Portugal’s canned tuna industry has a long history dating back to the 19th century, with Vila Real de Santo António considered its cradle and playing a central role in both fishing and canning development.

Some of the well-known Portuguese canned tuna brands include Santa Catarina, A Poveira, and Ramirez. These names are not only popular domestically but also widely exported to international markets.

Among the countries in the European Union (EU), Portugal is regarded as one of the significant markets for tuna consumption. The country is renowned for its high per capita seafood consumption, with tuna—both fresh/frozen and canned—accounting for a substantial proportion.

Portuguese consumers have a penchant for incorporating tuna into their daily meals and especially favor canned tuna products for their convenience, diverse flavors, and alignment with traditional tastes.

The Portuguese tuna processing industry heavily relies on imported raw materials, particularly frozen loins of yellowfin and skipjack tuna. Annually, the country imports significant quantities of frozen tuna meat/loins (HS code 0304) and frozen steamed tuna loins (HS code 16) from various markets, including Vietnam.

According to Vietnam Customs, Vietnam primarily exports these two product groups to Portugal. In 2024 alone, the export value of frozen steamed tuna loins to this market accounted for over 81% of the total tuna export value from Vietnam to Portugal.

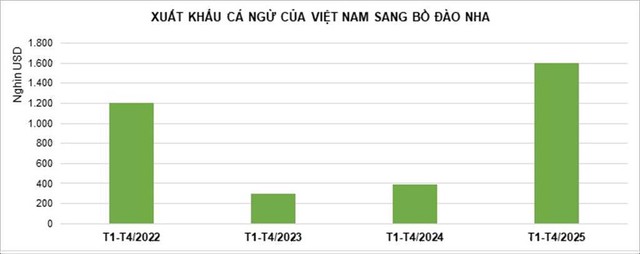

Vietnam’s tuna exports to Portugal in 2024 witnessed robust growth, evident in a remarkable 353% increase compared to 2023. This growth trend persisted in the first months of 2025, with a 313% surge, amounting to over $1.6 million.

In the Portuguese market, during the first quarter of 2025, Vietnam was the second-largest supplier of tuna from outside the EU, only after Ecuador. The import value of tuna in Portugal from both Ecuador and Vietnam displayed a positive growth trend, whereas imports from China showed a declining pattern.

Tuna is one of Vietnam’s key export products.

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), the strengthened bilateral trade cooperation between Vietnam and Portugal, coupled with the effective utilization of tariff preferences from the EU-Vietnam Free Trade Agreement (EVFTA), has provided a significant boost to Vietnam’s tuna exports to Portugal.

The EVFTA’s tariff reductions on seafood products, including tuna, have not only enhanced the price competitiveness of Vietnamese goods but also encouraged exporting enterprises to invest in advanced processing technologies to meet the EU’s high standards. As a result, Vietnamese tuna has solidified its position in the Portuguese market.

However, VASEP notes that businesses anticipate challenges in sustaining this growth trend due to the scarcity of domestic tuna raw materials, further exacerbated by regulatory inconsistencies and complexities in confirmation and certification processes, which hinder export growth.

The Vietnamese tuna industry is actively working to expand markets, enhance processing capabilities, and strengthen quality control in line with international standards. These efforts aim not only to maintain stable growth but also to pursue an ambitious goal: surpassing the $1 billion milestone in tuna export turnover in 2025.

“Vietnam’s ‘Superfood’ Surprise Hit in Portugal: Exports Surge 313%, Captivating All of Europe”

“Exports of this product to European countries have surged by triple digits since the beginning of the year.”

The Tasty Tuna: Vietnam’s Canned Export Slump

The Vietnam Association of Seafood Exporters and Producers (VASEP) reported a significant dip in canned tuna exports in April, reaching a near two-year low.