STOCK MARKET REVIEW FOR THE WEEK OF 09-13/06/2025

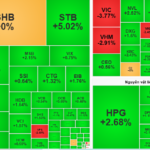

During the week of June 9-13, 2025, the VN-Index declined, ending the week with a volatile trading session. Although it remained above the Middle Bollinger Band, the index is struggling to return to its March 2025 highs (around 1,320-1,340 points). Trading volume for the week also decreased compared to the previous breakout period, indicating a more cautious investor sentiment. Currently, the 1,300-point level remains a crucial support zone. A breakdown below this level could trigger further downward pressure, pushing the VN-Index towards the next support area of 1,270-1,280 points.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Remains below the Middle Bollinger Band

On June 13, 2025, the VN-Index declined, accompanied by an increase in trading volume that surpassed the 20-day average, reflecting investors’ pessimistic outlook.

Additionally, the index remained below the Middle Bollinger Band, while the Stochastic Oscillator continued its downward trajectory after generating a sell signal. These indicators suggest a persistent bearish outlook.

HNX-Index – MACD Generates a Sell Signal

On June 13, 2025, the HNX-Index witnessed a decline and formed a candle pattern resembling a Bearish Engulfing pattern, accompanied by a trading volume exceeding the 20-day average, indicating a highly pessimistic investor sentiment.

Furthermore, the index reversed its upward trend after testing the long-term moving averages of SMA 100 and SMA 200 days (around 225-229 points) as the MACD generated a sell signal. This suggests a high likelihood of continued downward adjustments in the upcoming sessions.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index for the VN-Index is currently below the EMA 20-day. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will increase.

Foreign Money Flow Variation: Foreign investors continued net buying on June 13, 2025. If this trend is maintained in the following sessions, the situation may become less pessimistic.

Technical Analysis Department, Vietstock Consulting

– 16:58 15/06/2025

The Flow of Funds: Post-“Bull-Trap”, Market Faces Further Downside Risk

The escalating Middle East conflict sparked a global stock market sell-off last weekend, impacting domestic markets. However, experts deem this a mere catalyst, as the downward trend had already been brewing.

Stock Market Outlook for June 13: Will Bank Stocks Continue to Lead the Charge?

The trading session on June 12 ended on a positive note, with the banking sector stocks leading the market higher. This performance has sparked hopes for a continuation of this bullish trend in the next session.