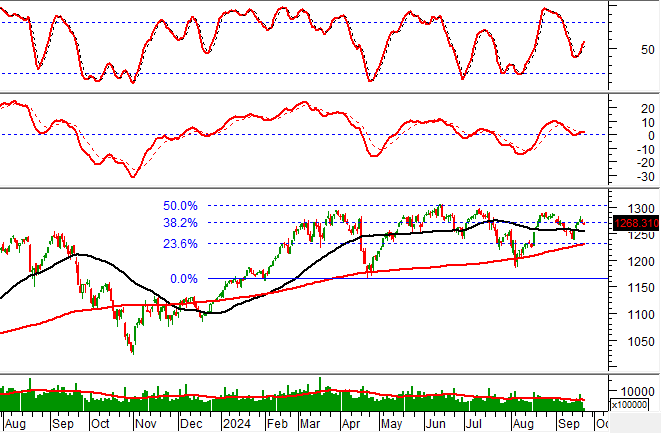

According to Bloomberg data, ETF capital has been withdrawing from the US stock market for several weeks, starting from the week of March 24-28 to May 05-09. Notably, during the week of April 07-11, there was a strong net inflow of over $45.9 billion when Trump announced a 90-day delay in tariff policies against individual countries. Throughout this period, the US stock market experienced a significant crash but has since recovered.

It’s not just stocks; US bonds have also become less attractive, with net inflows continuously narrowing and even experiencing a net outflow of over $1.4 billion in the week of April 21-25.

In contrast, non-US stocks have seen net inflows, vividly illustrating the shift in capital flow.

Source: Bloomberg

|

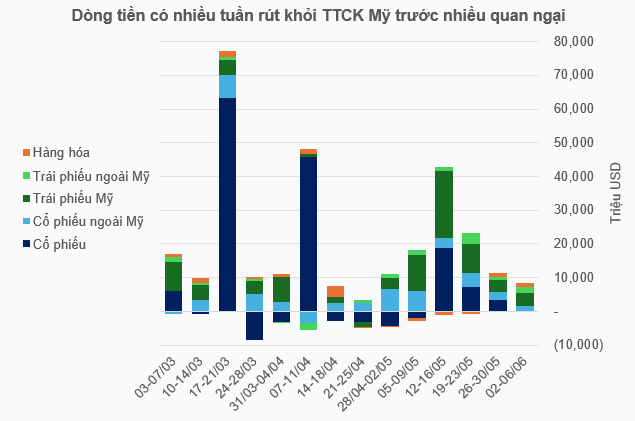

In the Asian stock markets, the allure returned prominently from the latter half of April, with Taiwan and India standing out. Vietnam also drew attention, shifting from continuous net outflows of hundreds of millions of dollars to net inflows until mid-May, including a week of net inflows of $148.5 million from May 12-16.

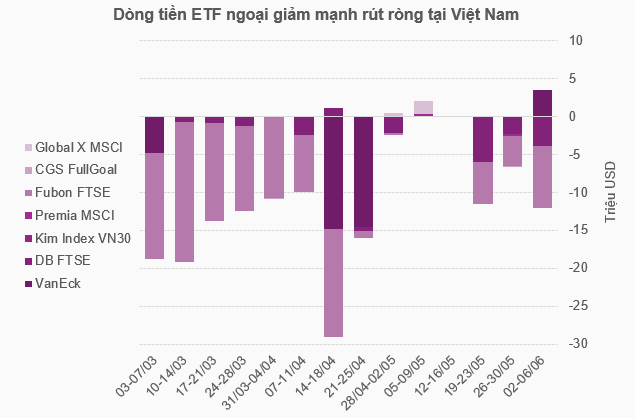

Regarding foreign ETF capital into Vietnam, the net outflow phase also decreased continuously until early May, except for a period from April 14-25 when VanEck and Fubon FTSE triggered strong net inflows.

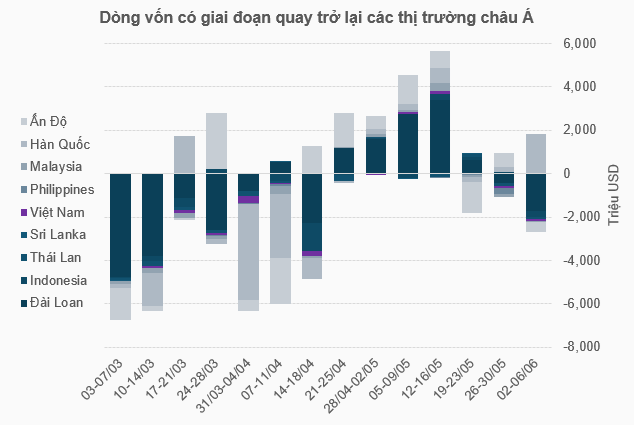

For Vietnam, after a fierce sell-off following the announcement of significant tariff rates, investor sentiment has stabilized. They now have a certain perspective and evaluation. As a result, a rapid recovery from the low of 1,073.61 points concluded May at 1,332.6 points. The resumption of net buying by foreign investors has been a significant driving force.

Source: Bloomberg

|

Source: Bloomberg

|

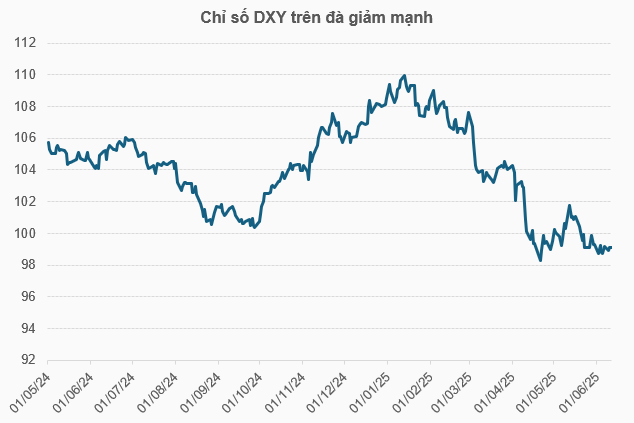

Speaking at the Vietnam and the Indices program on June 02, Tran Hoang Son, Market Strategy Director of VPBank Securities (VPBankS), stated that the weakening USD has prompted investors to reduce their exposure to assets denominated in this currency, particularly in the US, and shift back to emerging and frontier markets.

Therefore, in the Vietnamese market, if enterprise valuations are attractive and less affected by tariff issues, investors can confidently buy during the adjustment phase and hold for the year-end rally.

Mr. Son emphasized that Trump’s style is to escalate issues, inviting parties to negotiate for the most benefit for the US. The market will remain unpredictable in the short term, but the potential for recovery and growth in the long term, especially in frontier and emerging markets, is very positive.

In an interview with Vietstock, Luu Chi Khang, Head of Self-employed Vietnam Construction Securities (CSI), opined that while the VND is still depreciating against the USD, the latter’s weakness will inevitably lead to a trend of net buying in emerging markets, including Vietnam. This context is supported by the economy’s positive signals and the fact that foreign ownership stood at only about 16% as of May, following a strong selling-off period.

Thus, the expert concluded that the net buying trend is more long-term than short-term.

Source: Author’s compilation

|

Despite these changes, there has been a recent indication of net inflows back into the US stock market in the past few weeks, with a scale of nearly $18.7 billion in the week of May 12-16, over $7.3 billion in the week of May 19-23, and more than $3.5 billion in the week of May 26-30.

The recent rise in US bond yields has been identified by Nguyen The Minh, Director of Research and Development at Yuanta Vietnam Securities, as one of the causes. Statistics show that long-term maturities, such as 10 and 30 years, have high yields of 4.5-5%.

According to Mr. Minh, this development reflects the sell-off’s impact on public debt and the US economy’s capital costs. This will undoubtedly affect short-term macro trends, especially exchange rate pressure.

Should the yield trend continue to rise and surpass 5% for the 30-year maturity, Vietnam’s exchange rate risk would increase significantly, indirectly influencing foreign capital.

Mr. Minh also forecasted that exchange rate pressure would remain high in June and continue to rise until September. Although the DXY index has decreased, the high-interest rate differential makes it challenging to cool down the exchange rate. If the DXY index reverses, the exchange rate pressure will be even more significant.

Source: Author’s compilation

|

With capital inflows into Asia and Southeast Asia performing well, a recent divergence has emerged, with South Korea and Japan attracting money while many other countries, including Vietnam, Thailand, the Philippines, Malaysia, Taiwan, and even India, experiencing net outflows. Note that these developments occur during a sensitive period as the final rounds of tariff negotiations draw near.

In summary, the tariff variable remains challenging to predict and could cause foreign capital in the financial market to continuously shift directions.

– 08:04 13/06/2025

Unveiling the Biggest Challenge at Vietnam’s Top 10 Global Project Site: A Record-Breaking Figure Just Released

This mega-project is being constructed at an impressive pace, with 80-90% completion achieved in just over nine months. It is a testament to efficient planning and execution, and the speed at which this project is taking shape is truly remarkable.

“The United States Seizes Vietnam’s Export Offerings”

“The Minister of Industry and Trade emphasized that, regarding the ongoing bilateral trade agreement negotiations between the two nations, Vietnam is eager to open its markets and offer enhanced concessions for American exports. Vietnam anticipates reciprocal gestures from the United States, expecting a proportionate response to foster a mutually beneficial trade relationship.”

The Home Secretary’s Heartfelt Words Ahead of a ‘Historic, Sacred Moment’

“These decisions are of historic significance and carry great strategic weight, as they are designed to shape the future and forge a new development paradigm for the nation,” expressed Minister of Home Affairs Pham Thi Thanh Tra.