Vinacontrol Corporation has recently announced its plans to distribute the remaining 2024 cash dividends and issue new shares to increase its charter capital. The company intends to pay a 2% cash dividend, equivalent to VND 200 per share, with a record date of July 10, 2025, and an expected payment date of August 1, 2025.

With approximately 10.5 million shares currently in circulation, Vinacontrol will distribute roughly VND 2.1 billion in dividends for this period. In addition, the company will issue approximately 10.5 million bonus shares in a 1:1 ratio, effectively doubling its charter capital to VND 210 billion post-issuance.

As the allocation ratio is 1:1, this issuance of shares to increase charter capital from owner’s equity will not result in fractional shares. The capital for this issuance will be sourced from the Investment Development Fund as stated in the audited 2024 Financial Statements of the Parent Company, and the bonus shares will not be subject to transfer restrictions.

Vinacontrol has consistently maintained a policy of paying cash dividends annually since 2006. For 2025, the company aims to distribute a minimum dividend of 10%.

In October 2024, the company had paid an interim cash dividend of 10%, bringing the total dividend payout for 2024 to 12%. Taking into account both the cash dividend and the bonus shares, Vinacontrol’s shareholders will receive a total dividend and bonus payout of 112% for 2024 – the highest level since its listing.

The previous time the company issued bonus shares was 13 years ago, with a ratio of 3:1.

Vinacontrol is Vietnam’s oldest appraisal enterprise and the only publicly listed company in its industry. It has gained attention for its stable senior management team, with Mr. Bui Duy Chinh serving as Chairman of the Board of Directors and Mr. Mai Tien Dung as General Director since 2005.

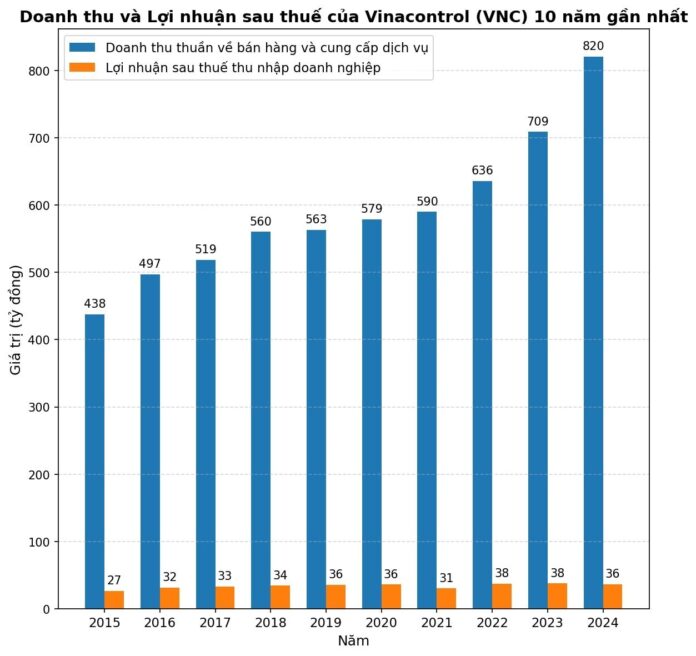

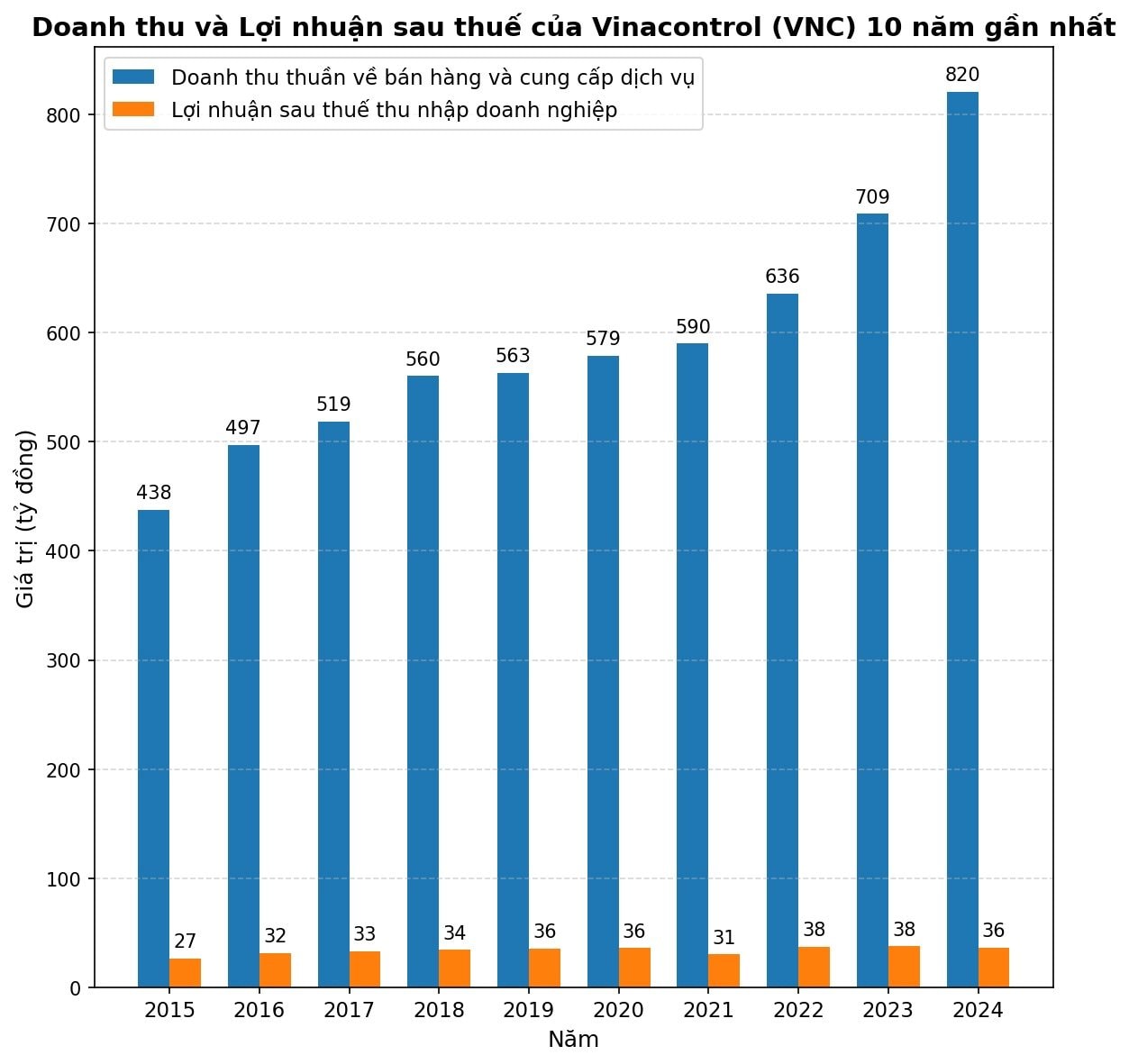

Despite its modest scale, Vinacontrol has consistently demonstrated stable growth in its business operations. From 2012 to 2022, the company experienced steady year-over-year increases in net revenue. Over the last five years, from 2020 to 2024, Vinacontrol achieved an average revenue growth rate of 7.2%, with average annual revenues of approximately VND 667 billion and net profits of around VND 35 billion.

“DXG Boosts Charter Capital to Over VND 10,000 Billion Post Bonus Share Issuance”

With the conclusion of its recent shareholder bonus initiative, Dat Xanh has successfully increased its chartered capital. Over 148 million bonus shares were issued, resulting in a significant leap in the company’s chartered capital from nearly VND 8,726 billion to VND 10,206.3 billion.

DXG Issues Over 148 Million Bonus Shares, Increasing Charter Capital to Over VND 10,206 Billion

Are there any other adjustments or refinements you would like to make?

“Issuing a source capital of over VND 1,480 billion, with VND 1,200 billion derived from undistributed post-tax profits on the 2024 audited financial statements, and over VND 280 billion sourced from share capital surplus on the separate 2024 audited financial statements, we aim to make a powerful impact.”

“PVTrans Sets Record Date for 2024 Stock Dividend”

PVTrans plans to issue over 113.9 million dividend shares for its 2024 shareholder payout, with a distribution ratio of 100:32. The record date for this allocation of rights is June 20, 2025.