The cash flow was too strong, not giving VN-Index a chance to adjust. The index rose sharply throughout the morning but towards the end of the afternoon session, it pulled back to just above the reference mark. It seemed like it would be another distribution session, but no, money immediately poured into the VN-Index, which closed with a gain of 7.79 points, advancing towards the 1,322 region with a very favorable breadth of 210 gainers over 86 losers.

The green spread across all industry groups except for real estate, especially the VinGroup stocks. Real estate fell nearly 2% today as VIC tumbled 3.77% and VHM lost 2.91%, while most other stocks rose, such as NVL, up 2.52%; KDH, DXG, DIG, VPI, and DXS, which all hit the daily limit-up.

On the other hand, banks gained 1.32% with not a single loser. STB led the sector with a 5.02% surge, followed by TCB, which climbed 2.82%. Securities firms followed suit, with VND, VCI, and MBS painting the screen green.

The export and logistics sectors, usually susceptible to tariff impacts, also excelled today following news that the US may continue to delay tariffs until specific negotiation results are reached with other countries. Steel stocks surged, along with construction, infrastructure investment, and food sectors, among others.

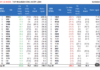

Today’s top performers, boosting the market, included TCB, HPG, STB, GVR, MBB, CTG, and VCB. Overall, investor sentiment has improved significantly, with matched orders across three exchanges today reaching VND 21,700 billion, including net foreign buying of VND 421 billion. In terms of matched orders, foreigners net bought VND 420 billion.

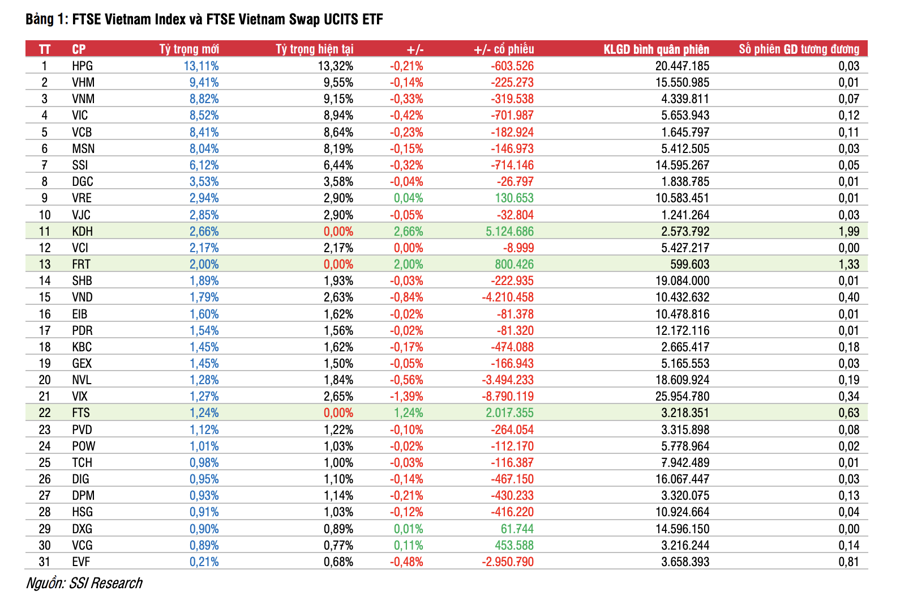

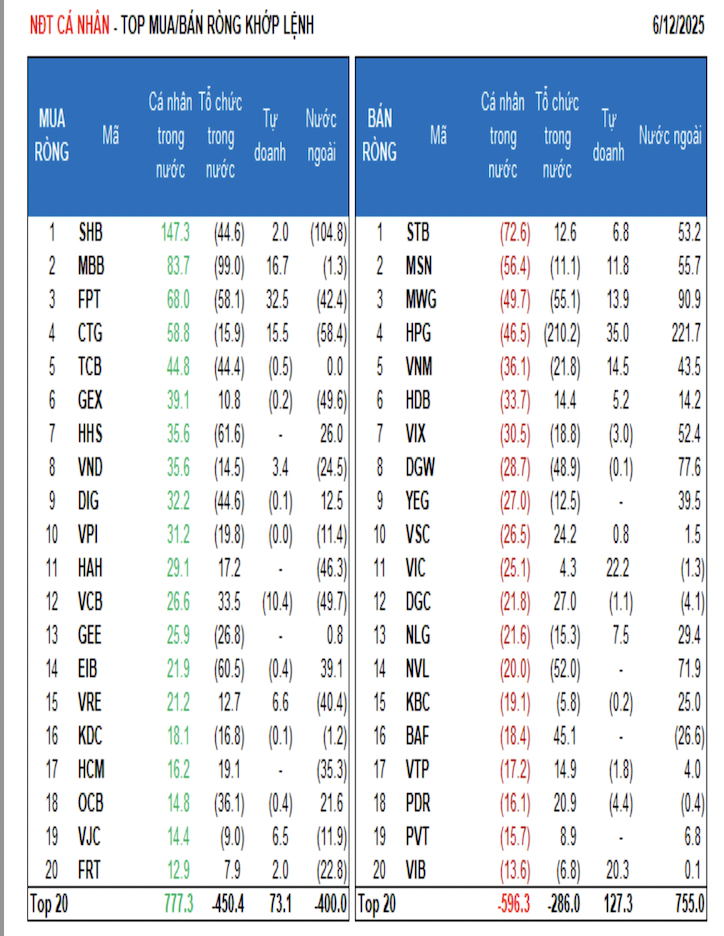

Foreigners’ main net-buying on the matched orders side focused on the Basic Resources and Retail sectors. The top net-bought stocks by foreigners on a matched orders basis included HPG, MWG, DGW, VCI, NVL, MSN, STB, VIX, VPB, and VNM. On the net-selling side, they offloaded stocks in the Industrials & Business Services sector. The top net-sold stocks by foreigners on a matched orders basis were SHB, CTG, VCB, GEX, HAH, FPT, VHM, VRE, and HCM.

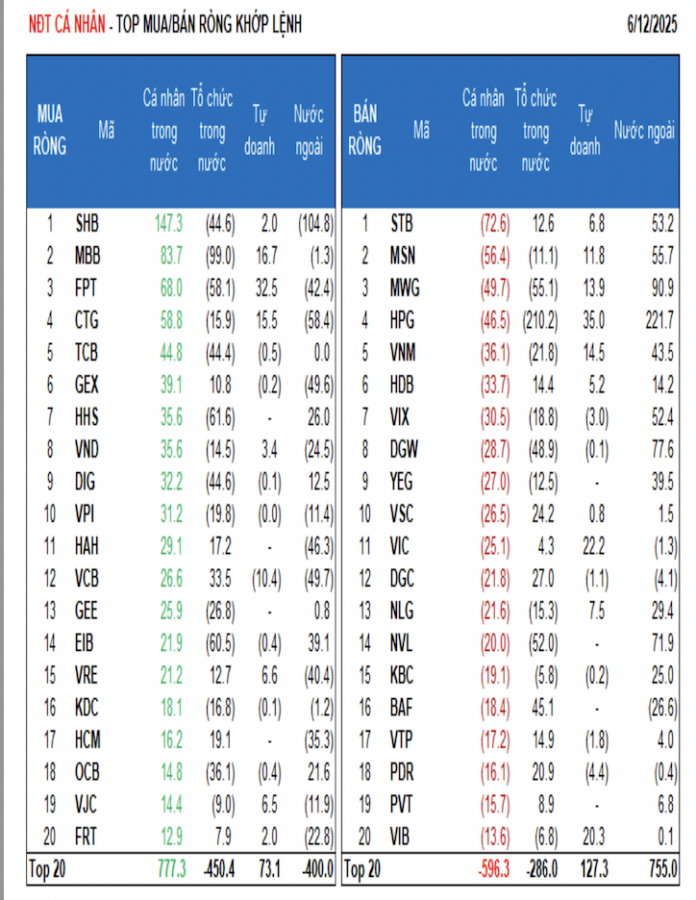

Individual investors net sold VND 94.9 billion, but on a matched orders basis, they net bought VND 111.9 billion. Looking at matched orders only, they net bought 8 out of 18 sectors, mainly the Banking sector. Their top net-bought stocks included SHB, MBB, FPT, CTG, TCB, GEX, HHS, VND, and DIG. On the net-selling side, they offloaded stocks in 10 out of 18 sectors, primarily in the Food & Beverage and Real Estate industries. Their top net-sold stocks were STB, MSN, MWG, HPG, VNM, HDB, DGW, YEG, and VSC.

Proprietary trading accounted for net buying of VND 330.8 billion, and on a matched orders basis, they net bought VND 319.3 billion. Focusing on matched orders only, proprietary trading net bought 13 out of 18 sectors, with the largest net buying in the Banking and Real Estate sectors. Their top net-bought stocks today were HPG, FPT, VPB, VIC, ACB, VIB, VHM, MBB, CTG, and VNM. On the net-selling side, they offloaded stocks in the Industrials & Business Services sector, with the top net-sold stocks being VCB, PDR, SSI, VIX, POW, SBT, VTP, GMD, PC1, and DGC.

Domestic institutional investors net sold VND 684.6 billion, and on a matched orders basis, they net sold VND 851.1 billion. Looking at matched orders only, domestic institutions net sold 11 out of 18 sectors, with the largest net selling in the Banking sector. Their top net-sold stocks were HPG, MBB, VPB, VCI, HHS, EIB, FPT, MWG, NVL, and DGW. On the net-buying side, they accumulated stocks in the Industrials & Business Services sector, with the top net-bought stocks being DBC, BAF, VHM, VCB, SSI, DGC, VSC, PDR, HCM, and HAH.

Today’s matched orders value reached VND 1,306.2 billion, down 25.1% from the previous session, contributing 6.0% of the total trading value.

A notable matched orders transaction occurred in MSB, with 16.5 million shares worth VND 204.2 billion traded between foreign institutions.

The cash flow allocation today increased in Banking, Steel, Food & Beverage, Retail, and Oil Equipment & Services while decreasing in Real Estate, Securities, Construction, Chemicals, Aquaculture & Fisheries, Electrical Equipment, Software & Services, Warehousing & Logistics, and Air Transport.

Focusing on matched orders only, the cash flow allocation increased in the large-cap VN30 sector while decreasing in the mid-cap VNMID and small-cap VNSML sectors.

The Stock Market’s Turbulent June: Uncovering the Quietly Surging “Safe Haven” Stock Sector

The VN-Index, according to SHS, is likely to face corrective pressure, retesting support around the 1,300-point level. Investors are advised to pay close attention to their portfolio management during this potential period of volatility.

Stock Market Outlook for Tomorrow, June 12: Buying Pressure on Stocks Yet to Break Through

The equity research firms assert that while the supply of stocks is not substantial, the demand remains weak. Investors are advised to trade with caution.