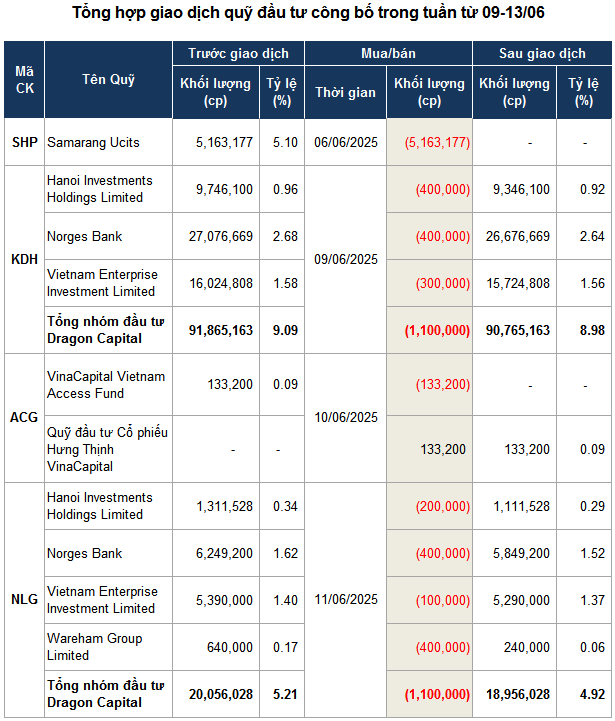

Specifically, Dragon Capital sold a total of 1.1 million NLG shares of Nam Long Investment Joint Stock Company during the June 11 session, thereby reducing its ownership in the enterprise to 4.92%, equivalent to nearly 19 million shares. With a rate of under 5%, Dragon Capital is no longer a major shareholder at NLG.

| NLG share price movement from the beginning of 2024 to the session on 06/13/2025 |

Temporarily calculated at the closing price of the June 11 session at VND 38,000/share, the foreign fund may have earned about VND 42 billion from this capital divestment deal. This move comes as the NLG share price has recovered strongly from its April 9 low – the time when it was affected by tax factors – and is currently trading around its highest level in more than six months.

| KDH share price movement from the beginning of 2024 to the session on 06/13/2025 |

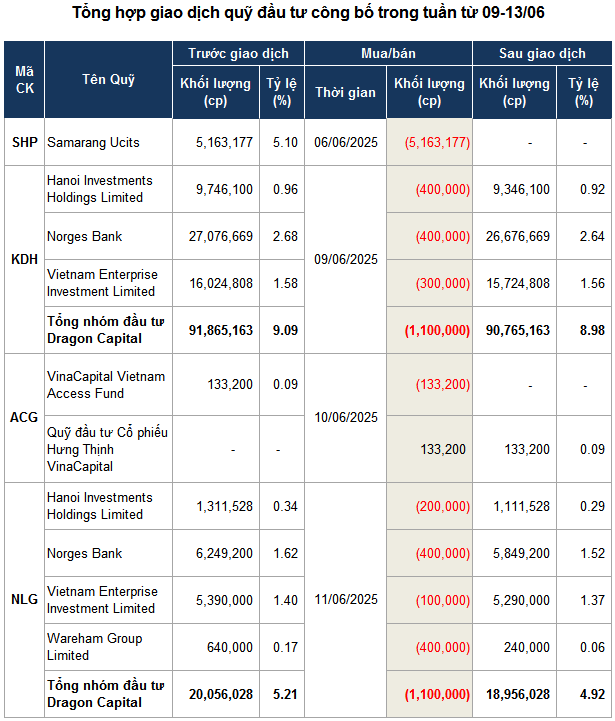

Earlier, in the June 9 session, Dragon Capital also sold 1.1 million KDH shares of Khang Dien House Investment and Trading Joint Stock Company, lowering its ownership to below the 9% threshold, equivalent to nearly 91 million shares. With the closing price of the same session at VND 29,850/share, this deal is estimated to have brought the fund nearly VND 33 billion. The KDH share price has also increased by more than 22% compared to the bottom on April 9.

| SHP share price movement from the beginning of 2024 to the session on 06/13/2025 |

Not only Dragon Capital, but another foreign fund, Samarang UCITS – Samarang Asian Prosperity (Luxembourg), also sold all of its nearly 5.2 million SHP shares (of Southern Hydropower Joint Stock Company) in the June 6 session, equivalent to 5.1% charter capital.

Notably, this session recorded a matching volume equal to the volume sold by Samarang, with a total value of nearly VND 186 billion, equivalent to VND 35,950/share, higher than the closing price of VND 35,800/share.

On the buying side, Dak R’tih Hydropower Joint Stock Company (DaHC) – a major shareholder of SHP – increased its ownership from 10.33% to 15.43% (equivalent to more than 15.6 million shares) through a matching transaction in the same session.

These transactions took place in the context that the SHP share price is trading around its historical peak since its listing. From the beginning of the year to the session on June 13, the SHP share price has increased by more than 8%.

Source: VietstockFinance

|

– 07:28 06/15/2025

Unleashing the Dragon: Dragon Capital Divests 1.1 Million Shares of Nha Khang Dien

Dragon Capital has successfully offloaded 1.1 million KDH shares, thereby reducing its ownership stake in Nha Khang Dien to 8.9765%.

“Dragon Capital Boosts Ownership Ahead of DXG Group’s Bonus Share Issue”

On the eve of a bonus share issuance, Dragon Capital has bolstered its position in DXG with a recent purchase of 2 million shares. This strategic move brings their total holdings to an impressive 123.4 million shares, representing a substantial 14.17% stake in the capital of Dat Xanh Group.