The stock market was painted in red today, with over 260 stocks on HoSE trading lower. While there were moments when the VN-Index recovered close to the reference level, persistent selling pressure throughout the session, coupled with high liquidity, pushed the benchmark deeper into negative territory.

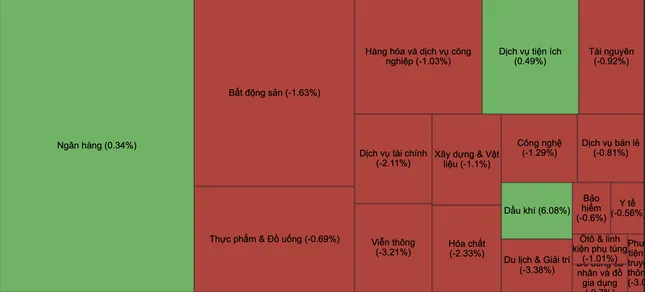

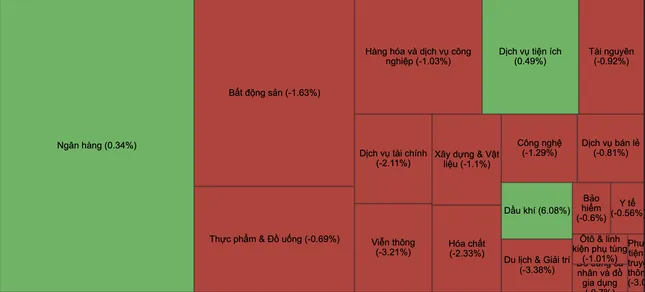

Stocks across various sectors witnessed a downward trend.

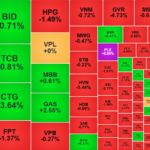

Apart from the Vingroup’s stocks, other major contributors to the downward pressure on the VN-Index included FPT, HPG (down 1.12%), HVN (down 5.58%), MWG (down 1.89%), GVR (down 4%), and GEE (down 4.48%).

Numerous stocks witnessed high trading volumes in the hundreds of billions of dong, with significant declines in their share prices. SHB fell over 3%, trading over 870 billion dong. VIX also declined by nearly 3%, with liquidity surging to 858 billion dong. SSI attracted more than 815 billion dong in trading value as its share price dropped by over 2%. Several stocks witnessed declines of 4-5% with high liquidity in the hundreds of billions of dong, including DIG, HVN, HDC, VTP, HAG, KBC, and NTL.

Real estate, securities, construction, and materials sectors were predominantly in the red. In contrast, banking and oil & gas stocks attempted to curb the downward trend. Thanks to their large market capitalization, CTG, TCB, BID, VCB, and MBB played a supportive role in mitigating the VN-Index’s loss, although their gains remained below 1%.

Meanwhile, the upward momentum in oil & gas stocks coincided with the oil price surge due to Middle East tensions. Brent crude oil prices soared by 9% to reach $75 per barrel, the highest level in the past two months.

At the closing bell, the VN-Index lost 7.5 points (0.57%) to finish at 1,315 points. The HNX-Index declined by 2.91 points (1.28%) to 224.82 points, while the UPCoM-Index fell by 0.62 points (0.63%) to 97.54 points.

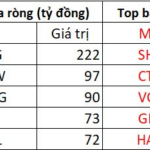

Liquidity surged, with the trading value on HoSE exceeding 27,100 billion dong. Foreign trading was relatively balanced, with a slight net buy of over 82 billion dong. CTG, NVL, VPB, and VHM were among the most bought stocks by foreign investors, while they net sold VIX, FPT, SHB, and CEO.

Today’s performance in the domestic stock market mirrored the trend across several regional markets. Japan’s Nikkei 225 declined by 0.92%, while South Korea’s KOSPI dropped by 0.87%. China’s Shanghai Composite and Hong Kong’s Hang Seng Index also witnessed declines.

The Powerhouse Industries: Banking and Oil to the Rescue, Yet Stocks Suffer

The Middle East tensions erupted suddenly before the domestic market opened, causing a significant impact. While the VN-Index was propped up by some large-cap stocks, a deep sell-off occurred across hundreds of stocks. The index closed slightly lower, down 0.57%, but 107 stocks fell by more than 2%, not to mention nearly 70 others that declined between 1% and 2%, or on the HNX.

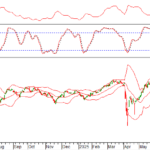

Stock Market Outlook for June 9-13, 2025: Intense Tug-of-War

The VN-Index curbed its decline and concluded a volatile trading week, characterized by alternating sessions of gains and losses since dipping below the Middle Bollinger Band. Presently, the index is undergoing a short-term correction, with a crucial support zone hovering around the 1,300-point mark. Maintaining this level is essential to mitigate the risk of further significant declines in the near term. Additionally, a sustained net buying spree by foreign investors would positively influence investor sentiment.

Stock Market Insights: Advantage for the Cash-Rich

The market surprisingly favored the cash holders, even though no one anticipated the overnight missile pass. Much like the tariff tumble, it was a miraculous blessing for the stock market!