In its recently published research and analysis report, Yuanta forecasts a recovery in the real estate market from the second half of 2025, supported by six key factors, signaling a new phase of development for Vietnam’s real estate sector.

EXPECTATIONS FOR STREAMLINED ADMINISTRATIVE PROCEDURES

Firstly, the government is simplifying administrative procedures and promoting efforts to boost the economy. Amendments to several key laws in the past year have streamlined administrative processes.

The revised Law on Credit Institutions took effect on July 1, 2024, while changes to the Law on Real Estate Business, the Law on Land, and the Housing Law came into force on August 1, 2024. These modifications and more detailed guidelines on implementation will ensure consistency and efficiency in the future.

The government has taken decisive action to untangle legal obstacles for 2,200 projects totaling 347,000 hectares and approximately $235 billion in investment—equivalent to 50% of Vietnam’s 2024 GDP. While specific approval timelines are uncertain, Yuanta believes most of these projects will be ready for launch within 3–5 years. This would equate to an annual supply averaging 10–15% of GDP, excluding new projects.

Special legal frameworks are facilitating housing development planning. As of April 29, 148 projects totaling 840 hectares in Hanoi are undergoing investment approval procedures. This group includes projects owned by listed companies such as HDG (Thanh Xuan, 2.24 ha), PC1 (Gia Lam, 0.96 ha), DGC (Long Bien, 5.43 ha), VPI (Van Phu Complex, 2.47 ha), G36 (Dong Da, 0.98 ha), and MIG (MIC Tower, 2.53 ha). Meanwhile, Ho Chi Minh City is reviewing a list of 371 projects covering 1,700 hectares.

Yuanta is particularly optimistic about the potential removal of construction permit requirements for projects already approved at the 1/500 scale.

The highest-level government agencies are directly addressing administrative bottlenecks. For instance, the detailed planning at the 1/5,000 scale for the C4 area was approved within three weeks, as mandated by the Deputy Prime Minister.

“Innovation 2.0” – the most “ambitious” administrative reform – is expected to unlock significant economic potential if successful, boosting growth through efficient policy implementation and attracting increased foreign investment. This growth will directly stimulate the real estate market.

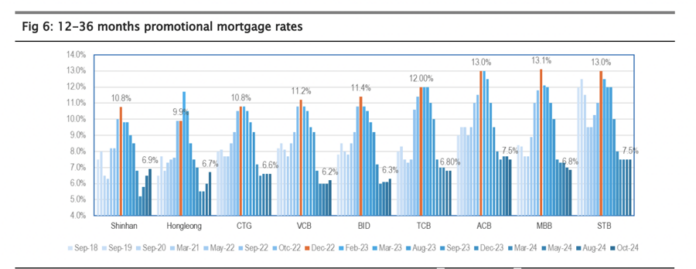

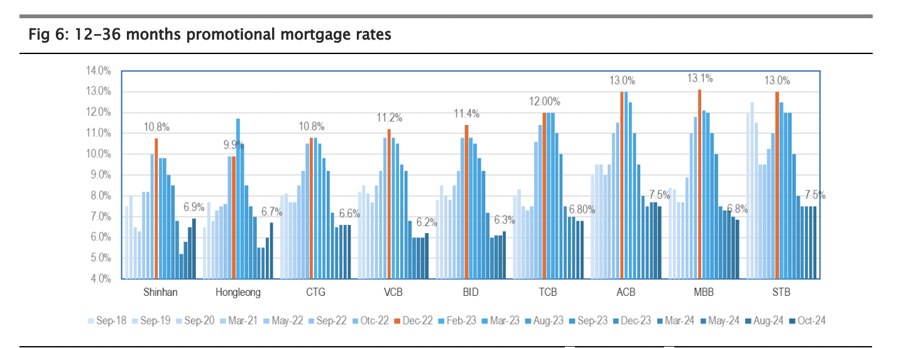

Secondly, housing loan interest rates have stabilized at low levels, with promotional rates ranging from 5.5% to 7.5%. Even a 0.5–1.0 percentage point increase is unlikely to significantly impact the real estate market sentiment. Promotional rates of 5.5–7.5% are offered for terms ranging from 12 to 36 months.

Responding to the Prime Minister’s call to support the real estate market, VCB, Agribank, and BIDV are offering an annual interest rate of 5.5% for five years to borrowers under 35 years old. Many other banks are also providing promotional housing loan rates with varying terms and conditions.

FOREIGN CAPITAL INFLOWS INTO REAL ESTATE

Thirdly, supply is improving, driven by positive momentum from administrative reforms.

Increasing housing loans indicate resilient homebuyer sentiment. Homebuyer loans increased by +0.54% year-to-date as of Q1 2025, maintaining positive momentum after an 11.94% surge in 2024. This marks a significant recovery from the minimal +0.08% year-over-year growth recorded in 2023.

Steel consumption in Q1 2025 hit a new record of 2.6 million tons, up 9% from the previous quarter and a substantial 61% from the same period last year. The figures for 2024 and 2023 were 8% and -11%, respectively. While steel usage is not exclusively for residential real estate, this growth also indicates a boom in the construction sector.

Fourthly, foreign direct investment (FDI) into real estate continues. In the first five months of the year, total registered FDI reached $18.4 billion, up 66% year-over-year, while disbursed FDI stood at $8.9 billion, an increase of 8%.

In May alone, registered FDI hit $4.58 billion, marking a substantial 61% jump from the previous quarter and a remarkable 155% surge year-over-year. Disbursed FDI for the month reached $2.16 billion, up 21% and 10% compared to the previous quarter and the same period last year, respectively.

Based on Q1 2025 FDI statistics, registered FDI for real estate amounted to $2.39 billion, a 52% increase year-over-year. Yuanta expects this pace to continue in the future.

Foreign investor confidence in Vietnamese real estate has been relatively strong in recent months, marking a key difference from the previous market downturn between 2008 and 2013, when foreign sentiment was weak. This stronger FDI sentiment toward real estate indicates a quicker recovery this time around, according to Yuanta.

Lastly, positive demographic trends persist, supporting actual housing demand. Vietnam is in the final phase of its “golden population structure,” with about one decade left before the number of dependents (children and elderly) starts to create a significant burden on the workforce.

From a long-term economic development perspective, demographics are not ideal, but these favorable conditions will persist for another decade.

In terms of stock prospects, Yuanta favors quality developers with strong balance sheets and clear upcoming project launches. The top picks are to buy KDH and NLG. There is also an emerging developer with strong income potential in the future: DXG.

Additionally, emerging developers (e.g., SCR, AGG, NTL, HQC) and real estate service companies (e.g., DXS, CRE, KHG, NRC) are on the watchlist as they stand to benefit from the real estate market’s next expansion phase.

The Housing Market Rebounds: A Race to Profitability

The Vietnamese real estate market witnessed a notable recovery in Q1 2025, with numerous businesses delivering projects and recognizing revenues and profits. This positive momentum has brightened the profitability landscape for the first quarter, setting a promising tone for the year ahead.

The Expert’s Paradox: When Supply Increases, Prices Should Decrease, But Not in This Case.

Mr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, shared his insights on the country’s real estate market. He noted that it is unlikely for property prices to decrease and that there are indications of rising prices. Interestingly, he pointed out a contradiction where an improvement in supply should, in theory, lead to lower selling prices. However, in the current market, supply is increasing, but prices remain high.