The VN-Index closed the 24th trading week of 2025 at 1,315.49 points, a decrease of 14.4 points or -1.08% from the previous week, with liquidity continuing to decrease slightly (-8.9%).

The average matching order value on the HOSE (excluding auction orders) was 18,256 billion VND in week 24, down 8.3% from the 5-week average and falling below the 20,000 billion VND threshold for the first time since the second week of May 2025.

By market cap, money flow continued to weaken in mid- and small-cap stocks, while a slight improvement was seen in large-cap stocks after three consecutive weeks of decline. Although the VN30, VNMID, and VNSML indices all lost ground this week, active buying power remained low.

By sector, Banking, Retail, Chemicals, Oil & Gas, Information Technology, and Steel witnessed improvements in both scores and liquidity. Meanwhile, Real Estate, Securities, Construction, Agriculture & Seafood, and Electrical Equipment sectors declined with lower liquidity than the previous week, indicating that selling pressure was not significant.

Across the three exchanges, the average trading value per session in week 24/2025 reached 21,940 billion VND, of which the average matching order value per session was 20,446 billion VND, down -9.6% from the previous week.

Notably, proprietary trading bought a net of 16/18 industries at the second level, focusing heavily on Banking, Real Estate, Steel, and Retail. These were also the sectors in which foreign investors made net purchases this week, indicating a significant consensus between these two investor groups.

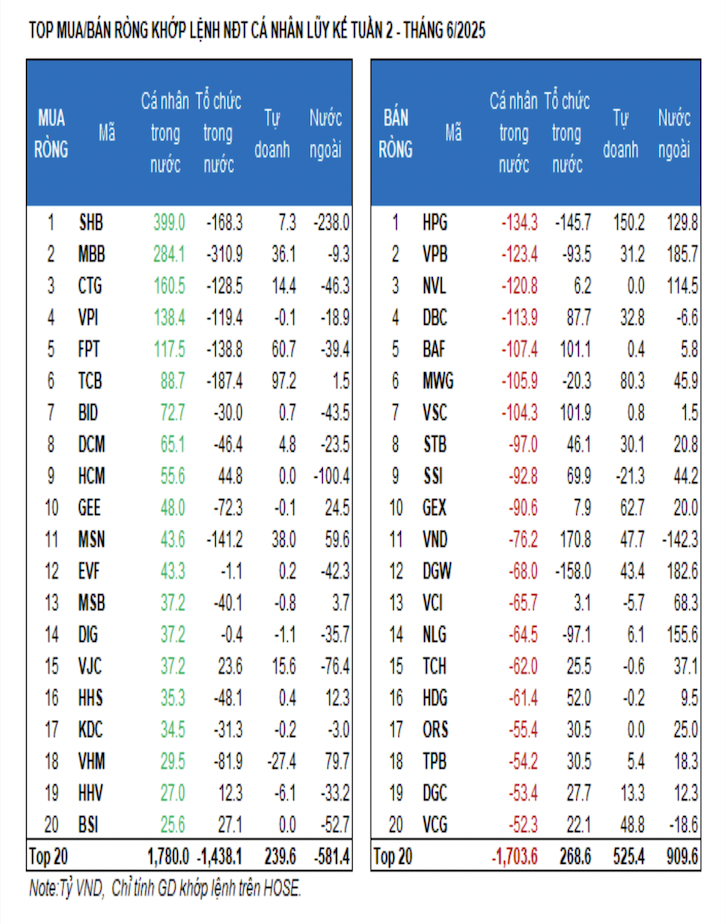

Accordingly, foreign investors sold a net of 427.2 billion VND, including 458 billion VND. Considering only matching orders, they bought a net of 6/18 industries, mainly in the Banking sector. The top net buys of individual investors included: SHB, MBB, CTG, VPI, FPT, TCB, BID, DCM, HCM, and GEE.

On the net selling side: they sold a net of 12/18 industries, mainly in the Real Estate, Industrial Goods & Services sectors. The top net sales included: HPG, VPB, NVL, DBC, BAF, MWG, STB, SSI, and GEX.

Individual investors bought a net of 2,605.7 billion VND, including 543.5 billion VND in matching orders. Considering only matching orders, they bought a net of 12/18 industries, mainly in the Banking sector. The top net buys of individual investors included: VIC, STB, SSI, MWG, EVF, HDC, KDH, PVD, FPT, and VPB.

On the net selling side: they sold a net of 6/18 industries, mainly in the Food & Beverage and Industrial Goods & Services sectors. The top net sales included: VHM, DBC, HAG, VRE, MSN, VSC, NVL, VND, and GEX.

Proprietary trading bought a net of 1,339.4 billion VND, with a net buy of 1,217.4 billion VND in matching orders. Considering only matching orders: Proprietary trading bought a net of 16/18 industries. The strongest buying group was Banking, Real Estate. The top matching net buys for proprietary trading this week included HPG, TCB, MWG, GEX, FPT, VIC, VIX, VCG, VND, and DGW.

The top net sell was the Media group. The top net sold stocks included VCB, VHM, SSI, CTR, VTP, DPM, HDB, HHV, VCI, and PDR.

Domestic institutional investors sold a net of 1,259.6 billion VND, with a net sell of 1,051.8 billion VND in matching orders. Considering only matching orders: Institutions sold a net of 11/18 industries, with the largest value in the Banking sector. The top net sales included MBB, EIB, TCB, VIX, SHB, DGW, HPG, MSN, FPT, and CTG.

The largest net buy was in the Industrial Goods & Services sector. The top net buys included HAH, VND, VCB, VSC, BAF, DBC, PVD, SSI, DPG, and HDB.

Money flow allocation by sector increased in Banking, Steel, Retail, Chemicals, Information Technology, Oil & Gas, and Aviation, while decreasing in Real Estate, Securities, Construction, Agriculture & Seafood, Food & Beverage, Electrical Equipment, and Power.

Money flow strength: By market cap, money flow allocation increased in large-cap stocks, while it decreased sharply in mid-cap stocks and remained stable in small-cap stocks.

Week 24 saw the average trading value of the VN30 group increase slightly by 144 billion VND (+1.8%) compared to the previous week, contrary to the downward trend of the overall market (-8.9%). As a result, the money flow allocation to large-cap stocks recovered to 44.7%, compared to the 1-year low of 40% in week 23.

In contrast to large-cap stocks, the VNMID group witnessed a sharp decline in liquidity of 1,614 billion VND (-17.8%), dragging the money flow allocation down from 45.3% to 40.9%. The VNSML group also experienced a liquidity decrease of 287 billion VND (-13.5%), but the money flow allocation remained almost unchanged at 10.1%.

In terms of price movements, all three indices fell during week 24, with the VNSML index losing the most (-1.41%), followed by VN30 (-1.25%) and VNMID (-1.08%).

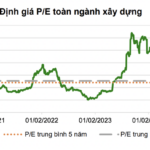

“Undervalued Construction Stocks: Outperforming Earnings Prospects”

The volatile and uneven fluctuations in the cost of raw materials can put varying degrees of pressure on the profit margins of construction companies. However, the sustained low-interest rate environment will serve as a crucial supportive factor, alleviating financial burdens, especially for the capital-intensive construction industry.

Stock Market Insights: The 1,300 Point Region – A Critical Support Level

The VN-Index declined and concluded a volatile week of trading. A decrease in weekly trading volume compared to the previous breakout period indicates a return to cautious investment strategies. The 1,300-point level remains a crucial support zone, and if breached, the VN-Index could face further downward pressure, potentially testing the next support zone around 1,270-1,280 points.

The Market is Worry-Free: VPBank Securities Experts Identify 3 Groups of “Leading” Stocks for the Coming Period

“Given a market adjustment to the 1,280 to 1,300 range, investors are presented with an opportunity to buy and hold for the year’s final upticks,” emphasized Mr. Son.