TVC’s 2025 Annual General Meeting was held online in the morning of June 14th – Screenshot

|

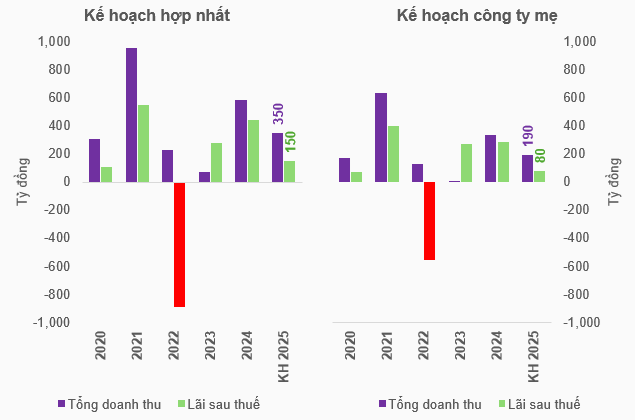

Retrograde business plan with a focus on real estate investment

The meeting approved a retrograde business plan for 2025. In the consolidated plan, the company only expects a total revenue of 350 billion VND and a profit after tax of 150 billion VND, down 40% and 66%, respectively, compared to the 2024 performance. In the parent company’s plan, total revenue and profit after tax are 190 billion VND and 80 billion VND, respectively, down 43% and 72%.

While the plan represents a step back from 2024, it also presents significant challenges for TVC, especially considering the company’s consolidated loss of over 42 billion VND and the parent company’s loss of nearly 30 billion VND in the first quarter of this year.

Source: VietstockFinance

|

Commenting on the plan, Chairwoman Nguyen Thi Hang attributed the relatively low figures to the efforts of the management and staff. She noted that the company still incurs significant expenses for operations, salaries, bonuses, and recruitment. In the context of efficient cost management, revenue is expected to be impacted by stock market fluctuations, uncertain US tariffs, and geopolitical challenges.

The Chairwoman also emphasized that 2025 is the final year of the restructuring process, and she expects a more positive outlook for 2026.

Facing tariff risks, Ms. Hang shared the company’s long-term strategy, which includes increasing asset values, financing sources, focusing on medium-term securities investment, and prioritizing resolving past issues. The company is considering a new direction toward real estate investment to create a safe and sustainable cash flow. Additionally, they are committed to building and training their personnel.

In response to a shareholder’s question about the investment portfolio management plan amid market volatility, Ms. Hang replied that the company would focus on listed stocks in leading industries with strong growth potential over the next 12 months, coupled with high liquidity and healthy governance. Priority will be given to stocks in the VN30 basket and blue-chip stocks.

Another notable statement from the TVC Chairwoman was the plan to explore real estate investment.

In fact, the meeting approved the purchase of real estate for the company’s headquarters, with a value equal to or greater than 35% of the company’s total assets as recorded in the latest audited or reviewed financial statements.

Based on the data as of December 31, 2024, in the audited consolidated financial statements for 2024, the company’s total assets exceeded 2,281 billion VND. Therefore, the expected real estate transaction value is at least 798 billion VND.

The company may co-own the property with a third party if the value exceeds its financial capacity or lease or sell a portion of the area if it does not utilize the entire space.

Chairwoman Nguyen Thi Hang answering shareholders’ questions at the meeting – Screenshot

|

Dividend payout for 2021 in Q4 and repurchase of 15 million shares

Regarding profit distribution, the Board of Directors will present a proposal to the AGM for consideration after the 2025 business results are available, with a maximum dividend payout ratio of 6%. For the past year, 2024, despite having undistributed profits after tax of nearly 344 billion VND as of December 31, 2024, the Board of Directors proposed and the shareholders approved not to allocate funds for reserves and dividend payout to strengthen the financial foundation, proactively respond to market fluctuations, and seize future opportunities.

Additionally, the company will continue to implement the 2021 dividend payout plan with a maximum ratio of 20% approved at the 2021 AGM. In reality, the company has already paid an interim dividend of 8%, equivalent to over 55 billion VND in September 2021, and approved a second interim dividend of 10% in March 2022. According to the Chairwoman of TVC, the company plans to distribute the remaining 10% dividend for 2021 in Q4/2025.

The company also intends to repurchase 15 million shares in 2025 to reduce its charter capital. With over 110.6 million shares currently in circulation, TVC expects to decrease the number of shares to over 95.6 million after the repurchase, resulting in a charter capital reduction from the thousand-billion-dong level to over 956 billion dong.

Previously, the company had repurchased 8 million shares during the period from December 18, 2024, to January 15, 2025.

“The company’s accumulated profits to date exceed 300 billion dong. Temporarily calculating the repurchase of a maximum of 15 million shares at 13,500 dong/share, we have used about 200 billion dong. The remaining 10% dividend for 2021 is planned to be distributed. If the 2025 business results are favorable, the company will pay an interim dividend of about 6% at the end of the year,” shared Ms. Hang.

Changes in two Board members and explanation for the absence of a CEO

The meeting approved the dismissal of Ms. Nguyen Thi Hang Nga, an independent member of the Board of Directors for the term 2023-2028, and Mr. Chu Van Tuong, an independent member of the Board of Directors for the term 2024-2027. Additionally, Mr. Ngo Long Giang was elected as a non-executive member of the Board of Directors, and Ms. Phan Thi Thu Ha was elected as an independent member of the Board of Directors.

According to TVC’s introduction, Mr. Ngo Long Giang, born in 1979, holds a Master’s degree in Business Administration. He previously served as CEO of TVC from November 2024 to January 2025 and has been the CEO of T-Cap Securities Joint Stock Company (HOSE: TVB), a subsidiary of TVC, since January 2025. Before that, Mr. Giang held important positions in several securities companies, including Head of Self-finance Department at VPBank Securities, Director of Investment Division at MBS Securities Joint Stock Company, and Director of Investment at MB Capital Investment Fund Management Joint Stock Company.

Ms. Phan Thi Thu Ha, born in 1971, holds a Bachelor’s degree in Economics. For a long period from 2006 until now, she has been the Chief Financial Officer of Bao Son Group and the Chief Accountant of Bao Son Construction and Tourism Investment Joint Stock Company. Prior to that, Ms. Ha worked as Chief Accountant for several companies from 1992 to 2006.

Regarding personnel matters, a shareholder inquired about the reason for the long-vacant position of CEO. It is known that the position has been vacant since January 16, 2025, when Mr. Ngo Long Giang was dismissed.

In response, Chairwoman Nguyen Thi Hang explained that the vacancy is due to the need for new personnel aligned with the company’s new strategy, and recruiting high-quality talent is not an easy task. Since the beginning of the year, the company has approached various candidates but has not found a suitable match.

“The high-level job market in the securities industry is quite scarce, and the talent pool is lacking in both quantity and quality. There are suitable individuals, but due to objective circumstances and personal directions, we have not been able to align in terms of timing,” shared Ms. Hang.

Additionally, she mentioned that the company is not ruling out the possibility of hiring foreigners for the CEO position as they navigate through the “clean-up” process and strive for international investment thinking. For now, the priority is to strengthen the current team, and the CEO position will be the last piece of the puzzle.

Another question was raised regarding the frequent changes in the person responsible for information disclosure and the concern that financial statements are always disclosed on the last day. Ms. Hang explained that the changes in the information disclosure personnel were made to ensure compliance with the law. Initially, the person in charge had communication expertise but lacked management and legal expertise, so the leadership decided to appoint someone with a legal background.

Regarding the timely disclosure of financial statements, she assured that she would remind the functional department, but the delay could be attributed to the restructuring process.

Chairwoman Nguyen Thi Hang speaking at the meeting – Screenshot

|

Name change to T-Corp

At the meeting, the shareholders approved the change of the company’s name from Tri Viet Asset Management Group Joint Stock Company to T-Corp Asset Management Group Joint Stock Company.

This decision comes not long after the 2025 Annual General Meeting of TVB, where the name change to T-Cap Securities Joint Stock Company was approved. The leadership of TVB shared that the name change to T-Cap aligns with international trends, attracts foreign strategic partners, and reflects their future direction of international business operations. Additionally, T-Cap is a concise and memorable name for customers.

Huy Khai

– 16:25 14/06/2025

“Seamlessly Own a Bcons Uni Valley Townhouse with Our Revolutionary Payment Plans.”

With their groundbreaking sales policy of “Buy a House for $0 Down,” Bcons Uni Valley is offering an unmissable opportunity for investors to own a top-tier commercial townhouse, perfectly positioned to ride the wave of the upcoming merger between Binh Duong and Ho Chi Minh City.

“SCS Announces 60% Cash Dividend Plan, Preparing for Potential ACV Collaboration at Long Thanh Airport”

“Saigon Cargo Service Joint Stock Company (HOSE: SCS) has unveiled an ambitious plan, targeting record-high profits and a generous 60% cash dividend. With its eyes set on the future, the company is also actively gearing up to seize opportunities arising from the development of the Long Thanh International Airport.”