CEO Trinh Kien has been appointed to manage DNP Holding’s investment in the soon-to-be-established company. Mr. Kien is responsible for working directly with the founding shareholders, finalizing legal procedures, and coordinating organizational structure and operational direction for the new enterprise.

If the plan proceeds as expected, this will be the fifth direct subsidiary of DNP Holding, alongside existing units including Tan Phu Vietnam (HNX: TPP), Nhua Dong Nai, Dau Tu Nganh Nuoc DNP, and CMC (HOSE: CVT). Among these, Dau Tu Nganh Nuoc DNP, with an investment of over VND 1,350 billion, leads in the clean water and environment sector. CMC, specializing in tiles, TPP in household plastics, and Nhua Dong Nai in the water industry ecosystem, complete the portfolio.

DNP Holding inaugurated the Son Thanh clean water treatment plant in Khanh Hoa in September 2024. Source: FB DNP Holding

|

In parallel with DNP Holding’s plans, the Board of Directors of TPP has also resolved to contribute VND 135 billion for a 45% stake in a linked company based in Ba Ria – Vung Tau, likely the same entity that DNP Holding intends to establish. Chairman of the Board of Directors of TPP, Tran Duc Huy, has been appointed to manage this investment directly.

Currently, DNP Holding indirectly owns several companies operating in the clean water sector in provinces and cities such as Bac Giang, Hanoi, Binh Thuan, Tien Giang, Tay Ninh, Khanh Hoa, Binh Phuoc, Lam Dong, Gia Lai, Cu Chi, and Ho Chi Minh City, but has yet to establish a presence in Ba Ria – Vung Tau.

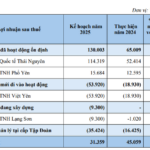

In 2025, DNP Holding aims for consolidated revenue of over VND 9,600 billion, an 8.7% increase from the previous year and the highest ever. The household and building materials segments are expected to grow by 28% and 14%, respectively, while the clean water and environment segment is projected to increase by 7.8%.

Profit before allocation of commercial advantages and post-M&A depreciation is estimated at VND 359 billion, a 14% decrease from the previous year. After the first quarter, the company achieved approximately 21% of the revenue plan and 17% of the profit target for the full year.

– 11:09 14/06/2025

A Fresh Slate: Nominating a Foreign Shareholder to the TNH Hospital’s Board of Directors for the Upcoming Term

Access S.A., SICAV-SIF – Asia Top Picks, a leading Luxembourg-based foreign fund, has nominated Ms. Nguyen Thi Thuy Giang to the Board of Directors of TNH Hospital for the 2025-2030 term.

“A Bleak First Quarter for POM: Q1 2025 Results Show Continued Losses, Climbing to VND 2.7 Trillion.”

The Pomina Steel Joint Stock Company (coded POM-HOSE) has released its consolidated business results for the first quarter of 2025. The company reported a loss of nearly VND 160 billion, a 29% improvement compared to the same period last year (VND 225 billion loss).