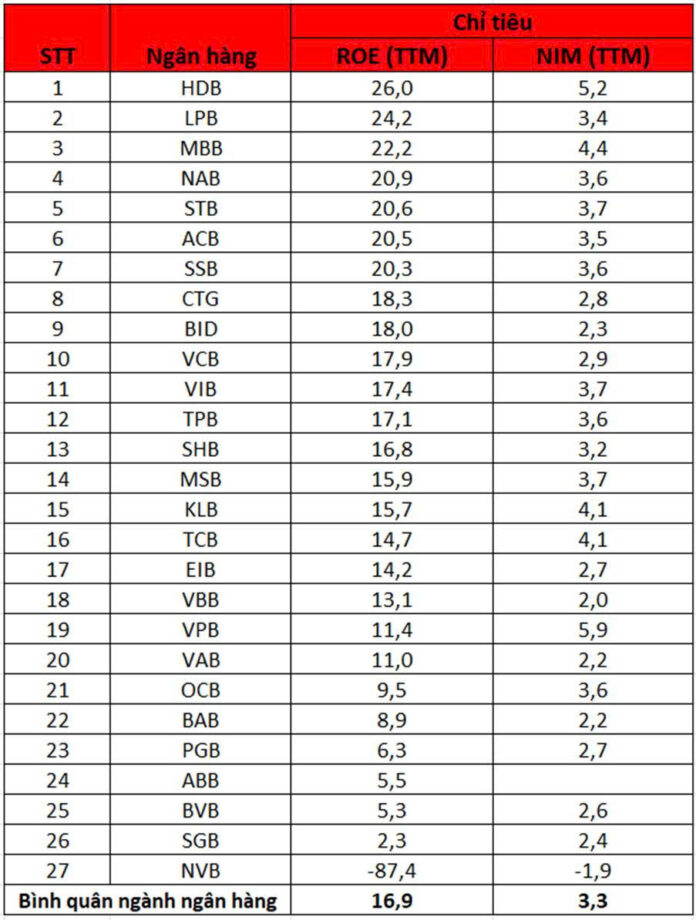

According to data from WiChart, the trailing four-quarter return on equity (ROE TTM) of 27 listed banks in Vietnam as of Q1 2025 reached 16.95%. HDBank continues to lead the industry with an impressive ROE of 25.99%, outperforming the industry average by a wide margin. Following HDBank are LPBank (24.2%), MB (22.2%), and NAB (20.92%). Banks that consistently maintain an ROE of 20% or higher tend to demonstrate strong profit growth, efficient cost management, and robust financial capabilities to execute long-term strategies.

HDBank has consistently topped the Vietnamese banking industry in terms of ROE for several consecutive quarters. This achievement reflects not only superior financial performance but also the success of its long-term strategy, robust risk management, and continuous innovation.

In 2024, HDBank’s pre-tax profit reached VND 16,731 billion, a remarkable 28.5% increase from 2023. This positive trajectory continued into Q1 2025, with a pre-tax profit of VND 5,355 billion, representing a 33% year-over-year growth. The compound annual growth rate (CAGR) for the 2021-2024 period stood at approximately 27.5%/year, outpacing the industry average.

LPBank has made a remarkable comeback, achieving an ROE TTM of 24.2% following a period of restructuring. This impressive growth can be attributed to the bank’s diverse credit product portfolio and focus on rural and urban area customers, where there remains significant growth potential.

In Q1 2025, MB maintained its stable performance, recording an ROE TTM of 22.2%. This success is a result of its effective ecosystem-building strategy. The bank has set an ambitious pre-tax profit target of over VND 31,000 billion for 2025, representing a 10% increase from the previous year. Its planned ROA is approximately 2%, with an expected ROE of 20-22%.

Nam A Bank also stands out with an ROE TTM of 20.9%, positioning it among the industry leaders in profitability. The bank’s focus on maintaining asset quality and tightly managing non-performing loans has laid a strong foundation for its growth, especially as it executes its expansion strategy.

ACB, known for its centralized management and robust risk control, has consistently maintained an ROE of around 21%, showcasing its operational stability. While not pursuing explosive growth, ACB’s steady performance underscores its disciplined approach.

Meanwhile, Sacombank is accelerating with an ROE TTM of 20.6%. Having overcome significant asset quality challenges following its merger with Southern Bank, Sacombank is in the final stages of its restructuring process under the supervision of the State Bank of Vietnam. The bank is poised for a strong recovery in the coming years.

The state-owned bank group (Vietcombank, VietinBank, BIDV), despite facing profit pressures due to their operational nature, has demonstrated solid profitability with an ROE TTM ranging from 18%. These banks are expected to maintain stable profitability by focusing on loan disbursements to support economic growth, as directed by the government.

“Mcredit Appoints New CEO”

The Board of Directors of Mcredit, a leading consumer finance company, is pleased to announce the appointment of Mr. Dinh Quang Huy as its newest Member and CEO. With a wealth of experience and a deep understanding of the industry, Mr. Huy is set to lead Mcredit towards new heights, effective June 11th.

The Ever-Changing Landscape of Deposit Interest Rates: Unraveling the June Enigma

As of early June, several banks have made adjustments to their savings interest rates. Notably, Bac A Bank and LPBank, two prominent joint-stock commercial banks in Vietnam, have unveiled new rates with a downward revision for long-term deposits.

A Fresh Start for HDBank: Unveiling a New Era with a Dynamic Leadership Change

“HDBank’s dynamic leadership team undergoes a strategic shift with the lateral movement of its two esteemed Deputy General Directors. These seasoned professionals take on new challenges as Senior Directors, one spearheading Regional Management and Debt Handling in the Western Region, while the other assumes diverse responsibilities assigned by the General Director.”

“HDBank Projects Over 30% Loan Growth and Profits Surpassing VND 20,000 Billion in 2025”

“HDBank is projected to achieve above-average growth in credit and profits in 2025, outpacing the industry average. This optimistic forecast is underpinned by the bank’s strong performance in its core business areas, strategic focus on ramping up public investment, and the anticipated recovery of the real estate market. HDBank’s resilience and diverse capabilities position it well to capitalize on these favorable conditions and maintain its positive trajectory.”

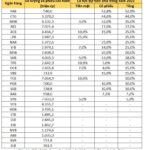

The Ultimate Guide to Banking Dividends: Unveiling the Top Performer of 2025

As of 2025, nine prominent Vietnamese banks boasted an impressive dividend payout ratio of over 20%. These financial powerhouses included VietABank, VietinBank, MB, BIDV, LPBank, Nam A Bank, ACB, VIB, and MSB.