**The Merger of Binh Duong and Ba Ria-Vung Tau into Ho Chi Minh City**

In a significant development, Vietnam’s National Assembly passed Resolution 202/2025/QH15 on June 12, 2025, which came into effect immediately. Per the resolution, Binh Duong and Ba Ria-Vung Tau provinces are now merged into Ho Chi Minh City, resulting in a metropolitan area with a population of 14 million people and a natural area of 6,772.59 square kilometers.

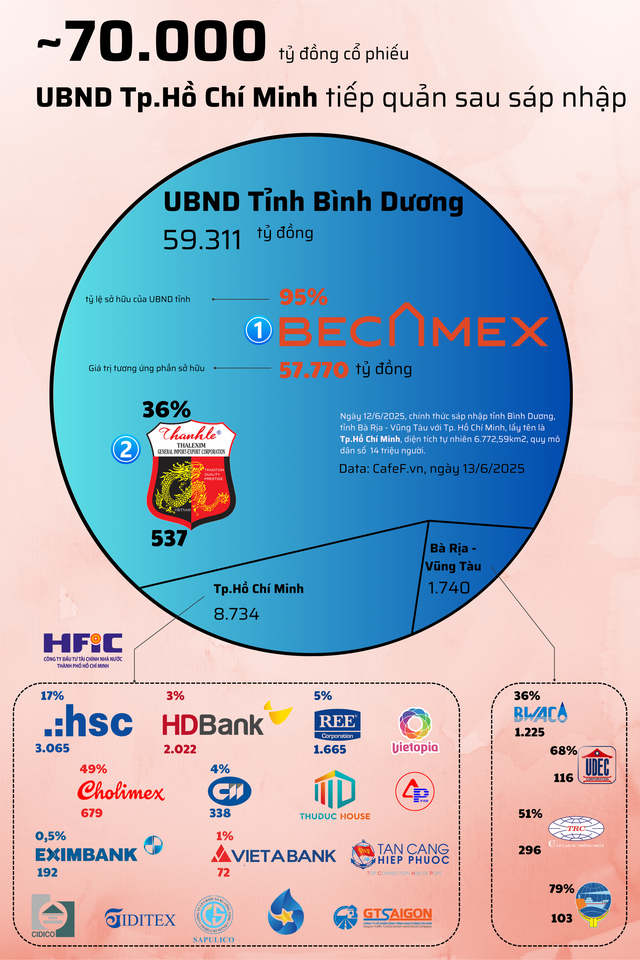

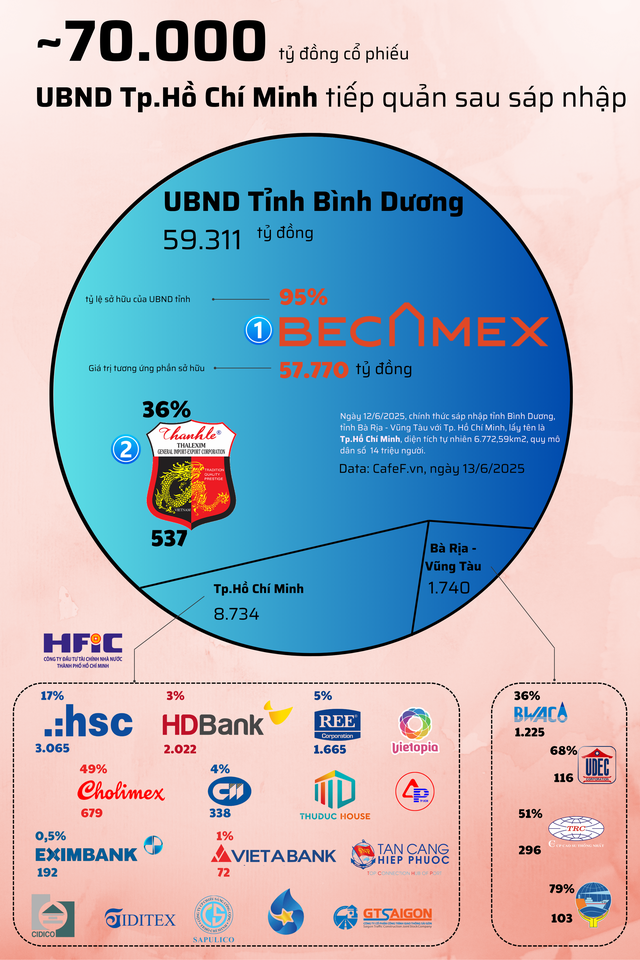

This merger has led to a substantial change in the ownership structure of several businesses. The Ho Chi Minh City People’s Committee now holds nearly VND 70,000 billion worth of shares inherited from the former provincial authorities of Binh Duong and Ba Ria-Vung Tau.

The most notable contribution to this portfolio is from Becamex IDC, a leading industrial development corporation, with a market capitalization of over VND 58,700 billion, equivalent to a 95% stake. Prior to the merger, the Binh Duong provincial authority held this stake, despite only investing in two businesses, and it accounted for over 85% of the total value of the shares held by the three localities.

In addition to Becamex IDC, Binh Duong also held a 36% stake in Thanh Le Export-Import Trading Joint Stock Company (TLP), valued at VND 537 billion. On the other hand, the Ba Ria-Vung Tau provincial authority invested in four businesses with a total market capitalization of VND 1,740 billion:

(1) Thong Nhat Rubber Joint Stock Company (TNC): 51% stake, valued at VND 296 billion.

(2) Ba Ria-Vung Tau Urban Development and Construction Joint Stock Company (UDC): 68% stake, valued at VND 116 billion.

(3) Ba Ria-Vung Tau Water Supply Joint Stock Company (BWS): 36% stake, valued at VND 1,225 billion.

(4) Vung Tau Ship: 79% stake, valued at VND 103 billion (par value)

Meanwhile, the Ho Chi Minh City People’s Committee, through the Ho Chi Minh City Finance and Investment State-owned Company (HFIC), has invested in 18 businesses with a total market capitalization of only VND 8,734 billion. These investments cover various sectors, including finance, banking, real estate, and infrastructure.

Some notable enterprises in their portfolio include: Ho Chi Minh City Securities Joint Stock Company (HCM): 17% stake, valued at VND 3,065 billion, making it the largest investment; Ho Chi Minh City Development Joint Stock Commercial Bank (HDB): 3% stake, valued at VND 2,022 billion, a small percentage but high value due to the bank’s scale; Cho Lon Import-Export and Investment Joint Stock Company (CLX): 49% stake, valued at VND 679 billion; Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (CII): 4% stake, valued at VND 338 billion; and Refrigeration Electrical Engineering Joint Stock Corporation (REE): 5% stake, valued at VND 1,665 billion.

The portfolio also includes smaller companies such as Giditex (VND 151 billion), Eximbank (VND 192 billion), and Vietopia (VND 11 billion).

The Vibrant Saigon River: Unveiling Ho Chi Minh City’s Riverside Renaissance

Vice Prime Minister Tran Hong Ha has approved the adjusted master plan for Ho Chi Minh City’s development until 2040, with a vision towards 2060. This decision, outlined in Resolution No. 1125, charts a course for the city’s future, addressing key aspects of urban planning and development to create a sustainable and thriving metropolis.

Uncover the Ultimate Guide to Safeguarding Your Digital Empire: Unmasking the 21,000 International Credit Card Fraud Syndicate

The Danang police have recently busted a large-scale cybercrime ring led by two individuals who illegally used Visa, Mastercard, and Discover card data of foreigners to make purchases on Amazon, reaping illicit profits.

“The Struggles of a Decade-Old Business: Why Can’t They Secure a Bank Loan?”

“Accessing bank capital is an incredibly challenging endeavor for our company, given the nature of our work in construction and public investment, which often entails slow disbursement of state budget funds. For over a decade, we have been unable to secure bank funding.” – Mr. Nguyen Van Manh, CEO of Hanoi Housing Construction and Trading JSC, lamented.