Illustration

Oil Prices Surge 7% as Israel-Iran Strikes Stoke Middle East Supply Fears

Oil prices surged by 7% as concerns grew over potential disruptions to Middle Eastern supplies due to escalating tensions between Israel and Iran. Brent crude oil closed at $74.23 per barrel (up 7.02%), while WTI reached $72.98 per barrel (a 7.62% increase). During the session, both oil benchmarks climbed over 13-14%, the highest intraday gains since the start of the year.

Israel targeted Iran’s nuclear and military facilities, while Iran fired missiles at Tel Aviv. Although oil refineries were not directly impacted, there are mounting concerns about security in the Strait of Hormuz, through which approximately 18-19 million barrels of oil are transported daily, accounting for about 20% of global consumption. Iran currently produces 3.3 million barrels per day and exports more than 2 million barrels.

Experts warn that if the conflict escalates, targeting oil infrastructure could invite retaliatory strikes, jeopardizing supply across the region.

Gold Prices Soar as Israel-Iran Tensions Spur Safe-Haven Demand

Gold prices surged as investors flocked to safe-haven assets following Israel’s strikes on Iran, sparking fears of a wider Middle East conflict. Spot gold jumped 1.3% to $3,428.10 per ounce, nearing its record high of $3,500.05 set in April, and has risen nearly 4% this week. U.S. gold futures also climbed 1.5%, settling at $3,452.80.

Analysts attribute the rally to geopolitical tensions and expectations of Fed rate cuts following a spate of weak inflation data. Goldman Sachs predicts gold could reach $3,700 per ounce by the end of 2025 and $4,000 by mid-2026. Meanwhile, physical gold demand in Asia has softened due to elevated prices, particularly in India.

Other precious metals saw mixed performances: silver gained 0.9% on the week despite a slight dip during the session, platinum rose 4.8% on the week but plunged 5.9% on the day, and palladium fell 1.3%.

Copper and Industrial Metals Dip as Israel-Iran Conflict Sparks Risk Aversion

Copper and other industrial metals declined as a stronger U.S. dollar and risk-off sentiment weighed on prices following Israel’s large-scale attacks on Iran. Three-month copper on the London Metal Exchange fell 0.5% to $9,653 per ton, after touching its lowest since June 3 at $9,532. U.S. Comex copper also slipped 0.3% to $4.82 per pound.

Analysts noted that algorithmic funds sold off positions, while some Chinese investors took the opportunity to buy at lower levels. Aluminum prices on the Shanghai exchange rose 0.4% to 20,425 yuan per ton, supported by robust domestic demand and shrinking inventories on the Shanghai Futures Exchange, which fell to 110,001 tons—the lowest since February and a decline of 54% since late March.

Other metals like LME aluminum fell 0.5%, lead dipped 0.3%, and zinc lost 0.6%. In contrast, nickel and tin edged up 0.3% each.

Iron Ore Heads for Weekly Loss as Trump’s Steel Tariffs Weigh

Iron ore prices fell for the second straight session and are on track for a weekly loss after U.S. President Donald Trump announced a 50% tariff on several steel-related products from June 23. The September 2025 iron ore contract on the Dalian Commodity Exchange slipped 0.14% to 703 yuan per ton (approximately $97.90), down 0.7% for the week. The July 2025 contract on the Singapore Exchange also dropped 0.15% to $94.40 per ton, the lowest since April 10, and is headed for a 1.2% weekly decline.

While the move is largely seen as psychological and unlikely to significantly impact the Chinese steel market in the near term, iron ore demand remains steady, with average daily hot-rolled steel output holding around 2.42 million tons in the week ending June 12. Exports of Chinese steel products are forecast to rise 1.2% to 112 million tons this year, while domestic consumption is expected to dip 1%.

In other raw materials, coking coal and coke prices edged higher, while steel prices on the Shanghai exchange mostly eased, except for rebar, which climbed 0.27%.

Soybeans, Soyoil Surge on U.S. Biofuel Proposal

U.S. soyoil prices soared to the maximum allowed limit, and soybeans climbed to a three-week high after the Environmental Protection Agency (EPA) proposed higher biofuel blending mandates than expected. July soyoil futures on the Chicago Board of Trade (CBOT) rose 3 cents to reach 50.61 cents per pound. Soybeans jumped 27.5 cents to $10.69-3/4 per bushel.

The EPA proposed increasing biofuel usage over the next two years while tightening import restrictions, leading to expectations of greater domestic soyoil consumption in biodiesel production. This is expected to boost U.S. soybean crushing in 2026-2027.

July corn futures on the CBOT settled 6 cents higher at $4.44-1/2 per bushel, and July wheat futures (WN25) climbed 17-1/4 cents to $5.43-3/4 per bushel.

Wheat prices remained under pressure this week, falling 2%, as harvesting in the Northern Hemisphere progressed. The new proposal did not change ethanol quotas, so it had little impact on corn used for fuel.

Rubber Prices Track Crude Oil Higher After Israel-Iran Strikes

Rubber prices in Japan and China rose in tandem as escalating tensions between Israel and Iran pushed crude oil prices over 7% higher. The November 2025 rubber contract on the Osaka Exchange climbed 1% to 293.7 yen per kg, while the September 2025 contract on the Shanghai Futures Exchange gained 0.6% to 13,860 yuan per ton. Butadiene rubber also rose 0.7%.

The surge in oil prices benefited natural rubber, which competes with synthetic rubber derived from petroleum. On the Singapore Exchange, July rubber futures jumped 1.9% to 163 cents per kg.

Robusta Coffee Hits 10-Month Low, Sugar Plunges to Over 4-Year Low

Robusta coffee futures on ICE fell to their lowest in 10 months due to favorable harvesting progress in Indonesia and Brazil, along with improved prospects in Vietnam. The contract settled 0.6% lower at $4,287 per ton, marking the seventh straight weekly loss. The U.S. Department of Agriculture forecasts Vietnam’s 2025/26 robusta output to rise 7% to a four-year high of 30 million bags.

Raw sugar prices also tumbled 0.9% to 16.13 cents per pound, the lowest since April 2021, despite the jump in oil prices following the Israel-Iran strikes. Market sentiment for sugar remained bearish due to beneficial rains in India, Thailand, and China. Thailand’s 2025/26 sugarcane area is expected to increase by over 8% year-on-year.

Cocoa prices also plunged, pressured by improved supplies from Nigeria and non-West African countries. London cocoa fell 2.2% to £6,228 per ton, while New York cocoa dropped 3.1% to $8,952 per ton.

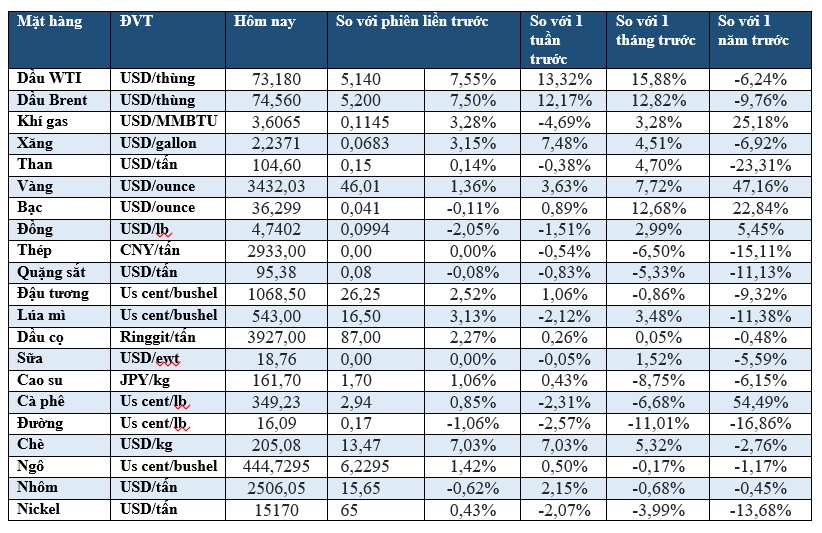

Prices of Key Commodities as of This Morning

Global Oil Prices Surge by Over 10% After Israel’s Declaration of Attack on Iran

The escalating oil prices have sparked concerns about potential energy supply disruptions from the Middle East.

Gold Surges as US CPI Falls Short of Expectations

The demand for gold as a safe-haven asset remains strong, according to analysts. This is due to the unpredictable nature of US trade policies and the escalating geopolitical tensions in the Middle East. Gold has traditionally been seen as a hedge against economic and political uncertainty, and it appears that investors are still seeking this precious metal as a means of protecting their wealth. With the potential for further volatility in the global markets, it seems that gold’s allure as a safe investment is here to stay.