The VN-Index ended the June 12 session at 1,322.9 points, up 7.79 points (+0.59%).

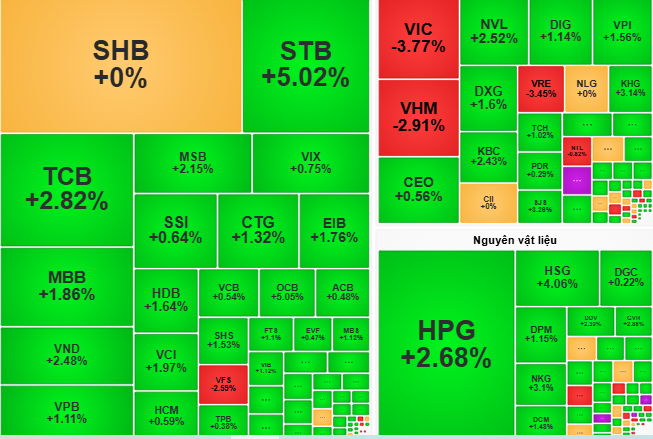

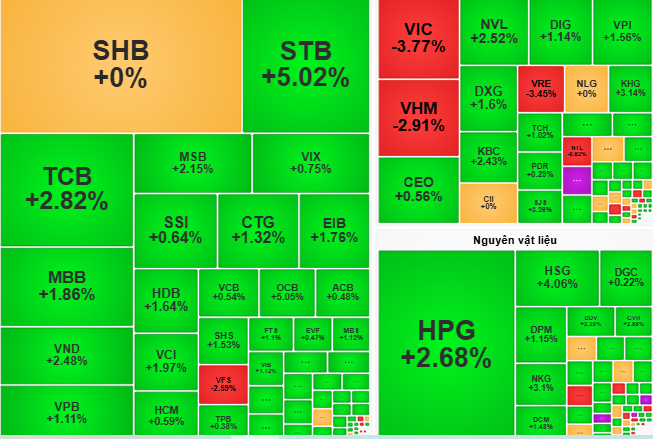

The VN-Index opened the morning session of June 12 within a narrow range, fluctuating around a 6-point gain. However, the upward momentum showed signs of cooling off towards the end of the morning session. Steel stocks such as HPG, HSG, and NKG performed well, while banks like TCB, STB, and MBB resumed their leading role, attracting strong cash flow, reflecting investors’ stabilizing and increasingly optimistic sentiment.

In the afternoon session, the VN-Index maintained its upward trajectory despite facing selling pressure, dipping to a low of 1,316 points at one point due to large-cap stocks such as VIC, VHM, and VRE. However, the banking sector continued to surge, propping up the overall index.

At the close, the VN-Index ended at 1,322.9 points, a gain of 7.79 points (+0.59%). Turnover reached nearly VND 20,000 billion, higher than the recent average.

According to VCBS Securities Company, although the Vietnamese stock market recovered thanks to the banking sector’s leadership, the buying force was not strong enough, and the market needs more time to accumulate and determine a clear trend.

“Investors should avoid chasing after stocks that are already hot,” VCBS recommended. “Instead, consider investing when the market undergoes a correction phase. Notable sectors for the second half of 2025 include banking, real estate, and construction materials.”

Meanwhile, Rong Viet Securities Company (VDSC) assessed that liquidity improved, but the stock supply also increased. The market may continue to be contested on June 13, with banks playing a pivotal role. If it surpasses the 1,325-point threshold with good liquidity, the VN-Index will have the opportunity to advance towards the old peak of 1,350 points.

The Foreign Buying Frenzy Continues: Net Buying Spree Reaches Nearly $100 Billion, Contrasting the Heavy Sell-Off of a Single Securities Stock

For foreign transactions, foreign investors continued to net buy over 86 billion VND on the entire market.

Middle East Tensions: Impact on the Vietnamese Stock Market

The stock market in Vietnam witnessed a decline today (June 13th), mirroring trends across the region amidst Israel’s attack on Iran. The VN-Index fell by over 7 points, despite a valiant effort by oil and gas stocks, along with select banking sector equities, to steer the market in a positive direction.

The Powerhouse Industries: Banking and Oil to the Rescue, Yet Stocks Suffer

The Middle East tensions erupted suddenly before the domestic market opened, causing a significant impact. While the VN-Index was propped up by some large-cap stocks, a deep sell-off occurred across hundreds of stocks. The index closed slightly lower, down 0.57%, but 107 stocks fell by more than 2%, not to mention nearly 70 others that declined between 1% and 2%, or on the HNX.

Stock Market Outlook for June 9-13, 2025: Intense Tug-of-War

The VN-Index curbed its decline and concluded a volatile trading week, characterized by alternating sessions of gains and losses since dipping below the Middle Bollinger Band. Presently, the index is undergoing a short-term correction, with a crucial support zone hovering around the 1,300-point mark. Maintaining this level is essential to mitigate the risk of further significant declines in the near term. Additionally, a sustained net buying spree by foreign investors would positively influence investor sentiment.