I. VIETNAMESE STOCK MARKET WEEKLY REVIEW: JUNE 09-13, 2025

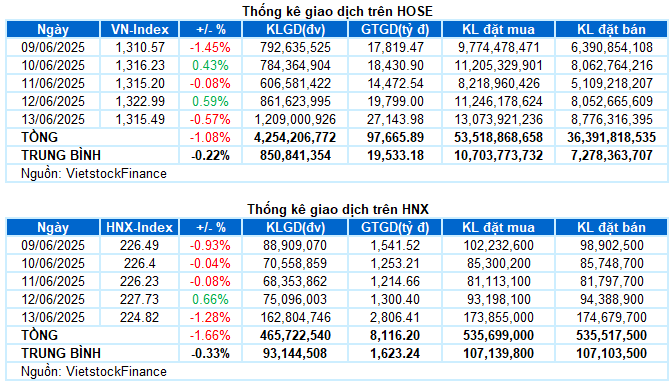

Trading: The main indices were dominated by red in the last trading session of the week. VN-Index ended the week at 1,315.49 points, down 0.57% from the previous session; HNX-Index also lost 1.28%, falling to 224.82 points. For the whole week, the VN-Index lost a total of 14.4 points (-1.08%), while the HNX-Index lost 3.79 points (-1.66%).

The Vietnamese stock market experienced a less positive trading week. After a deep decline at the beginning of the week, the VN-Index struggled to find balance around the 1,315-point mark with alternating rising and falling sessions. However, escalating geopolitical tensions caused unexpected strong selling pressure in the last session of the week. Thanks to support from a few large caps, the index narrowed its decline towards the end of the session, ending the week at 1,315.49 points, down more than 1% from the previous week.

In terms of impact, VHM, GVR, VIC, and HVN were the main stocks that put pressure on the VN-Index, causing a total loss of 5 points in the last session. Meanwhile, CTG was the main stock that pulled the index up, contributing nearly 2 points. Following were GAS, PLX, and BSR, which brought about 2.5 points, helping to narrow the VN-Index’s decline.

Most sectors ended the week in the red. The telecommunications group was the worst-performing sector in the market, falling by 3.31%, with the main pressure coming from the two large-cap stocks, VGI (-3.99%) and FOX (-2.16%).

The real estate group also lost 1.59% as the red spread widened, with notable stocks including VIC (-1.5%), VHM (-2.29%), VRE (-2.58%), KDH (-1.52%), NLG (-1.45%), KBC (-3.56%), PDR (-3.74%), TCH (-4.27%), and IDC (-1.23%), among others. In addition, the materials, information technology, and industrial groups also recorded declines of over 1%.

On the other hand, energy was a rare bright spot in the context of soaring oil prices due to geopolitical conflicts. The green spread across BSR (+5.41%), PVS (+6.75%), PVD (+5.68%), POS (+6.67%), and PVB (+4.21%), with PVC hitting the ceiling price.

In addition, bank stocks also made a significant contribution to preventing the overall index from falling too deeply thanks to their large capitalization. Notably, CTG (+3.64%), VCB (+0.36%), BID (+0.71%), TCB (+0.81%), MBB (+0.61%), and MSB (+0.42%) performed well. However, many other stocks in this industry were still subject to strong selling pressure, such as SHB (-3.01%), EIB (-1.95%), SSB (-1.1%), OCB (-1.31%), and NVB (-1.75%), among others.

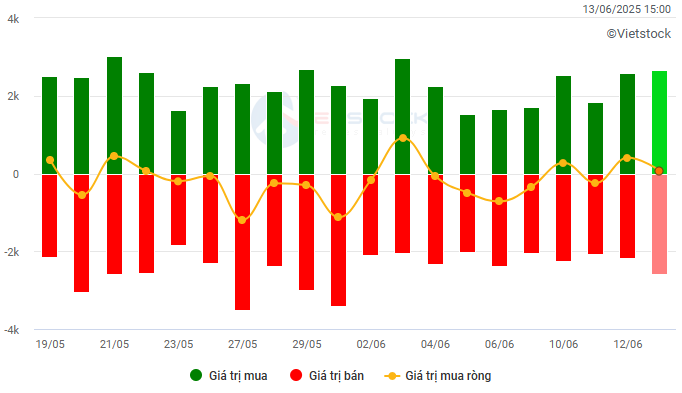

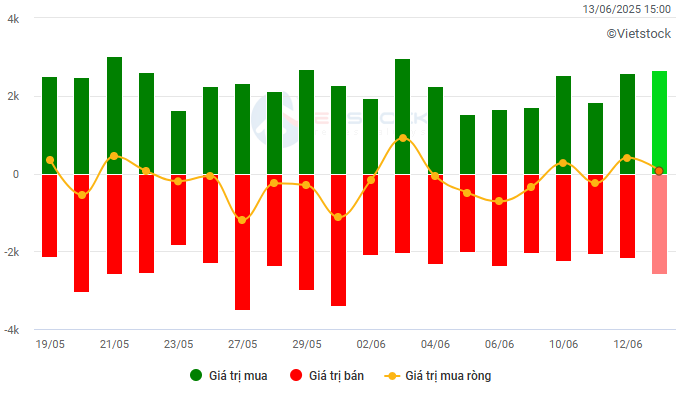

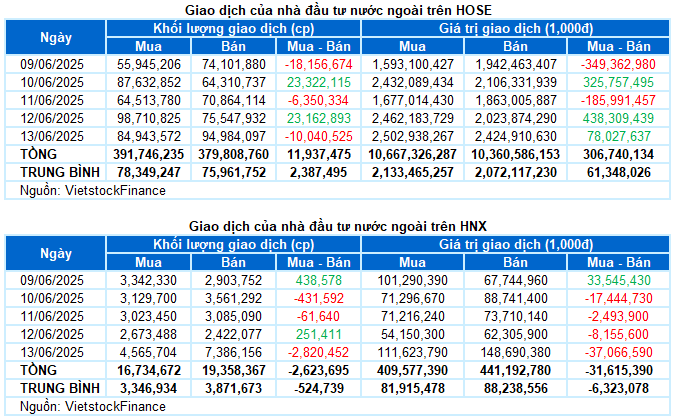

Foreign investors returned to net buying with a value of 275 trillion VND on both exchanges during the week. Specifically, they net bought over 306 billion VND on the HOSE and net sold over 31 billion VND on the HNX.

Trading value of foreign investors on the HOSE, HNX, and UPCOM exchanges by day. Unit: VND billion

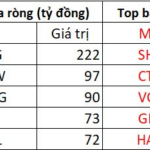

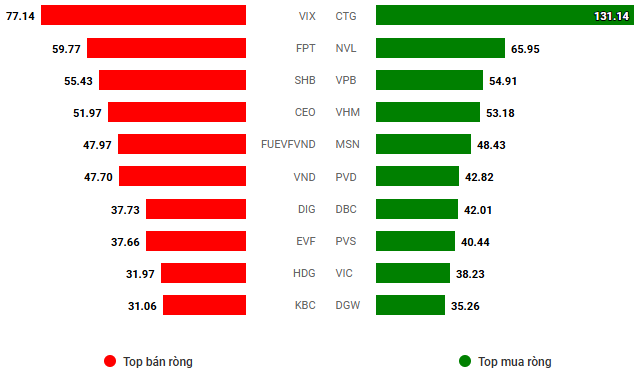

Net trading value by stock code. Unit: VND billion

The standout stock this week was DGW

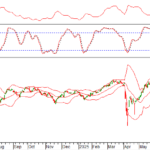

DGW rose 19.58%: DGW broke out strongly with 4 out of 5 gaining sessions this week. The stock price has consecutively surpassed the 100-day and 200-day SMA and closely followed the Upper Band of the Bollinger Bands. In addition, trading volume has been maintained at a high level above the 20-session average in recent days, reflecting the very optimistic sentiment of investors.

Currently, the MACD indicator is still maintaining a buy signal since the end of April 2025. If this status continues to hold in the coming period, the short-term outlook for the stock remains positive.

The stock with the largest decline this week was VIC

VIC fell 11.86%: VIC stock faced quite negative selling pressure this week after falling below the Middle Band of the Bollinger Bands. In addition, trading volume fluctuated around the 20-day average, reflecting the unstable psychology of investors.

Currently, the Stochastic Oscillator and MACD indicators continue to decline after giving sell signals. This suggests that the risk of adjustment in the short term remains.

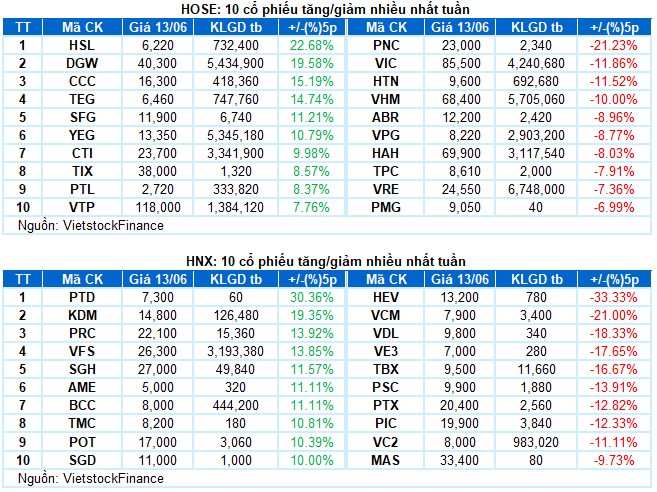

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economic & Market Strategy Division, Consulting Department, Vietstock

– 17:10 13/06/2025

Technical Analysis for June 13: Risk Signals Start to Emerge

The VN-Index and HNX-Index both witnessed a slight dip in the morning session, accompanied by an uptick in liquidity. This indicates a somewhat cautious sentiment among investors, as they navigate the current market landscape with a touch of hesitancy.

Market Pulse for June 13: Banking Stalwarts Struggle to Hold Indices Steady

The market witnessed a failed recovery attempt, with selling pressure intensifying towards the end of the morning session. At the midday break, the VN-Index shed over 10 points, resting at 1,312.48, while the HNX-Index dipped 1.06% to 225.32. The market breadth remained skewed towards decliners, with 502 stocks falling against 190 advancing ones as the afternoon session loomed.