Real Extractable Assets: The Foundation for Sustainable Cash Flow

In today’s stringent investment market, real estate products that can operate stably and control cash flow are always the preferred choice. The shophouses in the Swan Lake subdivision offer many elements that meet these criteria. The five-story design with two open sides allows owners to easily organize business models on the lower floors, such as small cafes, creative studios, boutique personal product shops, or service offices. Meanwhile, the upper floors maintain privacy and amenities for family living or rental purposes.

The vertical functional division optimizes space utilization, saves operating costs, and minimizes conflicts between living and business activities. This type of property appeals to investors who prioritize efficiency and desire each part of the house to create value.

Although not yet in actual operation, the foundation for a steady stream of customers at Swan Lake is gradually taking shape. On one side, it has access to the 2.6-hectare lake landscape – a gathering place for numerous community activities. On the other side lies Solasta Street, where artistic performances, seasonal events, check-in activities, and outdoor entertainment frequently take place. The community restaurant, Swan Pavilion, currently hosts conferences and large parties, serving as a central hub for social and hospitality activities in the area.

The consistent presence of events, coupled with the urban lifestyle that is being activated, provides a basis for the business models here to soon enter a stable cycle of operation. With reasonable investment and potential for exploitation in the future, the Swan Lake shophouse is not just a piece of real estate but an asset prepared to welcome actual cash flow.

Untapped Price Range, Double Profit Potential

Swan Lake is not only a subdivision adjacent to the lake but also located at the intersection of the ecological landscape and the bustling avenue of the metropolis. This product line combines two elements that the market always craves: proximity to a 2.6-hectare lake and direct connection to the Solasta Avenue pedestrian street, positioned as the festival-commercial-cultural artery of Hoang Huy New City.

This combination makes Swan Lake a subdivision with a distinct potential for price appreciation in the future. In large cities like Hanoi and Ho Chi Minh City, properties located on commercial streets and close to water bodies have consistently been the group of real estate that holds and increases value over time. As time goes on, the value of such prime locations only appreciates further, as their scale cannot be expanded, nor can they be replicated in other areas.

The substantial customer base makes Swan Lake a cash flow-generating real estate (Image source: Hoang Huy)

In terms of cash flow exploitation, with a reasonable operating model such as a stylish cafe, lodging, health spa, or creative office, a monthly revenue of eighty to one hundred million dong is entirely achievable. Without the need for large marketing expenses or waiting for uncertain customer sources, the operating value of Swan Lake stems from real customers: intra-community residents, event attendees, and locals who flock to the pedestrian street and lake landscape for entertainment.

Unlike short-term investment products, Swan Lake creates a cycle of sustainable cash flow. The asset doesn’t lie dormant, waiting for price appreciation, but instead generates consistent monthly revenue. This is the essence of cash flow real estate: operability, profitability, and value enhancement aligned with the area’s development pace.

As the administrative and political center shifts its development focus to the north of the Cam River, Hoang Huy New City, and especially the Swan Lake subdivision, are at the forefront of this wave of change. With its central location in the urban area, unique landscape, clear customer base, and optimized design for operation, Swan Lake is the choice for pragmatic investors seeking high-growth assets in the medium and long term.

Profiting from Chaos: Domestic Firms Cash Out with Nearly 900 Billion Sell-Off Today

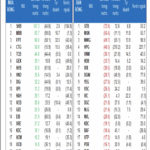

The domestic institutional investors recorded a net sell-off of VND 684.6 billion, with a striking VND 851.1 billion sold in the matched orders alone.

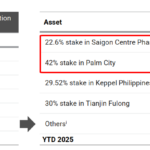

“Keppel Realizes Over $140 Million from Sale of Equity in Prime HCMC Project”

Keppel reaps windfall from divesting its stakes in property projects in China and Vietnam, notably the Saigon Centre Phase 3 project, which had been stagnant for over three decades.