The Ho Chi Minh City Stock Exchange (HOSE) has announced that the shares of Koji Asset Investment Joint Stock Company (HOSE: KPF) are currently suspended from trading due to the company’s delayed submission of its reviewed semi-annual financial statements for the first half of 2024, exceeding the regulated timeframe by over six months.

In addition to the trading suspension, KPF is also under warning status due to qualified opinions from the auditing organization regarding its audited financial statements for 2023 and is under control for delayed submission of its audited financial statements for 2024.

Notably, following the trading suspension, KPF continued to violate information disclosure regulations by delaying the submission of its audited financial statements and annual report for 2024. As of now, HOSE has not received KPF’s reviewed semi-annual financial statements for 2024, audited financial statements for 2024, or the 2024 annual report.

Consequently, HOSE is considering a mandatory delisting of KPF’s shares based on Decree 155/2020/ND-CP, Article 120.1.o, dated December 31, 2020, which stipulates that a listing organization that seriously violates information disclosure obligations, fails to fulfill its financial obligations to the Stock Exchange, or falls under other cases that the Stock Exchange or the State Securities Commission deems necessary for delisting to protect investors’ rights, shall be subject to mandatory delisting.

The potential delisting would bring an end to KPF’s tumultuous journey since its listing on HOSE in 2016 and reflect the severe instability in the company’s business operations and corporate governance during this period.

Since the second quarter of 2024, when KPF incurred a record loss of nearly VND 282 billion, eroding the company’s profits over the past 12 years (from 2012 to 2023, with profits of nearly VND 267 billion), KPF has attributed the profit decline to provisions for doubtful accounts and advances deemed unrecoverable during that quarter.

A Decade’s Profit Wiped Out in One Quarter: What’s Happening at KPF?

In reality, KPF’s business operations have been unstable since the second quarter of 2023, with zero revenue for eight consecutive quarters while expenses remained, resulting in a cumulative loss of nearly VND 135 billion as of the first quarter of 2025.

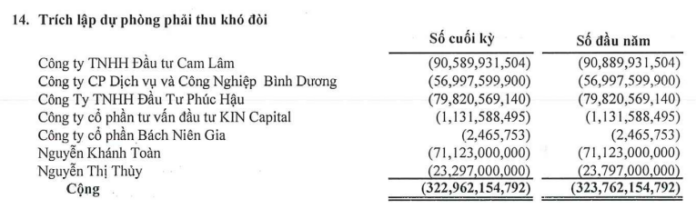

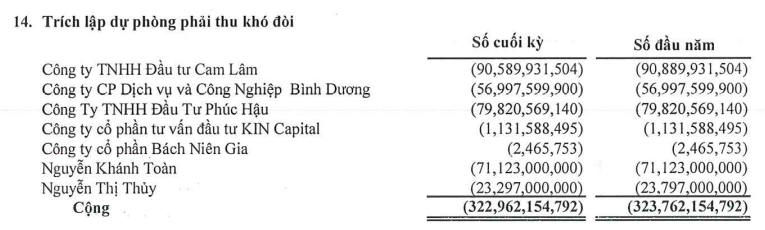

As of March 31, 2025, KPF’s total assets remained relatively unchanged at nearly VND 533 billion. Notably, the company has provisioned for short-term difficult-to-collect accounts receivable of nearly VND 323 billion, including amounts owed by two individuals: Mr. Nguyen Khanh Toan (sharing the same name as the former chairman of KPF, who was indicted for securities manipulation) with over VND 71 billion, and Ms. Nguyen Thi Thuy with over VND 23 billion.

Source: KPF

|

The majority of KPF’s assets comprise financial investments in bonds and capital contributions to other companies, totaling over VND 482 billion, or 91% of total assets. Payable debts stand at nearly VND 17 billion, a 2% increase.

KPF’s stock price has continuously hit new lows over the past year. As of June 13, 2025, KPF’s stock price was VND 1,210 per share, a 25% decrease compared to the beginning of 2025 and a 65% drop from the start of 2024. The average trading volume was over 80,500 shares per session.

| KPF Stock Price Movement since the beginning of 2024 |

– 07:03, June 14, 2025

The Business Exodus: When Companies Depart the Public Sphere

In the first half of 2025, the stock market witnessed a wave of companies delisting en masse, with dozens losing their public company status. This trend is not just a story of dry numbers, but a consequence of profound shifts in the legal framework and business strategies.

The Ho Chi Minh City Stock Exchange at 25: Expanding Products and Elevating Listed Companies’ Quality

The Ho Chi Minh Stock Exchange (HOSE) has, over its 25-year history, solidified its position as Vietnam’s pioneering centralized stock exchange and the nation’s largest securities trading platform. Listing on HOSE is a testament to a company’s operational excellence, a declaration of its commitment to transparency, and a demonstration of its adherence to governance standards—all of which contribute to building a robust corporate image and enhancing its value in the eyes of investors and the wider business community.

A Sewing Brand is Unraveling: 50 Years of Threads Snipped and Over 2,500 Jobs at Risk.

With a robust financial standing, a generous dividend policy, and a nearly 50-year operational history, the 29/3 Garment and Textile Joint Stock Company, better known as Hachiba (UPCoM: HCB), stands apart from the myriad of companies that have delisted due to unforeseen circumstances or losses. Hachiba’s departure from the stock exchange is simply a consequence of its evolving shareholder structure, marking a shift towards a more closed-off business model.