Hai An Transport and Stevedoring Joint Stock Company (Ticker: HAH, HoSE) has just released the documents for its upcoming 2025 Annual General Meeting of Shareholders (as of June 12, 2025).

The meeting is scheduled to be held at 8 am on June 26, 2025, at the Hai An Building, Km2 Dinh Vu Road, Dong Hai Ward, Hai An District, Hai Phong City.

The Board of Directors of Hai An Transport and Stevedoring plans to present several important agenda items to the assembly, including: Presenting the audited financial statements for 2024, profit distribution plan, and dividend payout for 2024; discussing the business and investment plans for 2025, and other matters within the competence of the General Meeting of Shareholders; and presenting the plan for issuing shares under the Employee Stock Ownership Plan (ESOP) for the parent company and its subsidiaries.

The Board also intends to propose the dismissal of members of the Board of Directors and the Supervisory Board and the election of supplementary members to the Company’s Board of Directors for the 2023-2028 term.

In 2024, Hai An Transport and Stevedoring achieved a total revenue of VND 4,024 billion, exceeding the set plan by 1.69%. The majority of this revenue came from ship operations, amounting to VND 4,347 billion (80.9%), with the remainder generated from port operations and other activities. The consolidated after-tax profit of the parent company in 2024 was VND 650 billion, representing 144.42% of the planned figure.

During the same year, the company successfully acquired and put into operation four container ships, including three newly built 1,800 TEU vessels (HA Beta, AB Sky, and HA Opus) and one secondhand 3,500 TEU vessel (HA Gama). This addition boosted the capacity of the Hai An fleet to 26,500 TEU.

Hai An Transport and Stevedoring successfully raised capital for these vessels through bank loans and the private placement of VND 500 billion worth of convertible bonds with a five-year term for four major domestic and foreign investors.

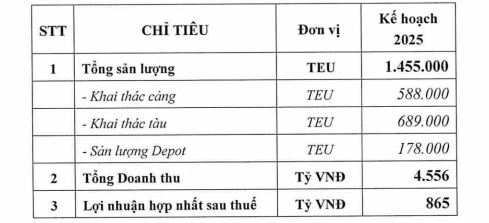

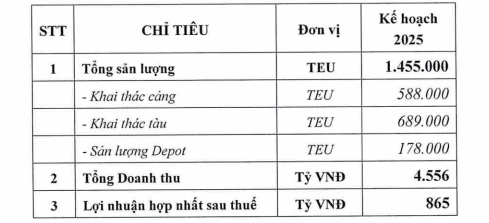

Based on market conditions and current capabilities, the management proposes the following key targets for 2025:

Source: HAH

In terms of investment plans, the management proposes the construction of four new container ships ranging from 3,000 to 4,500 TEU; the purchase of two to three suitable secondhand vessels to meet immediate needs and support the fleet expansion plan; and the research and development of a project to build vessels ranging from 7,000 to 9,000 TEU.

Regarding port and logistics operations, the company plans to dispose of old and damaged forklifts and invest in one or two new 45T Kalmar forklifts. They will also explore the installation of a solar power system to meet energy needs and support ESG goals, as well as upgrade and renovate the Hai An Building and office areas.

The Foreign Buying Frenzy Continues: Net Buying Spree Reaches Nearly $100 Billion, Contrasting the Heavy Sell-Off of a Single Securities Stock

For foreign transactions, foreign investors continued to net buy over 86 billion VND on the entire market.

Middle East Tensions: Impact on the Vietnamese Stock Market

The stock market in Vietnam witnessed a decline today (June 13th), mirroring trends across the region amidst Israel’s attack on Iran. The VN-Index fell by over 7 points, despite a valiant effort by oil and gas stocks, along with select banking sector equities, to steer the market in a positive direction.

The Foreigners’ Session: Net Buying Returns with a Bang, Snapping Up Stocks Worth Over VND 400 Billion, Defying the Sell-Off in Bank Shares

In the buying session, HPG witnessed the strongest net buying across the market, with a value of VND 222 billion.

“Shareholder Meeting of Tôn Đông Á: Steel Trade Flows are in Turmoil, with a Focus on the Domestic Market Aiming for a 75% Share.”

With a steadfast determination to ascend in the industry, Ton Dong A envisions a strategic shift to the Ho Chi Minh Stock Exchange (HoSE). This move is accompanied by ambitious plans to invest in a new plant, dubbed ‘Plant 4,’ with a formidable capacity of 1.2 million tons per annum. This decisive step propels the company deeper into the value chain of the prestigious coated steel industry.