Vietnam’s Cashless Festival – ‘Ting Ting Day 2025’ attracted thousands of participants in District 1, Ho Chi Minh City, on the morning of June 14.

At the festival, Deputy Prime Minister Ho Duc Phoc appreciated the development of cashless payments in Vietnam, highlighting its speed, convenience, and contribution to economic growth. He also emphasized the importance of cashless transactions in promoting efficiency in the banking sector, enhancing financial transparency, and supporting e-commerce and public services.

Government leaders, State Bank of Vietnam, and HCMC officials visit the booths at the “Cashless Day – Ting Ting Day 2025” festival. (Photo: D.V)

Phoc also acknowledged existing challenges, such as cybersecurity and personal data protection in digital payments, especially with the rise of sophisticated cybercrimes. He emphasized the need for improved regulations and policies to facilitate innovative payment models while ensuring risk management and system security to protect citizens’ assets.

Mr. Pham Tien Dung, Vice Governor of the State Bank of Vietnam (SBV), shared that cashless payments are playing a pivotal role in the development of the digital economy, enhancing transparency, and boosting e-commerce. He noted the significant progress in cashless payments, including QR code payments, and attributed it to the dedicated efforts of the SBV, with the Governor herself actively promoting QR code adoption among small businesses.

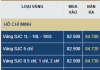

“Currently, 87% of adults in Vietnam have a bank account, and this percentage is even higher in Ho Chi Minh City. The interbank electronic payment system processes an average of VND 820 trillion per day, while the financial switching and electronic clearing system handles 26 million transactions daily,” said the Vice Governor of the State Bank of Vietnam.

He also highlighted the continuous upgrades to the national credit information infrastructure, improving automatic data processing and updating. The system has expanded its data collection and update sources within and outside the industry, achieving a success rate of over 98% in updating data from credit institutions.

According to the SBV representative, from July 1, 2024, individual customers were required to authenticate their identity and biometric data. Despite initial challenges, this initiative has resulted in over 110.8 million individual customer files and over 711,000 organizational customer files being cross-referenced with biometric data.

As of July 1, 2025, legal representatives of enterprises must also authenticate biometric data to perform transactions.

Mr. Nguyen Van Dung, Vice Chairman of the Ho Chi Minh City People’s Committee, acknowledged the ubiquitous presence of cashless payments in restaurants, cafes, and grocery stores. However, he pointed out the challenges and limitations in implementing cashless payments, particularly in ensuring secure transactions for users. With the rise of sophisticated cybercrimes, fraud, and data theft, ensuring transaction security remains a complex issue.

Cashless payments are becoming ubiquitous. (Photo: D.V)

The leadership of Ho Chi Minh City recognizes the critical role of cashless payments in promoting digital payments and the digital economy and has made several proposals to further advance this payment method.

Specifically, the city has requested that state management agencies and experts share their experiences in promoting cashless payments in e-commerce and the role of data connectivity in driving the digital economy, along with providing recommendations for Ho Chi Minh City.

Mr. Nguyen Van Dung suggested that departments, branches, and People’s Committees at the ward and commune levels proactively review and integrate cashless payment promotion content into their regular work programs. He emphasized the need to focus on implementing comprehensive solutions to enhance electronic payments in public services, especially in administrative procedures, education, healthcare, transportation, taxes, and fees, ensuring convenient and secure payment processes.

Ho Chi Minh City proposed coordinating promotional programs with cashless payment campaigns, especially during major consumer events like concentrated promotions, consumer stimulus programs, and tourism promotion. The city also suggested solutions to support businesses, business households, traders, and people in applying suitable digital payment solutions according to their scale and actual conditions.

Additionally, they emphasized the importance of diverse communication channels to raise awareness and enhance cashless payment skills for the people, encouraging a shift away from cash transactions in the community, especially in residential areas, traditional markets, and outlying districts.

According to Mr. Nguyen Van Dung, units such as the State Bank’s Ho Chi Minh City Branch and departments need to coordinate with central ministries and sectors to interconnect data between industries and sectors, forming a smart payment ecosystem in the city.

Fraud cases have decreased significantly

A representative of the Information Technology Department of the State Bank of Vietnam shared that fraud cases and the number of accounts receiving fraudulent money have decreased significantly after cleaning up the payment account information of individual customers.

From July 1, 2024, to the present, the average number of customers being scammed and losing money per month has decreased by 57% compared to the average of the first six months of 2024 (before the application of regulations on cleaning up account information of individual customers).

The average number of accounts receiving fraudulent money per month has also decreased by 46.5% from the middle of 2024 to the present, compared to the average of the first six months of 2024. Notably, some credit institutions have not had any fraud cases perpetrated by cybercriminals in recent times.

“Empowering Small Businesses: From Operational Challenges to Digital Transformation.”

On the evening of June 12, the livestream event “Is Retail Management Easy?” hosted by ACB, attracted over 10,000 live viewers, garnered nearly 6,000 comments, and was shared hundreds of times within just 90 minutes of its broadcast. This overwhelming response highlights the keen interest in a topic that, though seemingly familiar, continues to pose challenges for business owners.

Vice Prime Minister Ho Duc Phoc: Refining Institutions to Foster Secure and Innovative Payments

“Vice Prime Minister Ho Duc Phoc emphasized the importance of refining institutions and policies to foster innovative payment models. He stressed the need to create an enabling environment for such innovations while also ensuring risk management, system safety, and protection of citizens’ assets.”

The Billionaire Escape: Vietnamese Entrepreneurs Who Cheated Death and Built Empires

The Vietnamese judicial system has a history of handing down severe sentences to prominent businessmen, with the death penalty being the ultimate punishment. However, there have been fortunate cases where these individuals have had their sentences commuted, offering them a chance to rebuild their lives.