Khang Điền Corporation (code: KDH on HoSE) has just announced a resolution to issue bonus shares for 2024 and an employee stock ownership plan (ESOP).

Specifically, Khang Dien plans to issue bonus shares for 2024 at a ratio of 10% of the total outstanding shares, equivalent to 101.11 million shares. The issuance fund comes from undistributed post-tax profits accumulated up to the end of 2024 in the audited financial statements.

Shareholders owning 100 shares will receive 10 new shares. The expected timeline for the implementation is the third or fourth quarter of 2025.

Moving forward, Khang Dien plans to issue 9.96 million ESOP shares at a price of VND 14,000 per share. The criteria for employees to receive ESOP shares are based on their positions and contributions to the company.

The expected timeline for this issuance is also the third or fourth quarter of 2025. The ESOP shares will be restricted from transfer for one year. Proceeds from the issuance will be used to supplement the company’s working capital.

Currently, KDH shares are trading around the level of VND 29,000 per share. Therefore, the ESOP issuance price is only half of the market price.

Khang Dien has announced a list of 244 employees participating in the ESOP issuance. Among them, Chairwoman Mai Tran Thanh Trang is expected to buy 1.2 million shares. Vice Chairman Ly Dien Son is expected to buy 1.1 million shares. Board member and CEO Vuong Van Minh may purchase 1 million shares…

If both issuance plans are completed, Khang Dien will increase its outstanding shares to 1.12 billion, equivalent to a charter capital of VND 11,222.1 billion.

These plans were approved at the 2025 Annual General Meeting of Shareholders. The meeting also approved the business plan with revenue and profit after tax targets of VND 3,800 billion and VND 1,000 billion, respectively. These figures represent growth of 16% and 23% compared to 2024 results.

In terms of business results, according to the first-quarter 2025 consolidated financial statements, Khang Dien recorded net revenue of nearly VND 710 billion, up 112.6% over the same period last year. After deducting taxes and expenses, the company reported a net profit of nearly VND 119 billion, up 85.5%.

As of March 31, 2025, the company’s total assets decreased slightly by 1.8% from the beginning of the year to over VND 30,201.7 billion. Of this, inventory was nearly VND 22,404.5 billion, accounting for 74.2% of total assets.

On the other side of the balance sheet, total liabilities stood at VND 10,633.6 billion, down 5.9% from the beginning of the year. Of this, short-term and long-term borrowings totaled VND 7,400 billion.

“PVTrans Sets Record Date for 2024 Stock Dividend”

PVTrans plans to issue over 113.9 million dividend shares for its 2024 shareholder payout, with a distribution ratio of 100:32. The record date for this allocation of rights is June 20, 2025.

“Dividend Payment Schedule for June 9-13: Top Cash Dividends Over 40%, State-Owned Enterprise Allocates Approximately VND 1,500 Billion for Dividend Payments”

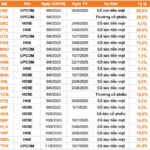

Introducing the top-performing stocks that offer lucrative cash dividends! 32 companies stand out with their generous cash payouts, ranging from a remarkable 41% to a solid 1.6%. These figures showcase a diverse range of opportunities for investors seeking steady income streams and strong returns. This impressive lineup underscores the potential for substantial gains in the stock market, providing a compelling proposition for those looking to grow their wealth.