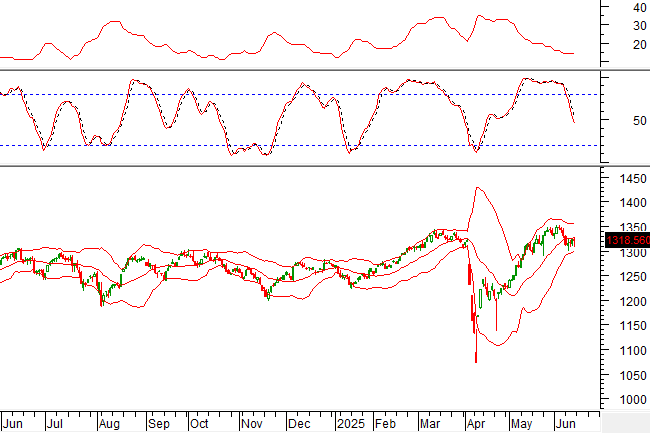

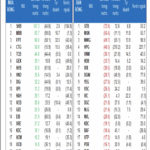

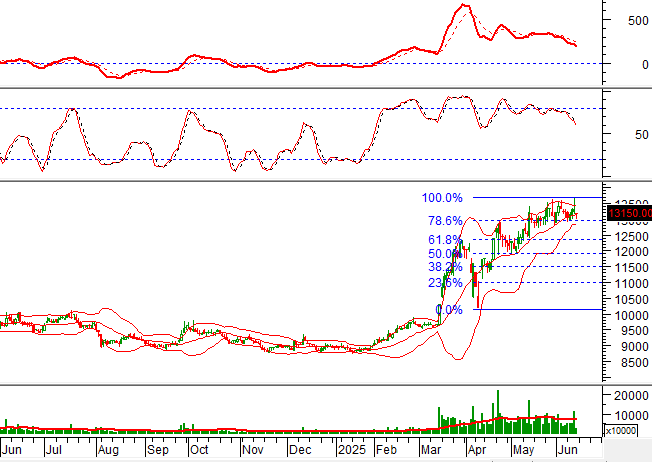

Technical Signals for VN-Index

In the trading session on the morning of June 13, 2025, the VN-Index opened slightly lower with trading volume expected to exceed the 20-day average by the end of the session, indicating a rather pessimistic investor sentiment.

Currently, the index continues to fluctuate and stays below the Middle Bollinger Band, suggesting a still pessimistic short-term outlook.

Additionally, the Stochastic Oscillator continues to decline after giving a sell signal, further adding to the pessimism.

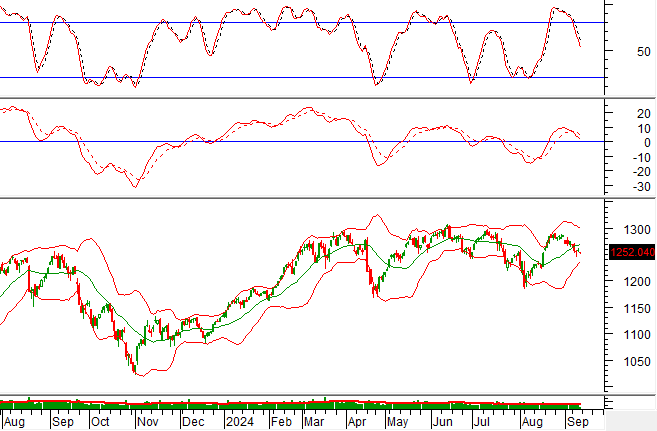

Technical Signals for HNX-Index

In the trading session on the morning of June 13, 2025, the HNX-Index recorded a slight decrease along with trading volume expected to exceed the 20-day average by the end of the session, indicating a rather pessimistic investor sentiment.

Moreover, a death cross appeared in May 2025, accompanied by a sell signal from the MACD indicator, suggesting that the negative scenario is likely to persist.

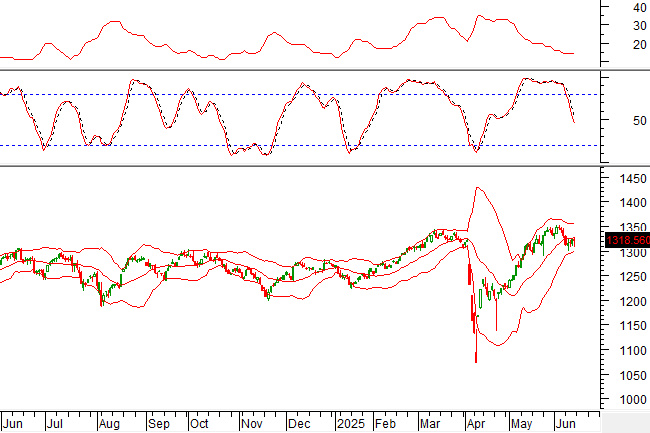

CTG – Vietnam Joint Stock Commercial Bank

In the trading session on the morning of June 13, 2025, CTG share price surged, forming a long candle pattern with high trading volume, exceeding the 20-session average, indicating active trading.

Notably, both the MACD and Stochastic Oscillator indicators signaled a buy, further reinforcing the stock’s recovery prospects.

In the short term, if the recovery momentum is maintained, the price target is expected to be the old peak of March 2025 (corresponding to the 42,500-43,500 region).

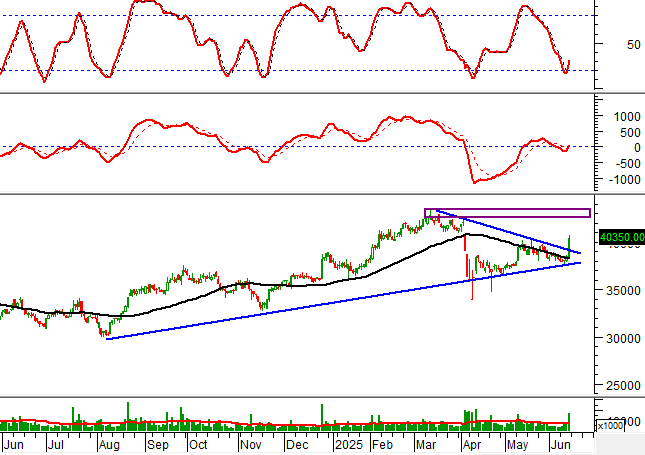

SHB – Saigon-Hanoi Commercial Joint Stock Bank

On the morning of June 13, 2025, SHB share price declined and stayed below the Middle Bollinger Band, indicating a rather pessimistic outlook.

Trading volume has been erratic, and price movements have been mixed, indicating investor instability. The Bollinger Bands are narrowing, suggesting a consolidation phase with decreasing price volatility. Price movements are expected to increase if the bands widen again.

Vietstock Consulting Analysis Team

– 12:22 13/06/2025

Market Pulse for June 13: Banking Stalwarts Struggle to Hold Indices Steady

The market witnessed a failed recovery attempt, with selling pressure intensifying towards the end of the morning session. At the midday break, the VN-Index shed over 10 points, resting at 1,312.48, while the HNX-Index dipped 1.06% to 225.32. The market breadth remained skewed towards decliners, with 502 stocks falling against 190 advancing ones as the afternoon session loomed.

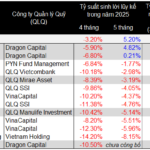

The Stock Group Posing a Challenge to Fund Managers

The movement of stocks VHM, VIC, VRE, and VPL has been dominating the VN-Index and the billionaire rankings this year. However, an imbalance also exists in the quartet’s upward trajectory.