The Middle East conflict that erupted last weekend caused stock markets around the globe to plunge into panic selling, and this has had an impact on the domestic market as well. However, experts believe this is merely a catalyst, and the downward trend had already begun.

Although there was bottom-fishing and some support in the last session, with the VN-Index falling less, this cannot yet be considered a reliable signal. The reason is that the price manipulation in some large-cap stocks that recovered towards the end of the session could only improve the index, while many other stocks continued to fall deeply.

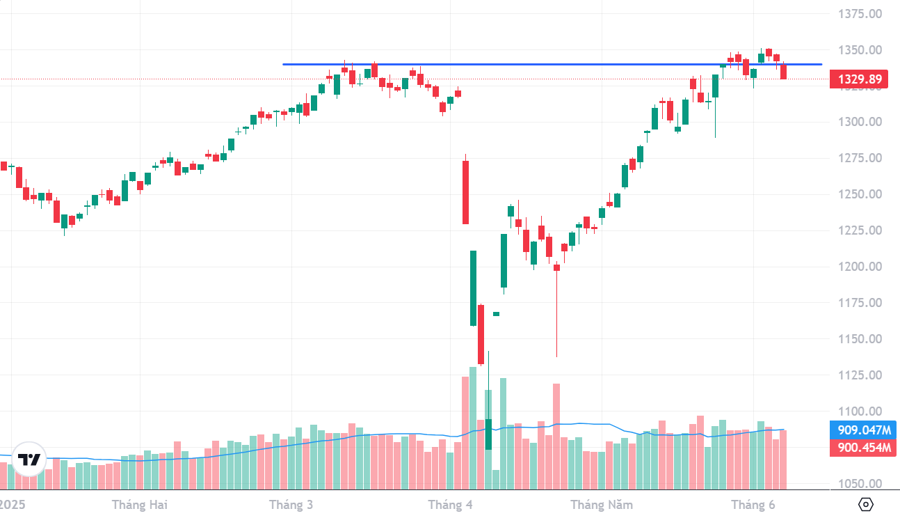

Especially, the 3-session mid-week recovery created a bull trap, and the strong correction in the last session increased the risk for portfolios. Experts advise investors to adhere to the discipline of cutting losses, especially for portfolios with a high proportion of stocks or leverage. With the increasing instability and unpredictability of this Middle East conflict, the market risks continuing to adjust to the 1280-point region and even to 1250 points.

Nguyen Hoang – VnEconomy

The market suddenly dropped sharply in the last session, coinciding with the escalation of tensions in the Middle East. Is this the reason for the market crash, or is it just a coincidence?

This geopolitical tension between Israel and Iran could be more complex than previous ones, and the scale of retaliation is likely to be larger. I believe the increased liquidity in the heavily declining codes belongs to the suppliers rather than the buying force.

Nguyen Thi My Lien

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

In my opinion, the news of tensions in the Middle East acted as a stronger catalyst than the root cause. In fact, the market had already risen for a long stretch and was at the old peak, so profit-taking pressure had been simmering. This sudden geopolitical event was like a trigger for a psychological reaction, becoming a reason to legitimize the decisive selling action of the majority at the same time. The reaction in the next sessions will show whether this is just a short-term shock or the beginning of a deeper correction.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

I see many signs that the market trend has weakened since the end of last week and entered a cooling-off period after a good upward movement earlier. The escalating geopolitical tensions as Israel attacks Iran contribute to increased caution, leading to an expanded adjustment phase. If this development had not occurred, I believe the market would still be under adjustment pressure, but with the escalation of the conflict, it adds more basis for the selling force.

Regarding trade developments, the third round of negotiations between Vietnam and the US, scheduled for the first half of June, is approaching, which also makes investors hesitate, and the buying force is somewhat weaker.

Nguyen Thi Thao Nhu – Director of Individual Customers, Rong Viet Securities

I think the Middle East tension was just the straw that broke the camel’s back, pushing the market into a temporary “panic selling” state. Previously, the market had shown clear distribution signals after a short recovery, with volume increasing but prices unable to break through the strong resistance of 1340 points, which is the old peak of the market in March 2025. If we ignore the 30-50 points contributed by the VinGroup stocks, the market index would fluctuate around 1300 points, which is also a strong psychological resistance for investors. Therefore, the geopolitical event is a trigger for psychology rather than the root cause. The core issue is still profit-taking and the lack of momentum from the leading stocks, which pushed the market into a volatile session last Friday.

Le Duc Khanh – Analysis Director, VPS Securities

The market is still in a short-term adjustment phase – the Middle East tension occurred and it happened to be Friday the 13th, a rare and infrequent event in the stock market. The adjustment session last Friday was not too strong, the adjustment range was not large, and the impact of the VinGroup stocks’ decline was also taken into account. There was no sell-off in the market, and instead, the bottom-fishing force as well as the force buying cheap stocks increased.

Nguyen Hoang – VnEconomy

Nevertheless, stocks fell deeply in the last session, and the VN-Index formed a bull trap with a significant increase in liquidity. What should investors who bottom-fished in the 3 mid-week recovery sessions do: cut losses or continue to hold?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

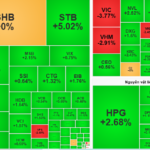

The last session witnessed a strong differentiation of cash flow with the return of the banking pillar group, along with the Oil and Gas and Fertilizer groups, following the rise in world oil prices due to the Israel-Iran conflict. This reflects the rotation of cash flow and helps support the general index, preventing a sharp correction. I believe that the market trend is being supported and can create a spread, helping to promote a technical recovery for the negatively affected groups. The individual stock decline has brought prices down to medium-term support levels. Therefore, for stocks that violate the “stop loss” (loss threshold), investors should still cut losses to reduce their proportions, but take advantage of the recovery to sell, instead of panic selling.

Le Duc Khanh – Analysis Director, VPS Securities

An experience that investors have gone through in April can also be drawn on this time, which is that buying during the 3 mid-week recovery sessions, if “negative”, is just a small matter – selling must also be based on other factors such as portfolio status, what stocks are being bought and held and in what proportions, and especially if they are following the strategy of buying and holding for a few weeks and a few months, then the question of whether to sell or not is probably not that important.

Thus, maintaining the portfolio position and taking advantage of market adjustments to buy potential stocks is a reasonable action. Controlling the proportion of stocks bought and held well will stabilize the investment psychology – the story is waiting for opportunities to appear in the market.

In the last session, the VN-Index plunged sharply, but there were signs of bottom-fishing at the end. However, the element of spread is lacking to affirm that cash flow has actually entered strongly. Therefore, I think this is not yet a reliable sign to be optimistic.

Nghiem Sy Tien

Nguyen Thi Thao Nhu – Director of Individual Customers, Rong Viet Securities

It is normal and even necessary for the market to have deep adjustment sessions, especially after technical recoveries, in a long-term upward trend. There is no market that goes up in a straight line, and short-term “shake-out” (shakeout) phases help filter out weak-handed investors, creating a stronger foundation for the next wave of increases.

From the perspective of a long-term investor, if you invest with the perception that the Vietnamese market is in a recovery cycle after the compression phase in 2022-2023, then the appearance of interspersed adjustment phases is completely reasonable. In an upward trend, the market often has adjustments of 5-10%, accompanied by large volume – this is the stage where the market “tests” investors, and it is also when strong cash flow starts to filter stocks.

For investors who have “accidentally” bottom-fished in the 3 previous recovery sessions, there is no need to rush to cut losses if the portfolio is fundamentally strong, leading stocks, and not using margin. The market adjustment does not mean that stocks no longer have value. However, if the stock is weaker than the market and has high leverage, it is necessary to reduce the proportion to manage risks and maintain purchasing power when clearer opportunities arise.

The right strategy at the moment is to reassess the position, not to act emotionally. The market still has the potential to enter a long-term upward cycle, but the differentiation will be significant. Only stocks with clear stories and substantial business results will retain strong cash flow.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

In my opinion, investors should strictly adhere to the principle of cutting losses. When the stock enters the account, take advantage of the technical recovery sessions within the session (if any) to actively reduce the proportion and preserve capital. Averaging down at this time is quite risky, so be patient and wait for the market to find a new balance.

Nguyen Hoang – VnEconomy

The VN-Index has dropped to around 1300 points and broken the first support threshold that you expected in previous discussions, around 1320 points. With the new tensions, has your expected support threshold changed?

Nguyen Thi Thao Nhu – Director of Individual Customers, Rong Viet Securities

Technically, it is true that when the market breaks through a certain resistance threshold, that resistance will become a support for the market. However, the transition between the two levels of resistance and support is often not easy to determine, and the estimated numbers are only relative. It can be seen that, in the case of the VN-Index in the first half of this year, just counting the VinGroup stocks alone, with their strong breakthrough, contributed up to 30-50 points, or 20-25% of the change in the whole index. Thus, the representative numbers such as VN-Index or VN30 do not really reflect the average profit of other stocks in the market.

With the above analysis, the VN-Index is still “struggling” around the strong psychological resistance of 1300 points, so with a necessary caution, the next support level that the market is likely to reach is the 1250-1280 point region.

The VN-Index will not correct deeply before the market returns to the uptrend to the 1400-1450 point area from now to Q3/2025.

Le Duc Khanh

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

From a technical perspective, the VN-Index continued to show a weekly loss after challenging the mid-term resistance and giving a reversal signal from the previous week. However, the bottom-fishing force was still maintained quite well at the low price ranges, creating a pulled foot candle, leaving room for the possibility of a short-term recovery. This signal is also observed on the daily chart when the downward momentum has eased towards the end of the week, but the adjustment trend is still dominant.

Thus, although the index may experience a short recovery at the beginning of next week, the movement will be differentiated and the risk of returning to the adjustment trend, continuing to test stronger support levels at 1280 points, still needs to be noted.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

I still maintain the first support threshold at around 1320 points, and a retreat below this level has increased the risk of a market adjustment. Currently, the closing index is still lower, and with the breakthrough of this threshold last week, this level has now reversed its role to become resistance in the recovery phase.

If the index’s movement remains weak and unable to break through, the decline may continue to fall to the lower support range of 1270-1280 points. The reaction may receive support from the 1300-point psychological mark, but I think this threshold has been tested, so it will not play a strong supporting role in the short term.

On the other hand, if the market shows a consensus breakthrough above the 1330-point threshold, it will be the basis for my expectation of a scenario of returning to the uptrend.

Le Duc Khanh – Analysis Director, VPS Securities

I still hold the view that the market’s strong support zone is still around the 1300-1315 (+/- 10 points) area.

Nguyen Hoang – VnEconomy

A somewhat positive development in the sharp decline session last Friday was that the index was supported by a number of banking and oil and gas stocks. However, most stocks were still heavily damaged. Is this a manifestation of supporting pillars, or is there really bottom-fishing cash flow?

The geopolitical event is a trigger for psychology rather than the root cause. The core issue is still profit-taking and the lack of momentum from the leading stocks.

Nguyen Thi Thao Nhu

Nguyen Thi Thao Nhu – Director of Individual Customers, Rong Viet Securities

Since the beginning of this year, or rather in the last 1-2 years, the banking sector has always been highly regarded for its good profit growth prospects despite the constant fluctuations of the economy, and it also has reasonable valuations compared to most other blue chips in the market. On the contrary, the oil and gas group has been “avoided” by the market for more than 1 year due to the continuous decline in oil prices, which even touched a 4-year low of $60/barrel. Therefore, the turnaround in oil prices after the Israel-Iran military conflict last week has created a very positive psychology for investors regarding oil price prospects in the short term. Thus, the phenomenon of cash flow into the Banking and Oil and Gas groups is quite understandable, with one side being the favored group and the other side being the group that has started to attract attention. Calling this “bottom-fishing cash flow” is correct, but with the short-term developments in the past 1-2 sessions, it would be more appropriate to call this “trend-following cash flow.”

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

I lean towards the scenario of supporting pillars rather than bottom-fishing, and the movement partly reflects the shift of cash flow. This geopolitical tension between Israel and Iran could be more complex than previous ones, and the scale of retaliation is likely to be larger. I believe the increased liquidity in the heavily declining codes belongs to the suppliers rather than the buying force. Cash flow selling in most industry groups may have shifted to groups expected to benefit from tensions such as Oil and Gas, Fertilizer, along with placing faith in the pillar groups of the economy – Banking. However, more signals are still needed to confirm the trend, but I maintain a cautious stance at this stage, unless there are clearer catalysts.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

In the last session, the VN-Index plunged sharply, but there were signs of bottom-fishing at the end. Some banking and oil and gas codes recovered slightly after touching the bottom, accompanied by a sudden increase in

The Market is Worry-Free: VPBank Securities Experts Identify 3 Groups of “Leading” Stocks for the Coming Period

“Given a market adjustment to the 1,280 to 1,300 range, investors are presented with an opportunity to buy and hold for the year’s final upticks,” emphasized Mr. Son.

The Foreign Buying Frenzy Continues: Net Buying Spree Reaches Nearly $100 Billion, Contrasting the Heavy Sell-Off of a Single Securities Stock

For foreign transactions, foreign investors continued to net buy over 86 billion VND on the entire market.

Middle East Tensions: Impact on the Vietnamese Stock Market

The stock market in Vietnam witnessed a decline today (June 13th), mirroring trends across the region amidst Israel’s attack on Iran. The VN-Index fell by over 7 points, despite a valiant effort by oil and gas stocks, along with select banking sector equities, to steer the market in a positive direction.