The State Securities Commission (SSC) has recently issued Decision No. 128/QD-XPHC on administrative sanctions in the field of securities and the securities market against Agricultural Packaging and Printing Joint Stock Company (APP, stock code: INN, on HNX).

Specifically, the company was fined VND 77.5 million for selling treasury shares without reporting to the SSC, as stipulated in point e, clause 2, Article 16 of the Government’s Decree No. 156/2020/ND-CP dated December 31, 2020, detailing sanctions for administrative violations in the field of securities and the securities market, which was supplemented by point c, clause 15, Article 1 of the Government’s Decree No. 128/2021/ND-CP dated December 30, 2021, amending and supplementing a number of articles of Decree No. 156/2020/ND-CP.

Illustrative image

In terms of business results, according to the company’s consolidated financial statements for Q1/2025, APP recorded net revenue of over VND 373.3 billion, a slight increase of VND 1.5 billion compared to the same period last year. After deducting taxes and expenses, the company reported a net profit of nearly VND 26.6 billion, up 9.9% year-on-year.

As of March 31, 2025, APP’s total assets decreased by 16.6% from the beginning of the year to nearly VND 1,006.2 billion. Inventories accounted for 16.6% of total assets, amounting to nearly VND 166.6 billion, while long-term assets under construction stood at nearly VND 154.8 billion, making up 15.4% of total assets.

On the liability side of the balance sheet, total liabilities were recorded at over VND 259 billion, down 46.7% from the beginning of the year. Short-term payables to sellers accounted for 43.6% of total liabilities, amounting to over VND 112.9 billion.

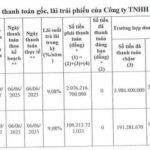

“Industry Newcomer Debuts on HNX with a Share Price of VND 11,700: A Merger of Two Enterprises”

Over 61.9 million TD6 shares of the Deo Nai Coal Joint Stock Company – Coc Sau – TKV will commence trading on HNX from June 16th, with a reference price of VND 11,700 per share, equating to a market capitalization of nearly VND 725 billion on debut. This company is the result of a merger between two subsidiaries of TKV, as part of a restructuring plan for the coal industry.