In a recent report on Vietnam’s upgrade prospects, Dragon Capital assessed that the country’s market upgrade process is drawing closer to reality after years of anticipation. Clear signals indicate that Vietnam could be officially announced for an upgrade by FTSE Russell in September 2025, with an effective date as early as March 2026. The main driving force comes from removing bottlenecks to meet the requirements of ranking organizations, especially allowing foreign institutional investors to purchase stocks without the need for pre-funding.

According to Dragon Capital, the upgrade will bring significant benefits to the Vietnamese stock market, including improved liquidity, enhanced valuations, and stronger participation from active and passive funds. However, the impacts won’t be limited to the financial market. Upon achieving emerging market status, Vietnam will make significant strides in its economy and country status, elevating itself to the level of other nations already in the emerging markets group.

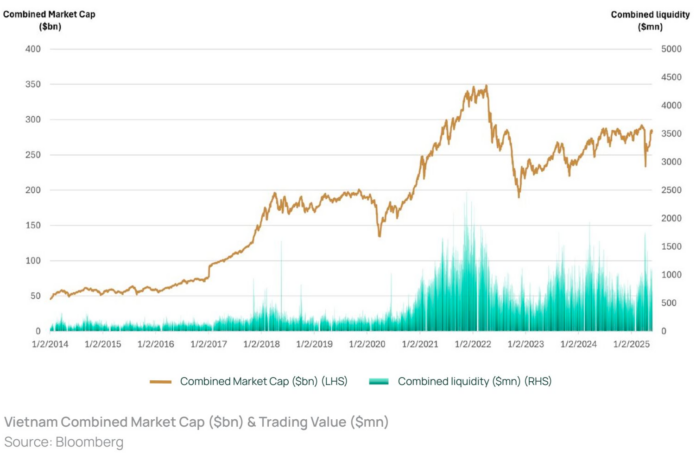

In reality, the Vietnamese stock market has witnessed robust growth in both scale and trading volume. As of the end of 2024, the total market capitalization of listed stocks reached $288 billion, equivalent to approximately 60% of GDP. The average trading value per session improved, with many peak sessions reaching or surpassing the $1 billion mark. Dragon Capital considers this a very high level of liquidity for a frontier market, with over 80% of trading volume coming from domestic individual investors and even rivaling some small-scale emerging markets. This improvement reflects the increasingly modern trading practices and deeper involvement of Vietnamese investors.

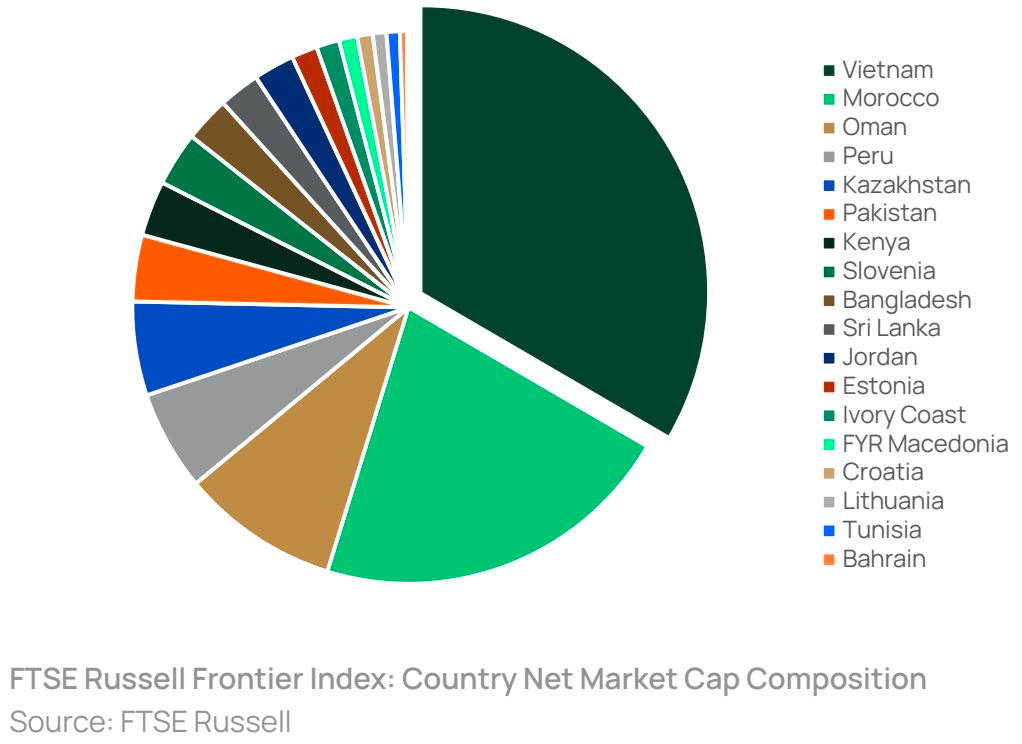

Additionally, Vietnam currently holds the largest weight in the FTSE Frontier Index, accounting for approximately 36% of the index’s total capitalization (equivalent to $100.6 billion as of February 2025). This significant weight reflects Vietnam’s superior maturity compared to its frontier market peers. However, it may also limit Vietnam due to the small size of frontier-focused funds.

According to projections from Dragon Capital, if upgraded to the “Secondary Emerging” market group, Vietnam’s weight in the FTSE Emerging Markets index will be much smaller than 36%, but it will have the opportunity to access a larger pool of capital from emerging market-focused funds.

Specifically, the analytics team estimates that Vietnam’s initial weight in the FTSE emerging market index could range from 0.3% to 0.5%. Currently, the total size of emerging market-focused funds stands at approximately $7.7 trillion, which is 77 times larger than the size of funds in the FTSE Frontier index. This means that even a 0.5% weight could attract a significant amount of capital in absolute terms. Moreover, if the stock market continues to grow, Vietnam could move towards a weight of nearly 1% in the FTSE emerging market index.

In its most recent assessment in March 2025, FTSE Russell maintained Vietnam on its watchlist for a potential upgrade from frontier to secondary emerging markets. According to the index provider, Vietnam still needs to fulfill the criteria of “Delivery versus Payment (DvP)” and “Settlement – Costs related to failed transactions.” Both criteria are currently rated as “Constraints.”

However, the market ranking organization acknowledged the continuous commitment of Vietnam’s market regulators to pursue regulatory reforms to further facilitate international investor participation in the Vietnamese stock market, including upgrading the main trading platform.

FTSE Russell also appreciated its constructive relationship with the State Securities Commission of Vietnam (SSC), other market regulators, and the World Bank Group, which supports a broader market reform program.

Middle East Tensions: Impact on the Vietnamese Stock Market

The stock market in Vietnam witnessed a decline today (June 13th), mirroring trends across the region amidst Israel’s attack on Iran. The VN-Index fell by over 7 points, despite a valiant effort by oil and gas stocks, along with select banking sector equities, to steer the market in a positive direction.

The Stock Market’s Hidden Gems: Unveiling June’s Top Growth Stocks

The An Binh Securities (ABS) team believes that the market is currently presented with a medium-term growth opportunity, attributed to positive developments in trade negotiations and the government’s proactive efforts.