Illustrative image

Egypt has secured deals with several energy and trading firms to purchase 150-160 cargoes of liquefied natural gas (LNG) as the country ramps up buying to meet domestic power needs.

The Arab world’s most populous nation has endured rolling blackouts over the past two years as domestic natural gas supplies fell short of demand. As a result, Egypt became a net importer of gas last year, buying dozens of cargoes and abandoning plans to become a supplier to Europe as domestic output plummeted.

Electricity costs are straining the government, which is already facing a cost-of-living crisis, currency troubles, and slowing economic growth, prompting it to seek help from the International Monetary Fund (IMF). These LNG purchase contracts are Egypt’s largest-ever import deals and will cost over $8 billion at current prices.

Agreements have been reached with global energy companies and traders, including Saudi Aramco, Shell, Vitol, Trafigura, BGN, SOCAR, and PetroChina. Around 50 to 60 cargoes will be used to meet this year’s requirements, in addition to the 75 cargoes Egypt purchased earlier this year. The remainder will be delivered through 2026, totaling 235 cargoes over the next two years.

Freight rates are higher than gas prices at the Dutch TTF hub by $0.70-$0.75, with deferred payments over nine months.

Martin Senior, LNG pricing director at Argus, said this volume far outstrips the annual LNG output of both Trinidad and Tobago and the UAE and surpasses the imports of Belgium, the UK, or Kuwait. However, he noted that Egypt’s large import volume is not expected to significantly tighten the market next year as additional liquefaction capacity comes online.

Egypt has purchased 2.25 million tons of LNG so far this year, almost 90% of its total purchases last year. And this figure could be even higher when including imports via Jordan.

“Egypt’s latest buying spree comes as maintenance is underway in the US and Norway and as Europe is in the midst of summer injections,” said Aly Blakeway, head of Atlantic LNG at S&P Global Commodity Insights. He added that Asian demand is also expected to rise in August.

“With Europe still needing to replenish storage ahead of winter and expected demand from South Korea and Taiwan during the summer peak, Egypt’s LNG tender could lead to even fiercer competition this summer for seaborne LNG cargoes,” he said.

The Secret’s Out: Two European Nations Can’t Get Enough of Russian Gas. A Whopping 97% of Their Imports Come from Russia, and They’re Not Planning to Stop in 2027.

The top two importers of Russian liquefied natural gas (LNG) in the EU are not in favor of the European Commission’s proposal to completely ban this fuel source by 2027.

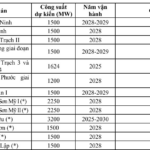

The First $1.4 Billion LNG-to-Power Plant in Vietnam Sets a Date to Power Up, Enough to Light Up 60% of Dong Nai Province

Nhơn Trạch 3 and Nhơn Trạch 4 power plants are set to boost Vietnam’s electricity supply significantly. With a combined annual output of 9 to 12 billion kWh, these power plants will contribute a substantial amount to the national grid, meeting the energy demands of Đồng Nai province, which currently accounts for the fourth-highest electricity consumption in the country. This equates to an impressive 60% of the province’s total electricity consumption, showcasing the immense impact these power plants will have on Vietnam’s energy landscape.

Deploying the Amended Power Plan: Supercharging Green Energy

On May 30, the Ministry of Industry and Trade issued a decision approving the implementation plan for the 8th Power Development Plan (PDP 8) adjustment, outlining a clear roadmap for power source and grid development and assigning specific tasks.