SJ Group Joint Stock Company (Stock Code: SJS, HoSE) has just announced the Board of Management’s resolution on implementing the plan to issue shares to increase charter capital from equity capital.

Specifically, the company plans to issue more than 182.6 million shares to existing shareholders. Of these, over 85.2 million shares will be issued as dividend payments for the years 2018, 2019, 2020, 2021, and 2024; the remaining nearly 96.4 million shares will be issued to increase charter capital from equity capital.

The entitlement ratio is 100:59, meaning that for every 100 shares owned on the record date, shareholders will receive 159 new shares. The shares will be freely transferable.

The total issuance value at par value is over VND 1,826.2 billion. The source of capital for issuing shares to pay dividends will come from undistributed post-tax profits in the audited 2024 consolidated financial statements; the source of capital for issuing shares to increase charter capital will come from the development investment fund and capital surplus.

SJ Group’s Nam An Khanh New Urban Area Project

The issuance is expected to take place in 2025 after the approval of the State Securities Commission (SSC) upon receiving the full issuance report.

If the issuance is successful, SJ Group’s charter capital will increase from nearly VND 1,148.6 billion to nearly VND 2,974.8 billion.

It is known that the above share issuance plan was approved by SJ Group’s shareholders at the Annual General Meeting of Shareholders (AGM) held on March 28, 2025.

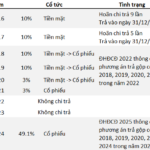

Accordingly, the company plans to pay cumulative dividends for the years 2018, 2019, 2020, and 2021 (according to the 2022 AGM resolution) in shares at a rate of 26% and pay a dividend for 2024 at a rate of 49.1% in shares.

According to our information, at the 2019 AGM, SJ Group approved the 2018 dividend payment in cash at a rate of 10%; the 2020 AGM approved a cash dividend payment of 10%; and the 2021 AGM approved a cash dividend payment of 3%. The total dividend payment in cash from post-tax profits for the years 2018, 2019, and 2020 is 23%, equivalent to nearly VND 262 billion.

However, to focus resources on SJ Group’s production and business activities, the 2022 AGM approved changing the form of dividend payment for 2018, 2019, and 2020 from cash to shares. At the same time, the company also approved a plan to pay 2021 dividends in shares at a rate of 3%.

Regarding SJ Group, the company was formerly known as Song Da Urban and Industrial Development Investment Joint Stock Company (Sudico), established in 2001, and mainly operates in the real estate sector.

SJ Group is known as the investor of several large projects, including: the expanded Nam An Khanh project; the Nam An Khanh New Urban Area project; the Van La Housing project; the Song Da – Ngoc Vung Eco-tourism project; the Tien Xuan Urban Area project; the Hoa Hai – Da Nang project; and more.

In April 2024, Sudico officially announced its new name as SJ Group Joint Stock Company, which was approved by the Hanoi Planning and Investment Department on April 11, 2024.

In terms of business results, according to the consolidated financial statements for the first quarter of 2025, SJ Group recorded net revenue of over VND 143.3 billion, up 21.1% over the same period last year. After deducting taxes and expenses, the company reported a net profit of VND 67.4 billion, up 52.1%.

As of March 31, 2025, SJ Group’s total assets decreased slightly by VND 21.2 billion compared to the beginning of the year, to nearly VND 7,823.1 billion. Of this, inventory accounted for VND 4,278.8 billion, or 54.7% of total assets, and long-term assets under construction amounted to over VND 2,400.3 billion, or 30.7% of total assets.

On the other side of the balance sheet, total liabilities stood at nearly VND 4,764.5 billion, a slight decrease of 1.8% from the beginning of the year. Of this, other long-term payable accounts amounted to nearly VND 1,919.6 billion, or 40.3% of total liabilities.

A Real Estate Firm Compounds Dividends with a 5-Year Stock Payout Strategy

The Ho Chi Minh City Stock Exchange-listed SJ Group Joint Stock Company (HOSE: SJS) has unveiled a plan to issue bonus shares and pay dividends in shares with a payout ratio of 159%. The issuance ratio relative to the number of shares currently in circulation stands at 160.33%, with the company holding nearly 1 million treasury shares.

“PVT Announces Stock Dividend: A Generous 32% Payout to Shareholders”

“PetroVietnam Transportation Corporation (HOSE: PVT) has announced a dividend payout of 32% for the year 2024. Shareholders owning 100 shares will be entitled to receive an additional 32 shares. The record date for this dividend issuance has been set as June 19, 2024, with the ex-rights trading date being the day before, June 18.”

“DIC Corp Completes Distribution of 36.5 Million Shares as 2024 Dividend.”

“DIC Corp has successfully distributed 36.57 million shares as dividends for the fiscal year 2024 to its 65,425 shareholders, resulting in an impressive surge in its chartered capital to VND 6,464.3 billion. “