Many residents in Hanoi and Ho Chi Minh City have noticed a recent increase in the prices of their everyday meals, from pho to banh mi. For example, a bowl of pho in Hanoi has increased by VND 5,000, now ranging from VND 40,000 to VND 60,000. Similarly, a bowl of bun rieu in Ho Chi Minh City has also gone up by VND 5,000, now costing VND 45,000.

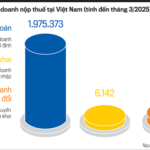

According to the restaurant owners and staff, one of the reasons for the price hike is the new tax policy that came into effect on June 1st. The policy requires individuals and households with an annual revenue of VND 1 billion to switch to declaring taxes based on actual revenue. As a result, they now have to source their supplies from providers with proper invoices, leading to higher input costs.

Additionally, the use of electronic invoices issued from cash registers directly connected to the tax authority has also contributed to the increased expenses. On top of that, the hot weather has led to higher electricity costs due to the constant use of air conditioning.

A well-known banh mi shop in District 1, Banh Mi Bay Ho, has increased its price from VND 22,000 to VND 24,000 per banh mi, including VAT. However, their payment methods remain the same, accepting both cash and bank transfers.

Banh mi prices increased by VND 2,000 due to tax reasons.

A bakery and hu tieu shop in Thu Duc City has also quietly raised their prices without any notice or menu updates. Specifically, a bowl of bakery canh thit increased from VND 30,000 to VND 35,000, and a bowl of hu tieu muc went up from VND 40,000 to VND 45,000.

When asked about the reason for the price increase, the owner of the shop replied, “We haven’t increased our prices for the past two years. But now, we have to pay taxes on every bowl of hu tieu, dish of banh xeo, and bowl of bakery canh, so the price increase is to cover the tax expenses.”

Meanwhile, a hu tieu shop in Binh Thanh District has maintained its original prices for dine-in customers but has raised its prices for delivery orders placed through food delivery applications by VND 5,000 to VND 10,000.

The owner explained that selling through apps incurs various expenses, with the platform fees and related costs amounting to nearly 30% of the order value. With the additional tax costs, the shop had no choice but to adjust its prices to make up for the short-term losses.

Some shop owners also attributed the price increases to new investments in management, software, machinery, accounting fees, and cashless transaction fees associated with data connectivity to the tax authority under the new regulations.

Ms. Ngoc Ha, a business owner in Tan Binh District, shared that since the beginning of June, some delivery companies have been adding 1.5% of the order value to the total collected amount without providing a detailed breakdown on the receipt. When questioned, the delivery staff replied that it was for taxes.

However, not all small business owners agree with this approach of increasing prices. Mr. Hoan, the owner of a bun rieu and banh uot Dalat shop in Thu Duc City, believes that these food businesses increasing their prices and blaming it on taxes are jumping the gun. As of now, small businesses like his, which fall under the tax-contracting category, are still in the process of declaring their taxes and receiving guidance from the tax authorities, with no concrete changes yet to justify the price hikes.

Furthermore, many small food stalls and unstable businesses have not started implementing the new tax policy, so using “including tax” as an excuse to raise prices is unjustified.

Consumers bear the brunt

According to economic expert Dinh The Hien, a 1.5% tax on revenue should not significantly impact the selling price of goods. Those who use tax as an excuse to increase prices may lose customers. There will always be businesses that take advantage of the situation and those that maintain their prices, and the latter will likely attract more customers.

“Let’s respect the market economy and support those who dare to increase prices reasonably, such as improving product quality, paying employees fairly, and paying taxes,” he said.

“However, if the price increase is unreasonable, we should not accept it. Those businesses will lose customers because no consumer will tolerate being taken advantage of. Healthy competition will improve the market, eliminating those who engage in speculative business practices,” Mr. Hien added.

The Sad State of Asia’s Fourth-Largest Economy: Soaring Prices Leave Citizens Reeling, Even Instant Noodles and Boiled Eggs Become Luxuries

Instant noodles were once considered a cheap meal, but prices in South Korea are on a continuous upward trend.

The Evolution of Electronic Billing: Seamless Efficiency at Your Fingertips

“Following the implementation of Decree No. 70/2025/ND-CP, the vast majority of citizens have cooperated and complied with the new policy. However, a significant number of businesses, particularly those run by older individuals, have faced challenges in adapting to the changes, resulting in ongoing data transmission issues. This challenge was inevitable given the short three-month preparation period for the decree and the delayed release of the guiding documents.”

Does an Order of VND 1,000 Require an E-Invoice?

The new regulations for issuing e-invoices generated from tax-compliant cash registers came into effect on June 1st. However, many businesses are facing challenges with the transition.

Declined Incoming Wire Transfers: Tax Evasion Scheme or Billing Blunder?

The latest news roundup: Widespread rejection of transfers sparks curiosity; the Deputy Minister of Construction speaks on abolishing building permits; the US monitors the currency of nine nations; a bustling Hanoi business street falls silent; tax crackdown on over 25,000 online businesses; and over 111,000 enterprises suddenly go ‘missing’. Intriguing developments, indeed!