HAH Board Member and Deputy General Director, Pham Quang Khanh

|

In his resignation letter, Mr. Khanh stated that he currently holds multiple positions, including HAH Board Member and Deputy General Director, and Director of Hai An Port Company – a subsidiary of HAH. To focus more on his roles as HAH’s Deputy General Director and Director of Hai An Port, he has decided to resign from his position as a Board Member.

Meanwhile, Mr. Truc also submitted his resignation, citing personal work commitments that prevent him from dedicating sufficient time to fulfill his duties as a Board Member effectively.

The resignations of these two board members come just before the upcoming 2025 Annual General Meeting of Shareholders, scheduled for June 26.

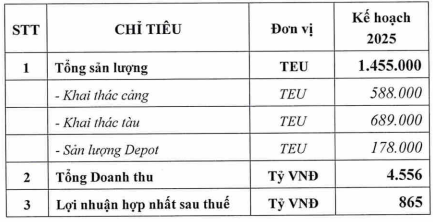

At this year’s meeting, the HAH management proposes a 2025 business plan with a target of nearly 1.5 million TEU in total throughput, a nearly 9% increase from the previous year. The consolidated revenue and post-tax profit targets are set at VND 4,556 billion and VND 865 billion, respectively, representing increases of over 13% and 33%.

|

HAH’s 2025 Business Plan

Source: HAH

|

To achieve these targets, HAH will support its member companies in expanding their business operations. This includes strengthening relationships with partners who require their services, as well as exploring new collaborations with ONE to serve the Vietnam-Singapore route and potentially other new routes, paving the way for long-term partnerships. Maintaining and fostering positive relationships with foreign partners will also be crucial to ensure smooth and efficient ship leasing.

In terms of investments, HAH sets its long-term goal on expanding its services to the Mediterranean-European (MED-EU) region and/or the US West Coast (USWC) in the next few years. This expansion will involve providing direct container transportation services to Vietnamese exporters and importers. To realize this goal, the company will need to build larger ships and meet the increasingly stringent international maritime standards.

Therefore, the management proposes the following investments: building four new container ships ranging from 3,000 to 4,500 TEU; purchasing two to three suitable used ships; and researching and developing a project to build ships ranging from 7,000 to 9,000 TEU.

In the port and logistics sector, HAH plans to dispose of old and damaged forklifts and vehicles and invest in one to two new 45T Kalmar forklifts. They will also explore installing a solar power system, renovating offices and the Hai An building, and transferring the container yard and port service project in Ba Ria-Vung Tau province. Additionally, they aim to seek investment opportunities in seaports in the Hai Phong region and infrastructure for the logistics sector in other areas, such as the Mekong Delta and Central regions.

Looking ahead to the market in 2025, the HAH management predicts a significant decrease in container freight rates from their peak in 2024. This is due to the return of excess ship capacity as new vessels continue to be delivered, the stabilization of the Red Sea situation, and the resolution of port congestion issues.

For the subsequent years, the container transport industry is expected to face a surplus in both mid and long-term capacity due to the recent surge in new ship orders and the environmental regulations that require significant investments in clean fuel and technology. Shipping companies will need to optimize their operations, develop value-added services, and adapt to changes in the global supply chain, such as the near-shoring and friend-shoring trends. Competition among shipping companies and alliances may also intensify.

Regarding the 2024 dividend, HAH intends to distribute a 40% dividend, including a 10% cash dividend and a 30% stock dividend. With this plan, the company expects to issue nearly 39 million shares for the dividend payment.

Additionally, HAH proposes to issue a maximum of 2.5 million ESOP shares (equivalent to 1.48% of the expected outstanding shares after the dividend payment) at a price of VND 10,000/share. These shares will be restricted from transfer for three years.

– 15:28 13/06/2025

“Nhất Việt Securities to Issue 10.3 Million Dividend Shares for 2024 Payout”

“Nhất Việt Securities plans to issue 10.36 million shares as a dividend for fiscal year 2024. The expected timeline for this issuance is the second or third quarter of 2025.”

“T-Cap: Unveiling a New Era of Financial Strategy”

The annual General Meeting of Shareholders of Tri Viet Securities Joint Stock Company (HOSE: TVB), held on June 07, 2025, approved a name change to T-Cap Securities. Amid challenging market conditions, the company has set conservative business targets for 2025 and plans to offer over 33.6 million shares to existing shareholders.

“Dividend Payment Schedule for June 9-13: Top Cash Dividends Over 40%, State-Owned Enterprise Allocates Approximately VND 1,500 Billion for Dividend Payments”

Introducing the top-performing stocks that offer lucrative cash dividends! 32 companies stand out with their generous cash payouts, ranging from a remarkable 41% to a solid 1.6%. These figures showcase a diverse range of opportunities for investors seeking steady income streams and strong returns. This impressive lineup underscores the potential for substantial gains in the stock market, providing a compelling proposition for those looking to grow their wealth.