West of Ho Chi Minh City Transformed by Infrastructure Investments

The “super interchange” My Yen, located in Ben Luc, Long An, is nearing completion. With a total investment of approximately VND 115,000 billion, it connects three major expressways: Ho Chi Minh City-Trung Luong, Ben Luc-Long Thanh, and Ring Road 3. This infrastructure project is set to become a highlight for the western region of Ho Chi Minh City.

The My Yen interchange, dubbed the “golden knot” of southern Vietnam’s infrastructure map, will not only relieve pressure on National Highway 1A but also boost economic and social development and real estate in the western region of Ho Chi Minh City.

While the Ho Chi Minh City-Trung Luong expressway, with an investment of VND 10,000 billion, has been in use for 15 years, the Ben Luc-Long Thanh route, nearly 58km long and crossing Long An, Ho Chi Minh City, and Dong Nai, with a total investment of VND 29,500 billion, has only been partially opened.

The Ring Road 3 project, over 76km long and with a total investment of more than VND 75,000 billion, runs through Ho Chi Minh City, Dong Nai, Binh Duong, and Long An. It was started two years ago and is expected to be technically completed by December 2025.

Once Ring Road 3 and the Ben Luc-Long Thanh expressway are fully operational, the My Yen interchange will become one of the most important transportation hubs in the western region of Ho Chi Minh City, connecting various areas. Construction is currently underway to meet the deadline.

Western Ho Chi Minh City enjoys synchronized infrastructure development.

Additionally, several key infrastructure projects are being accelerated in the western region, including Ho Chi Minh City’s Ring Road 4, National Highway 50, inter-provincial roads 827E, 830C, and 823D, National Highway 1A, and National Highway 22.

The Ring Road 4 section in Long An, about 40km long and passing through Duc Hoa, Ben Luc, and Can Duoc, is in the investment preparation phase. The local government has approved the feasibility study report and is expediting the measurement, valuation, and compensation processes. Once completed, this project will reduce travel time from Long An to Ho Chi Minh City and neighboring provinces.

Another key infrastructure project in the west, National Highway 50, is also nearing completion after two years of construction. The construction supervision board is urging contractors to speed up progress, aiming for full completion by December 31. This project will significantly enhance transportation capacity and boost economic linkages between Ho Chi Minh City, Long An, and the Mekong Delta region. Investors anticipate a potential increase in real estate values as the road nears completion by the end of this year.

Long An is also focusing on investing in its intra-provincial transportation system. The expansion and upgrade of provincial roads such as QL62, QL1A, QL22, 827E, 830C, and 823D, along with the construction of bridges, aim to create a seamless transportation network, easily connecting the western region with other areas of Ho Chi Minh City.

In late March 2025, the Long An Provincial People’s Committee approved the investment policy adjustment for the upgrade and improvement of DT.830C in Ben Luc district, with a length of about 9km. This project holds significant importance in connecting provincial roads with National Highway 1A and Ho Chi Minh City’s Ring Roads 3 and 4, as well as DT.830C and DT.830. It will provide a crucial boost to the economic and social development of Long An province and the Mekong Delta region as a whole.

According to Long An’s development plan until 2030, the province prioritizes investing in 14 key transportation infrastructure projects to enhance regional connectivity and economic growth. The continuous investment in infrastructure has made Long An an attractive destination for large-scale projects and investors.

Real Estate Market Dynamics

2025 is considered a pivotal year for Long An’s real estate market, with significant changes and the acceleration of key transportation infrastructure projects. These projects not only address connectivity issues but also open up vast opportunities for the real estate sector. Properties located near these infrastructure developments will directly benefit from the project timelines, attracting relocating residents, expanding urban areas, and sustainably increasing real estate values.

Recent observations show positive sales performance for some urban areas in the west near key infrastructure projects. For example, the Waterpoint urban area project, a 355-hectare development by Nam Long and Nishi Nippon Railroad (Japan), is currently introducing riverfront villas and mansions with limited availability to great interest. This urban area is located on Provincial Road 830, at the intersection with Ho Chi Minh City’s Ring Road 4, providing direct connections to the Ho Chi Minh City-Trung Luong-My Thuan expressway. It also offers seamless links to the Ben Luc-Long Thanh expressway and Ring Road 3, which are expected to be completed in 2025-2026. With easy access to Ho Chi Minh City (just a 30-minute drive away), this project has significant room for price appreciation, especially as the area’s infrastructure nears completion.

Similarly, several land plot projects in the same area have entered the market and witnessed positive sales. Developers are seizing the opportunity presented by the ongoing transportation infrastructure investments to launch their products. Savvy investors are anticipating future value growth and are actively entering the market.

Investors seek opportunities in real estate markets undergoing early-stage infrastructure development.

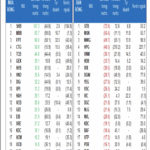

According to the latest report by DKRA Consulting, the supply of villas and houses in the market in the first quarter of 2025 increased by 7%, and consumption quadrupled compared to the same period last year. Long An and Binh Duong accounted for the largest consumption of villas and houses in the Southern market in Q1/2025, with 41% and 40%, respectively. Primary selling prices increased by an average of 6% compared to the previous quarter, while secondary prices rose by 8% to 12% compared to the end of 2024.

Commenting on the Long An market, Mr. Vo Huynh Tuan Kiet, Director of Residential CBRE Vietnam, stated that the real estate market in Long An would soon become very vibrant. He affirmed that the demand for villas, houses, and villas in Ho Chi Minh City remains high, but limited supply and high prices have pushed buyers to consider satellite areas like Dong Nai and Long An.

According to Mr. Kiet, the diversity in supply, competitive pricing, and convenient infrastructure connections have attracted buyers to satellite cities. Some areas have become long-term alternative markets for Ho Chi Minh City. Many prominent developers are investing in large-scale projects in Long An, attracting both investors and capital. Compared to other satellite areas, Long An offers more extensive urban areas, diverse products, and softer prices.

When asked about the market absorption in the western region of Ho Chi Minh City in the next six months, the CBRE Vietnam expert replied: “We will have to wait and see regarding the actual absorption rate and specific details. However, we can confidently state that the housing market in the western region of Ho Chi Minh City will be vibrant in the coming quarters.”

Profiting from Chaos: Domestic Firms Cash Out with Nearly 900 Billion Sell-Off Today

The domestic institutional investors recorded a net sell-off of VND 684.6 billion, with a striking VND 851.1 billion sold in the matched orders alone.

“The Approval of the Adjusted Master Plan for Ho Chi Minh City’s Visionary Future: 2040 and Beyond”

The newly approved master plan for Ho Chi Minh City sets a visionary course for the metropolis’ development over the next two decades and beyond. With this decision, signed by Deputy Prime Minister Tran Hong Ha, the city is poised to soar to new heights, transforming into a thriving hub of innovation, sustainability, and cultural vibrancy by 2040, with a long-term vision extending to 2060.