Statistics show that in 2024, construction stocks rose by nearly 17%, outperforming the VN-Index’s 12% gain. However, some large-cap stocks showed less positive performance compared to the overall market, namely: VCG (-26.5%), HHV (-24.6%), and CTD (-0.1%).

VALUATION OF AFFORDABLE STOCKS OFFERS ATTRACTIVE INVESTMENT OPPORTUNITIES

In 2025, driven by the momentum of promoting public investment disbursement and the heating up of the real estate market, these stocks have shown more favorable performance, with CTD (+22%) and VCG (+19%) as of March 31, 2025, compared to the beginning of the year. Overall, listed construction stocks have gained 13% since the start of the year.

In a recent update on the outlook for construction stocks, Agriseco believes that there is still room for growth in this sector, but it will be highly differentiated.

Total equity of the industry as of March 31, 2025, reached VND 135 trillion, a decrease of 10.5% compared to the end of 2024. This was mainly due to insignificant revenue improvement, while profit quality declined. Apart from the leading companies that maintained their performance, many others continued to struggle with prolonged losses or plunging profits, typically DDF, VVN, SD6, and HBC.

The increase in stock prices without a corresponding rise in equity could be attributed to speculative factors or indicate that companies are employing high financial leverage instead of increasing equity to maintain growth, thus increasing financial risk.

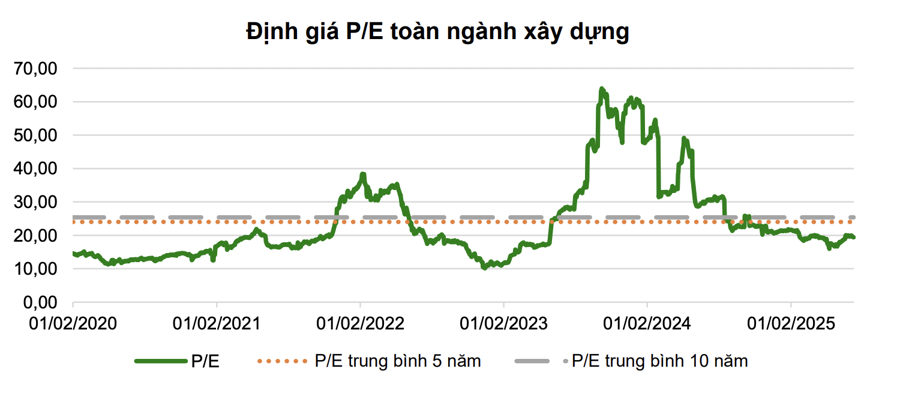

In terms of valuation, the P/E ratio of this sector was often recorded at a high level during 2023-2024 but has been showing a downward trend since the beginning of 2025.

For the construction industry, the P/E ratio tends to fluctuate significantly and is difficult to predict due to the cyclical nature of profits, which largely depend on the progress and timing of project accounting. Sometimes, profits at certain points may not fully and accurately reflect the core business performance due to extraordinary income or deep declines during difficult periods.

The P/B ratio has been hovering around 1.5-2 times in the last six years. The lower-than-historical-average P/B level suggests that the market is undervaluing the assets of construction companies while reflecting concerns about profit prospects in the context of fierce competition, with rising material and land costs.

However, Agriseco believes that with positive signals from the recovery of the residential real estate market and the potential for backlog growth due to accelerated disbursement of public investment projects, the lower-than-average 5-year and 10-year P/E and P/B valuations present attractive investment opportunities as the quality of assets and the outlook for business performance of construction companies are gradually improving.

The EV/EBITDA ratio for the entire construction industry and its representative stocks has been declining over the years, despite revenue and profit growth. This ratio indicates that most companies in the industry are undervalued compared to their profit growth prospects.

THREE FACTORS INFLUENCING PROFIT MARGINS

According to Agriseco, there are three factors that will influence the profit margins of construction companies.

Firstly, material costs account for the largest proportion of construction companies’ inputs. The price movement of these materials has been uneven in recent years. While steel and cement prices have remained low as major markets (China) face excess supply due to weak global construction demand, the prices of other materials such as sand, stone, and asphalt have been on an upward trend due to increased transportation costs and surging demand from public investment projects.

This trend may benefit civil construction contractors, while the profit margins of infrastructure construction contractors may be slightly affected.

Secondly, regarding steel, which accounts for 70% of construction material costs: it is forecasted that in 2025, China’s cut in steel production to address excess capacity and rising domestic demand for steel in infrastructure projects may lead to a recovery in steel prices.

However, according to the China Metallurgical Industry Research Institute, China’s steel demand is expected to continue to fall by 1.5% in 2025 due to the sluggish real estate market and trade war impacts, which could help curb the upward trend in global steel prices.

Thirdly, interest rates at major banks have been on a downward trend and have remained low. The construction industry is capital and labor-intensive, so borrowing costs significantly impact contractors’ profit margins. Stable and low-interest rates reduce debt servicing pressure on construction companies, stimulate homeownership demand, create a positive sentiment for investors, and support the improvement of real estate supply in the future. This trend is also being observed in central banks worldwide amid low inflation and slow economic growth, creating additional room for Vietnam’s monetary policy easing.

Stock Market Insights: The 1,300 Point Region – A Critical Support Level

The VN-Index declined and concluded a volatile week of trading. A decrease in weekly trading volume compared to the previous breakout period indicates a return to cautious investment strategies. The 1,300-point level remains a crucial support zone, and if breached, the VN-Index could face further downward pressure, potentially testing the next support zone around 1,270-1,280 points.

“Small Businesses Speak Out: “With Infrastructure Costs, Shopee is No Longer a Viable Platform for Us””

The recent announcement of Shopee’s infrastructure fee increment of VND 3,000 per order starting July 1st has stirred up a buzz among its sellers. While some lament the potential losses, others view it as an opportunity to weed out competitors and strengthen their foothold in the market. This move by Shopee is bound to have a significant impact on the e-commerce landscape in the region.

The Market is Worry-Free: VPBank Securities Experts Identify 3 Groups of “Leading” Stocks for the Coming Period

“Given a market adjustment to the 1,280 to 1,300 range, investors are presented with an opportunity to buy and hold for the year’s final upticks,” emphasized Mr. Son.