Initial Capital is Essential for Private Sector Growth

The experiences of Asian economies have shown that a robust private sector relies on capital from the ecosystem of investment funds. A review of the capital supply model for private enterprises in Asia and the region highlights the pivotal role of domestic investment funds in propelling business growth.

For instance, behind the success of Korean Chaebol such as Samsung, SK, and LG, lies substantial capital from domestic investment funds. This very resource propelled their research capabilities, leading to groundbreaking innovations and an astonishing scale of expansion.

Singapore boasts two renowned national funds, Temasek Holdings and GIC. In addition to investing in local companies, these funds have also directed capital towards numerous companies in the region, including Vietnam. Despite its small size, Singapore boasts a surprisingly prosperous economy, underpinned by a diverse and robust financial, technological, and service sector. The country’s policy focuses on cultivating an investment fund ecosystem centered on several large funds and mechanisms that attract international and regional funds to establish their operations.

Another example is Israel, which has leveraged venture capital to become the “Startup Nation,” despite its limited resources. To foster innovation, the government introduced a venture capital program in 1993, acting as a crucial catalyst in attracting substantial foreign and domestic venture capital. This model has spawned an incredibly dynamic innovation ecosystem, spawning numerous successful tech companies and a string of global-scale M&A deals.

Taiwan also has a national development fund that invests in and supports pioneering companies such as TSMC, the world’s largest chip manufacturer, and MediaTek (chip design).

Overall, domestic funds, whether state-owned or private, play a vital role as “seed capital,” providing the initial financial impetus for businesses. However, their role extends beyond mere financing; they also serve as a bridge to enhance governance, development expertise, market expansion capabilities, technological advancement, and international connections. Businesses nurtured by these funds have emerged as core growth drivers, contributing to economic miracles and expanding their global reach.

VinaCapital’s VOF fund invested $47 million in Hoa Phat Group in 2007, contributing to a 13.6-fold increase in market capitalization and a 25.6-fold rise in revenue by the end of 2024, compared to 17 years ago.

|

Domestic Resources: A Turning Point for Transformation

Vietnam has undergone an impressive developmental phase, fostering the growth of robust domestic enterprises within a unique economic context. The period between 2000 and 2010 witnessed a significant economic transformation, marked by WTO accession, the establishment of a stock exchange, and abundant investment inflows.

Numerous private enterprises rose to prominence during this period, notably Hoa Phat. In 2007, VinaCapital’s VOF fund invested $47 million (equivalent to 5% of its market capitalization at the time) through private equity, providing the financial foundation for Hoa Phat to construct an integrated steel production complex with a capacity of 2.5 million tons of construction steel per year. By the end of 2024, Hoa Phat’s steel capacity had reached 8.5 million tons annually, accompanied by a substantial increase in its market capitalization (13.6 times) and revenue (25.6 times) compared to 17 years ago.

Similarly, with capital from investment funds like VinaCapital, Kido successfully transformed from a traditional confectionery company into a diversified food conglomerate, focusing on essential products. In the healthcare sector, Tam Tri Hospital expanded from four to eight hospitals between 2018 and 2022, while also increasing its capacity from 400 to 1,200 beds.

The achievements of these companies not only showcase their growth potential but also underscore the role of domestic investment funds like VinaCapital in helping Vietnamese enterprises overcome capital, governance, and market expansion challenges to reach new heights.

“Investment funds not only provide capital but also accompany enterprises in establishing transparent governance, tight financial control, and optimized processes,” said Ms. Nguyen Thi Dieu Phuong, Deputy CEO of VinaCapital. “Additionally, investment funds can drive consolidation and scale in critical sectors such as technology, healthcare, finance, and manufacturing. Through M&A activities, investors help businesses become stronger, gain better positions in global supply chains, attract more investment, and achieve industry leadership.”

“We also hope that Vietnam will have large and strong private enterprise groups in terms of capital, technology, systems, and proactive participation in global production and supply chains, showcasing the strength of Vietnam’s private sector,” added Ms. Phuong.

Ms. Phuong of VinaCapital affirmed that Resolution 68 encourages the firm to continue seeking and accompanying potential enterprises, contributing to the robust development of Vietnam’s private sector.

Le Nguyen

– 07:49 14/06/2025

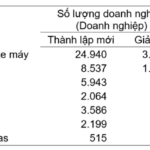

“May 2025: Over 111,600 Businesses Exit the Market, Matching the Number of New and Returning Enterprises”

The market witnessed a significant shake-up in the first five months, with approximately 111.6 thousand businesses exiting – a figure almost mirrored by the number of new businesses entering the fray or returning to activity, totaling 111.8 thousand.

Unlocking New Opportunities: Real Estate Businesses Anticipate Expanded Land Reserves and International Capital with Resolution 68

“At the recent seminar ‘Unblocking Institutional Bottlenecks – Unleashing Private Resources’ hosted by VTV, Ms. Nguyen Thanh Huong, Investment Director of Nam Long Group, emphasized that since the issuance of Resolution 68-NQ/TW, there has been a turning point, boosting businesses’ confidence, especially when dealing with international partners.”

When Vietnam Entered the Top 25 Largest Economies in the World

“Mr. Michael Kokalari, Head of Macroeconomic and Market Research at VinaCapital, asserts that the core vision of Resolution 68 on private economic development is to foster a rapidly growing, sustainable, high-quality, and globally competitive private sector. The UK-based independent economic forecasting center estimates that Vietnam will join the ranks of the world’s 25 largest economies by 2039.”