Vietnam’s Real Estate Market Enters a New Recovery Cycle

In a recent report, Agriseco Research forecasts a new recovery cycle for the real estate market in 2025. Land, villas, and detached houses are expected to recover after apartments, with transaction volumes increasing for projects with complete legal documentation that cater to both practical and investment needs near urban centers or peripheral provinces with well-developed infrastructure and locations.

The social housing segment is also predicted to recover, with many projects in the pipeline. The resort segment is expected to gradually improve by the end of this year with new supply and an increase in international tourists.

Overall, real estate companies’ profits and sales in 2025 are expected to improve compared to 2024, thanks to most real estate projects being delivered in the next 2-3 years, economic recovery, and the return of consumer confidence. Profits will remain polarized, favoring reputable developers with fully legal projects and ongoing infrastructure development.

Investors should consider selecting real estate stocks with large land banks that are in the delivery phase, focusing on affordable and mid-range housing in urban and peripheral areas. They should also look for companies with strong sales capabilities and the ability to navigate economic fluctuations and real estate challenges,

the report states.

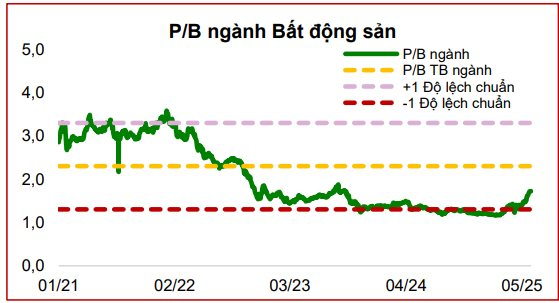

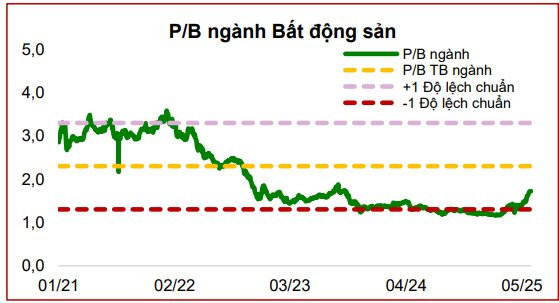

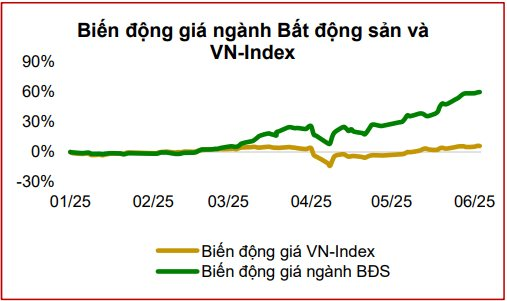

Currently, the valuation of real estate groups is trading at a P/B of 1.7x, lower than the 5-year historical average of 2.3x. The performance of the real estate sector since the beginning of 2025 has shown signs of recovery, with a 60% increase compared to a 6% rise in the VN-Index after a declining/sideways phase in 2024. This reflects the market’s expectations of government support for the industry in terms of legal framework, supply, and demand improvements.

In terms of valuation, the Agriseco analysis team believes that the stocks of companies with large land banks and strong project development capabilities have performed well and remain undervalued compared to the positive business prospects in the next 2-3 years. This presents an opportunity for investors to consider allocating capital and holding these stocks for the medium and long term.

Potential Investment Opportunities

Agriseco Research identifies four companies with appropriate valuations considering their potential for future earnings growth, healthy financials, and strategically located projects. Additionally, most of the projects of the following real estate companies have had their land use fees calculated and financial obligations fulfilled, mitigating the risk of increased investment costs due to market-based land price policy changes.

Firstly, Nam Long (NLG) is a real estate company with a total land bank of 685 hectares, all located in attractive provincial areas that are currently attracting investment, such as Ho Chi Minh City, Long An, Can Tho, Dong Nai, and Hai Phong.

Agriseco expects NLG to benefit in the medium and long term due to its large urban land bank of nearly 700 hectares, primarily consisting of affordable housing projects that cater to actual housing needs amid limited supply in the southern region. Improved sales performance will also boost growth.

NLG’s management has set a sales target of VND 14,600 billion for 2025, almost 2.8 times higher than in 2024. In the first four months of 2025, sales reached VND 2,600 billion, nearly 2.2 times higher than the same period last year, mainly driven by the Southgate project.

Next, Agriseco anticipates that Vinhomes (VHM)‘s sales for 2025 will continue to rise, reaching approximately VND 120,000-150,000 billion. This growth will be driven by projects like Vinhomes Wonder City Dan Phuong, Green City Long An, Green Paradise Can Gio, and Golden City Hai Phong, along with existing developments such as Royal Island and Ocean Park 2 and 3. This strong foundation will boost the company’s revenue and profits. The analyst team forecasts VHM’s net profit for 2025 to reach VND 31,000 billion, equivalent to an EPS of about VND 7,548 per share.

Additionally, Vinhomes holds a significant position in the residential real estate sector and has long-term growth potential due to its management of approximately 19,600 hectares of land across Vietnam. VHM is expanding its land bank by about 9,400 hectares in locations like Dan Phuong, Can Gio – Ho Chi Minh City, Hai Phong, Quang Ninh, and Long An. The company benefits from urbanization trends, improved infrastructure, and rising housing demand amid limited supply. According to Savills, the estimated housing demand for the 2023-2025 period exceeds supply, with 690,000 units needed.

Meanwhile, Nha Khang Dien (KDH) is one of the potential companies with multiple real estate projects in areas that offer long-term development potential, such as Thu Duc and the southwest of Ho Chi Minh City.

KDH’s business performance in 2025 is expected to grow positively, mainly due to the launch of the Clarita and Emeria projects, which are joint ventures with Keppel. In terms of progress, the projects have completed their infrastructure and are preparing to launch the first 230 villas for sale in the second to fourth quarters of 2025. KDH’s sales for 2025F-2026F are forecast to increase by +90% and +30%, respectively, compared to the previous year, with an estimated profit contribution of VND 2,500 billion from these two projects during 2025-2026.

According to Agriseco, KDH has the potential for medium and long-term growth due to its land bank of over 600 hectares in the eastern part of Ho Chi Minh City. As of December 31, its inventory stood at VND 22,450 billion, a 19% increase from the beginning of the year, spread across projects like KDC Tan Tao, Emeria, Clarita, Solina, Le Minh Xuan 3 Industrial Park expansion, Green Village, Phong Phu 2, and Binh Trung Industrial Cluster.

On the other hand, Hodeco (HDC), or the Ba Ria-Vung Tau Housing Development Corporation, is one of the reputable real estate investors in Ba Ria-Vung Tau province, benefiting from low capital costs.

Agriseco predicts that HDC’s profit in 2025 will increase significantly compared to the low base in 2024 due to three main drivers: (1) the delivery of The Light City Phase 1 and Ngoc Tuoc 2; (2) financial gains from divesting the Dai Duong project, from which HDC expects to recover over VND 1,000 billion in transfer money, to be recorded gradually in 2025-2026; and (3) the transfer of the Thong Nhat project to the affiliated company HUB. In the short term, HDC expects to benefit from information about divesting capital from large projects.

Hodeco’s sales are expected to improve due to the real estate market recovery cycle in Ba Ria-Vung Tau province during 2025-2026. Additionally, as market liquidity shifts towards real estate stocks, the government’s supportive policies, including legal reforms, increased public investment, and relaxed credit conditions for housing, will further boost Hodeco’s growth prospects.

“VPBank’s Strategy Director: Stocks Poised to Ride the Next Big Wave; Correction Offers Buying Opportunity”

“The market will experience some shakes, but it’s upward shakes, not downward ones,” asserted the expert from VPBankS.

The Ultimate Guide to Low-Rise Investment: Unlocking Opportunities with Limited Capital

“While low-rise real estate is often considered a ‘pricey game’, with just VND 1.2 billion, investors can now own a fully legal shophouse at Vinhomes Golden Avenue in Mong Cai, Quang Ninh. The ‘spread and build’ model in the Zen Harmony subdivision is the key to smart investing, generating significant returns even with limited capital.”