edged up 0.27%.

The financial services industry also adjusted, falling 1.27%, with SSI down 1.89%, VND down 1.52%, VIX down 1.49%, and HCM down 1.87%. The semiconductor sector also recorded a deep decline of 2.77%. Telecommunications fell 1.56%, with VTP down 1.56%.

This differentiation reflects the flexible movement of money between sectors, seeking opportunities in stocks that have not yet risen or have separate prospects in the context of a downward-trending market.

Currently, the market breadth shows that declining stocks dominate. With 448 falling stocks and 23 floor stocks, the market far outpaced 180 rising stocks and 24 ceiling stocks. Notably, 936 codes stood still, reflecting the sideways state of most stocks in the basket.

Source: VietstockFinance

|

Opening: Broad-based decline at the beginning of the session, energy sector shines along with global oil prices

The morning session started on a negative note, with most sectors dominated by red. Notably, the VN30 index had the most negative impact, with almost all stocks in this group losing ground.

A host of VN30 stocks fell sharply, including VHM, HPG, FPT, and MSN. Only PLX and GAS managed to stay in positive territory.

The real estate sector was among the top losers in the market, with red dominating most stocks: VIC fell 1.38%, VHM fell 2.29%, VRE fell 1.98%, and KDH fell 1.18%.

Telecommunications and information technology also painted a gloomy picture, mainly due to declines in leading stocks: VGI (-1.6%), CTR (-1.56%), VNZ (-2.53%), FPT (-0.68%), and CMG (-1.41%)…

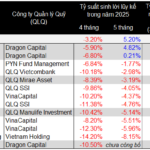

Profiting from Chaos: Domestic Firms Cash Out with Nearly 900 Billion Sell-Off Today

The domestic institutional investors recorded a net sell-off of VND 684.6 billion, with a striking VND 851.1 billion sold in the matched orders alone.

Market Pulse June 12: Afternoon Jitters Shake Markets, Late Rally Boosts VN-Index by Almost 8 Points

The market opened the afternoon session with a strong rally, surging towards the 1,326-point mark, but this momentum was short-lived as it quickly faced resistance and entered a corrective phase, dipping to 1,317 points. It was only in the final hour of trading that the market staged a recovery, returning to the morning’s price levels.