The Ho Chi Minh City Stock Exchange (HoSE) has announced its consideration to forcibly delist KPF shares of Koji Asset Investment Joint Stock Company due to serious violations regarding information disclosure obligations.

The shares of Koji Asset Investment Joint Stock Company have been suspended from trading since February 19, 2025, as KPF delayed submitting its 2024 semi-annual reviewed financial statements for over six months beyond the regulated timeframe.

Furthermore, KPF shares are also under warning status due to the auditor’s qualifications regarding the 2023 audited financial statements and are under control due to delays in submitting the 2024 audited financial statements.

Following the trading suspension, KPF continued to violate information disclosure regulations by delaying the submission of its 2024 audited financial statements and annual report. HoSE stated that it has not received the company’s 2024 semi-annual reviewed financial statements, 2024 audited financial statements, and 2024 annual report.

HoSE considers forced delisting of KPF shares of Koji Asset Investment Joint Stock Company.

Therefore, HoSE bases its decision on Point o, Clause 1, Article 120 of Decree 155/2020/ND-CP dated December 31, 2020, detailing the implementation of a number of articles of the Securities Law to consider the compulsory delisting of KPF shares.

KPF shares of Koji Asset Investment Joint Stock Company were listed on the HoSE in 2016. However, the company has recently faced business challenges. In Q2/2024, KPF incurred a record loss of nearly VND 282 billion.

From Q2/2023 onwards, the company’s business operations have shown zero revenue for eight consecutive quarters, including Q1/2025, with a cumulative loss of nearly VND 135 billion as of Q1/2025.

As of March 31, 2025, KPF’s total assets stood at nearly VND 533 billion. The majority of KPF’s assets comprise financial investments in bonds and capital contributions to other companies, totaling over VND 482 billion, or 91% of total assets. Payable debt amounted to nearly VND 17 billion, a 2% increase compared to the end of 2024.

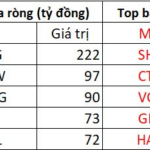

Currently, KPF’s market price is VND 1,210 per share, a 25% decrease compared to the beginning of 2025 and a 65% drop compared to the start of 2024. Market capitalization stands at nearly VND 74 billion. However, in the past, KPF shares have witnessed a remarkable increase of up to 700%, or eight times their value, within two months, specifically from November 22, 2017, to January 11, 2018.

Koji Asset Investment Joint Stock Company, initially named Hoang Minh Financial Investment Joint Stock Company and later known as KPF International Project Consulting Joint Stock Company, started as a consulting company in June 2009. It gradually expanded into the fields of construction material supply and production in 2010, investment construction and agriculture in 2012, and financial investment and real estate in 2015. On March 2, 2016, KPF listed its shares on the stock exchange with the code KPF.

“HOSE Considers Mandatory Delisting of KPF Stock”

On June 12th, the Ho Chi Minh City Stock Exchange (HOSE) announced its decision to consider a mandatory delisting of Koji Asset Investment Corporation’s (KPF) shares due to the company’s severe breach of information disclosure obligations.

Middle East Tensions: Impact on the Vietnamese Stock Market

The stock market in Vietnam witnessed a decline today (June 13th), mirroring trends across the region amidst Israel’s attack on Iran. The VN-Index fell by over 7 points, despite a valiant effort by oil and gas stocks, along with select banking sector equities, to steer the market in a positive direction.